Britain’s economy had been suffering chronic unemployment for a decade prior to 1936. Economic theory as it was then understood clearly showed that the cause of a market surplus was sellers asking a price in excess of what buyers are willing to pay. If buyers and sellers simply disagree, then so be it. But if the situation is aggravated by excessive regulation or other institutional problems, then economists would advise dissolving institutional barriers that prevent the smooth functioning of the market price system. Contemporary British economists were aware that labor union contracts fixed wages above market-clearing levels and that unemployment subsidies were a factor in preventing labor markets from clearing. The revolutionary John Maynard Keynes rejected the

Topics:

Robert Blumen considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Britain’s economy had been suffering chronic unemployment for a decade prior to 1936. Economic theory as it was then understood clearly showed that the cause of a market surplus was sellers asking a price in excess of what buyers are willing to pay.

If buyers and sellers simply disagree, then so be it. But if the situation is aggravated by excessive regulation or other institutional problems, then economists would advise dissolving institutional barriers that prevent the smooth functioning of the market price system. Contemporary British economists were aware that labor union contracts fixed wages above market-clearing levels and that unemployment subsidies were a factor in preventing labor markets from clearing.

The revolutionary John Maynard Keynes rejected the orthodox view. In his 1936 book The General Theory of Employment, Interest and Money, he proposed a wholly different approach. While carefully obscured in a sophisticated model, Keynes’s solution was simple: to leave nominal wages alone, but lower real wages through inflation. If business firms understood the difference, then when real wages reached an attractive level, they would begin to hire at the union pay scale.

In his critique of the Keynesian revolution, the British Austrian school economist William H. Hutt made compelling arguments against the use of inflation as a substitute for market prices. Hutt made several arguments for the superiority of sound money over inflation. Here I will look at several of his ideas.

Price Coordination versus Inflation

Hutt showed that lowering real wages through inflation is not the same thing as market price adjustments under sound money. Coordination means all producers making the best use of scarce factors to produce more of what consumers want at lower cost. The cost is less production of things that consumers care less about. Coordination requires prices driven by competition among entrepreneurs and scarcity of the factors. A well-functioning price system will bring idle labor and capital goods into use at lower prices, so they may contribute to alleviating scarcity. A lack of price coordination was at fault in the British labor markets.

Better coordination would have required many individual price adjustments, “countless widespread and deliberate acts of coordination.”1 Specific market price changes driven by the profit-seeking and loss-avoidance motives of entrepreneurs was needed. The prices most in need of adjusting were the wages of the unemployed. Each worker could have found work of their own choosing, either accepting the highest available wage, or the best offer they could find in the occupation they preferred.2

The main problem Hutt saw was that unemployed workers were asking for a wage above the point where the market for their services would clear. These wage demands were mostly intermediated through labor unions, who were trying to extract a benefit for their members at the expense of the nonunionized part of the workforce. The public at large in their role as consumers lost out either through higher prices or less supply, if they were willing to pay more. The effect of the union’s demands, if met, would be to drive up costs and prices in their industry and force the remainder of the system to adjust. If the consumer was not willing to cooperate, the unions only succeeded in pricing their membership out of a job.

A wage rate fixed above market clearance in one industry displaced workers into either unemployment or underemployment. If not out of work altogether, workers would be doing something that either paid less or working in an occupation that was not their first-choice line of work.

From a distance, if you squint, it might appear that lowering real wages through inflation achieves approximately the same thing as cutting nominal wages. So long as the prices of the goods that businesses sell and wages remain the same, and if other input costs do not rise any faster than their output prices, then real wages would fall. Business selling prices will rise to the point where it makes sense to hire workers at the wage they are holding out for—without the need for a political confrontation with labor unions.

One of the effects of this type of inflation is that it would lower wages in all sectors and industries where it was not anticipated, or in which there were contracts or other long-term agreements. A free price system would instead result in lower wages for those markets in surplus without collateral damage to other workers.

But as Hutt showed, inflation is not a good substitute for many entrepreneurial actions—each one changing a few specific prices. Compared to price adjustments, inflation is a blunt instrument. Rather than the prices of items in most oversupply falling the most, as would happen with market pricing, under inflation, the least obstructed prices will rise the most. Cantillon effects will dominate. Keynes’s policy of inflation might work to the degree that union wages were the most rigid—both upward and downward. The difficulty of negotiating a new contract and the length of existing contracts locked the nominal prices in those markets.

Asking Prices Must Change

Supply and demand both matter. A market stuck in surplus could reach clearance either through an increase in the offering price or a lower asking price. If neither one happens, it means only that buyers and sellers do not agree on the value. Everyone preserves what they have to what they do not. There is no opportunity for a mutually beneficial exchange. A value-free economist cannot say any more.

When markets are stuck in surplus and there are idle resources, Hutt placed the majority of responsibility on the sellers. It was sellers who must ask for less, in his opinion. He used the term “withholding” to describe a seller of labor or capital who will remain idle rather than accept a reasonable offer for their services. Hutt saw the unemployment in Britain as similar to the shopkeeper who stubbornly refuses to mark down inventory of a product that customers no longer care about, long after customers have stopped browsing that aisle of the store.

Hutt’s focus on the seller was based on different positions of the entrepreneur and the unemployed worker. Profit-motivated (and loss-avoiding) businesses in a competitive industry often do not have much scope to increase wages while continuing to make a profit. They are constrained, on the one hand, by their inability to pay more than the marginal value product of labor. At the end of the value chain, this value is set by the customer’s valuation of the product. On the other side, there is the supply of labor willing to work at an offered wage. While some businesses may defer layoffs, and attempt to keep their staff during a short downturn, they will only hire when they expect to see a positive margin between their costs and their selling prices.

Hutt quotes Robert W. Clower’s observation that the quantity of transactions in a market that is not at the market-clearing price is dominated by the “short side” (the seller when there is a shortage and the buyer when there is a surplus).3 This is similar to Murray N. Rothbard’s analysis of the pricing of the inventory of business firms. His discussion relied on the concept of reservation demand, which is the demand that the owner of a good exercises by not selling it for the best offered price. We all have reservation demand for our current property, some money, assets, etc. Rothbard argued that because businesses do not have any use for their inventory other than to sell it, businesses have no reservation demand for inventory that has been produced. At that point, the price is set by buyers only, in relation to a vertical supply curve.4

Unemployed labor, on the other hand, has no particular constraint on the ability to accept a lower wage. Workers have a reservation demand for labor in the form of leisure, but most workers need to have some income. It can make sense for someone who is speculatively unemployed to keep looking rather than accept a low wage if they think that with a bit more looking they can find a better offer. However, Hutt believed that many unemployed workers had an unrealistic view of the labor market, expecting wages to rise for no good reason, or relying on the dole to subsidize idleness. British workers at the time felt that accepting less than what had formerly been the customary wage in their industry (in better times), was a matter of losing face. Unions encouraged emotionalism in associating a particular nominal wage level with human dignity. Unions were aided by the failure of governments to enforce property rights, the threat of strikes, and a body of public opinion and case law in Britain with great respect for labor organization.

Hutt blamed labor unions for creating a political backstop that reinforced the ability of the unemployed to hold out for unreasonable wages. By “unreasonable,” he meant more than the entrepreneur would offer based on the anticipated marginal value product of labor under current business conditions. This value depends on the expected selling prices of the firms’ products. The value received by the employer is in the form of a contribution to the selling price. Under a general depression, selling prices all around are lower, and therefore labor is worth less than in good times.

When labor is unemployed, the unemployed workers’ best option was to accept the wage offer on the table rather than to hold out. During a depression, wages will be lower than they were at the peak of the previous boom, but the growth during the ensuing recovery—which would happen if people would accept the present reality of lower prices—would eventually increase the demand for labor all around. Competition among employers would ensure that wages would rise in line with labor’s marginal value product as sales volumes ramp up.

Only Works When Unanticipated

The inflationary “solution” relies on consumer prices rising faster than wages. This can happen, but it is not a sure thing. In Britain, the most troublesome wages were negotiated by unions who had not expected inflation to erode their value. Hard-won union wage agreements, perhaps at the cost of a strike, could not easily be renegotiated. The wage might be nearly impossible to change until the contract had run its course and another cycle of bargaining was concluded. Keynes’s approach assumes that businesses understand the difference between real and nominal wages while workers do not. That may be true once, but after the first round of inflation policy, labor unions will get out in front of the next cycle by demanding that wage indexing be added to their contracts.

At the time a form of the gold standard was still in effect, and memories of the classical gold standard persisted. Inflation had not been tried before as a way to systematically undercut labor unions. To outright suggest inflation as a policy was disgraceful in an age in which the solemn promise of convertibility of the British pound to gold was a moral obligation. This put the element of surprise on the side of the printing press.

If inflation is anticipated, as it came to be, then labor unions can adapt by building cost-of-living adjustments into their contracts. The same could be done with government benefits. As Hutt observed, “Unless this deception is possible, those who are in a position to raise prices and wage rates will do so in advance of the declining value of the money unit so that the original degree of withheld capacity will tend to be perpetuated.”5 Jacob Viner made a similar point in his critique of Keynes, that Keynesian inflation would lead to “a constant race between the printing press and the business agents of the trade unions.”6

Inflation Fails to Address the True Problem

Inflation was a one-time solution to the problems in Britain in 1936. Inflation not only postponed the necessity of dealing with the real problems but made it more difficult to do so effectively when the time came. Hutt argues that “there is no such easy solution; that a state of discoordination needs coordination.”7 Inflation is not a long-term solution to the problem of surplus, because it does not confront, straight on, the real problem: policies that prevent the price system from being flexible. Once people catch on, “the institutional setup which permits the rigidities evaded by the inflation will remain unreformed. Withheld capacity will return.”8

Hutt found an antecedent cause in the failure of economists and political leaders who understood the economic problem to educate the public and in so doing build political support for confronting the unions. As Hutt explained, inflation is “a dangerous policy” which “weakened market pressures to the basic adjustments needed,” which were open labor markets and flexible pricing. It constitutes “the buying off” of antisocial price behavior.9

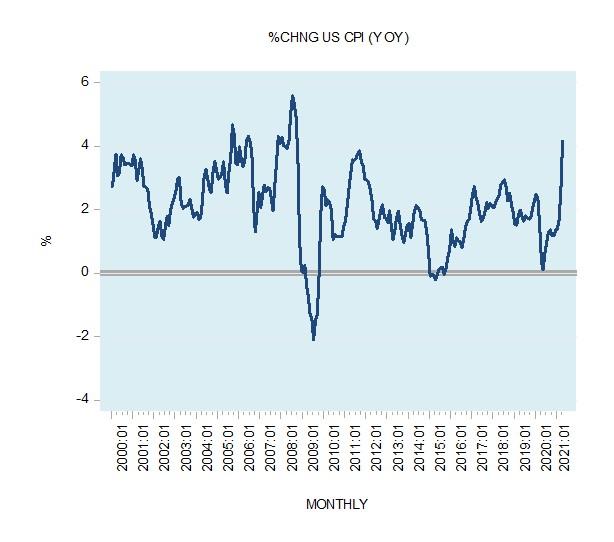

Hutt’s forecast proved to be accurate as governments became increasingly addicted to increasing doses of ever and ever less effective rounds of inflation. The failure to make the structural changes led to the “stagflation” of the 1970s. Hayek, writing in 1969 on the prior decades of Keynesian policies, stated,

Now we have an inflation-borne prosperity which depends for its continuation on continued inflation. If prices rise less than expected, then a depressing effect is exerted on the economy. I expected that ten years would suffice to produce increasing difficulty; however, it has taken 25 years to reach the stage where to slow down inflation produces a recession. We now have a tiger by the tail: how long can this inflation continue? If the tiger (of inflation) is freed he will eat us up; yet if he runs faster and faster while we desperately hold on, we are still finished.10

Conclusion

As Hutt explains, when stated in simple terms Keynes’s view was entirely consistent with what every economist knew, and therefore noncontroversial. Raising consumer prices while nominal wages are fixed does lower real wages and will clear markets in surplus. Had he said this it would have been noncontroversial and would not have required a revolution.

“Keynes,” wrote Hutt “would be ashamed to hold, as the ‘[monetary] cranks’ in effect did, that merely to dole out additional money is the cure for unemployment. Yet are not the identical ideas in all their navieté at the root of Keynes’ teachings, obscured in a mass of impressive but conceptually unsatisfactory theoretical paraphernalia?”11 Even advocates concede that The General Theory is poorly written and difficult to understand. The necessity of burying the policy in deep layers of obscurity came about because inflation was considered a shameful thing. Unlike in our current time, it could not be advocated openly. Yet no matter how deeply hidden, Hutt surfaced the truth that inflation does poorly what the price system does well.

- 1. W.H. Hutt, The Keynesian Episode: A Reassessment (Indianapolis, IN: Liberty Fund, 1980), p. 74.

- 2. Hutt, Keynesian Episode, p. 80.

- 3. W.H. Hutt, A Rehabilitation of Say’s Law (Athens: Ohio University Press, 1974), loc. 1482, Kindle.

- 4. Murray N. Rothbard, Man, Economy, and State, with Power and Market, 2d scholar’s ed. (Auburn, AL: Ludwig von Mises Institute, 2009), pp. 138–42.

- 5. Hutt, Keynesian Episode, pp.122–23.

- 6. Henry Hazlitt, ed., The Critics of Keynesian Economics (Irvington-on-Hudson, NY: Foundation for Economic Education, 1995), p. 9.

- 7. Hutt, Keynesian Episode, p. 74.

- 8. Hutt, Keynesian Episode, pp.123–24.

- 9. Hutt, Keynesian Episode, p.129.

- 10. Friedrich A. von Hayek, A Tiger by the Tail: A 40-Years’ Running Commentary on Keynesianism by Hayek, comp. Sudha R. Shenoy, 3d ed. (1972; n.p.: Institute for Economic Affairs and Ludwig von Mises Institute, 2009), p. 112.

- 11. Hutt, Keynesian Episode, p. 232.

Tags: Featured,newsletter