Lessons to be Learned from East Asia The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver. The Prime Minister of Singapore repeatedly appeared on TV to advise people to live normally and not let fear dominate. Taiwan had a total of 623 Covid-19 related deaths [ed. note: there were only...

Read More »Virus Z: A Thought Experiment

What’s striking about our thought experiment is how little reliable data we have about the transmissibility of our hypothetical Virus Z and the long-term consequences of its mutations. Let’s run a thought experiment on a hypothetical virus we’ll call Virus Z, a run-of-the-mill respiratory variety not much different from other viruses which are 1) very small; 2) mutate rapidly and 3) infect human cells and modify the cellular machinery to produce more viral...

Read More »Inflation Is a Form of Embezzlement

Monetary inflation is just a type of embezzlement. Historically, inflation originated when a country’s ruler such as king would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one. In the process of minting new coins, the king would lower the amount of gold contained in each coin and return lighter gold coins to citizens. Because of the reduced weight of gold coins that were returned to citizens,...

Read More »Banks Urged to think Green or Face Extinction

Financial institutions must be wary of being consumed by the consequences of careless environmental or social decisions. Keystone / Rank Augstein Climate change is forcing financiers to change the way they think and act. This could have a big impact on their balance sheets – and potentially their very survival. “Bankers are no longer purely financial specialists, but also connoisseurs of the environmental and social footprint of investments,” said Yves Mirabaud in...

Read More »Death and Libertarianism

Whenever a government program or policy produces deaths of innocent people, the way I figure it is that that makes it incumbent on libertarians to take a firm stand against such programs and policies. We all know that there are all sorts of government regulations that deprive people of liberty that we libertarians need to oppose. Recent examples include mandatory lockdowns and mask mandates. But there is something about the finality of death that makes government...

Read More »Swiss Meat and Eggs often not very Swiss

Any animal raised and slaughtered in Switzerland can be labelled Swiss. However, what the animal has been fed could be from anywhere. If animals are what they eat then much of the meat and eggs labelled Swiss aren’t very Swiss. © Sergio Bertino | Dreamstime.com A key challenge for meat, dairy and egg consumers is the absence of information on labels, which is limited to provenance. Information about what an animal has been fed is not contained on the labels of meat,...

Read More »FX Daily, July 02: US Jobs and OPEC+ Day

Swiss Franc The Euro has risen by 0.14% to 1.0946 EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US jobs report and OPEC+ decision are awaited. The dollar remains bid. Only the yen and Canadian dollar are showing a hint of resilience, though, on the week, the Scandis and dollar-bloc currencies are off between around 1-2%. The greenback is also firmer against the emerging...

Read More »Swiss Roaming Charges to Fall on 1 July 2021 but the Roaming Minefield Remains

On 1 July 2021, Switzerland’s revised telecommunications law came into effect. The new rules force mobile providers to make certain changes to deals they offer customers when roaming. Some of the resulting changes are positive, but not all. In addition, some operators have retained bundles that don’t comply with the new rules. © Jekaterina Voronina | Dreamstime.com The new rules force mobile operators to change for roaming calls in increments of a second instead of...

Read More »The Tyranny of the Covid-19 Eviction Moratorium

The U.S. Supreme Court recently permitted the eviction moratorium established by the Centers for Disease Control to continue, at least until July 31, when the CDC plans to lift it. The Court wrongly decided the matter. It should have immediately lifted the moratorium. Historically, governments have held “inherent” police powers to protect the health of the citizenry. But the federal government is different. It was never intended to have inherent powers. Our American...

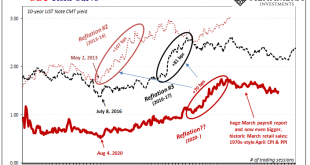

Read More »Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it). Whatever this thing was and was going to be, it sounded ridiculously earth-shattering. And then, poof, it was...

Read More » SNB & CHF

SNB & CHF