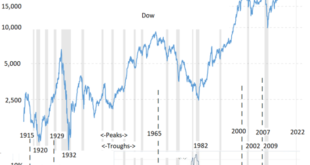

The conditions have now aligned for a repeat of the major stock market crashes that have occurred since the founding of the US Federal Reserve Bank (Fed) in 1913. Considering their vast experience and resources, the Fed has to know that their plan to control inflation by raising interest rates rapidly and significantly since 2022, and also tightening credit this year, will likely result in another major crash. Although the Fed has issued vague warnings about the...

Read More »Biden Wants Sanctions for Uganda Because Its Government Passed Anti-LGBT Laws

Just in case you wrongly thought sanctions had anything to do with national security: Biden wants to sanction the people of a small African country over anti-LGBT laws. Original Article: "Biden Wants Sanctions for Uganda Because Its Government Passed Anti-LGBT Laws" [embedded content] Tags: Featured,newsletter

Read More »Opposing Critical Race Theory Doesn’t Make You a “White Supremacist”

Much of critical race theory and “antiracism” is aimed at pulling people apart, not bringing them together. To oppose such theories and practices is not racist in itself. Original Article: "Opposing Critical Race Theory Doesn't Make You a 'White Supremacist'" [embedded content] Tags: Featured,newsletter

Read More »Coto Mixto: Anarchy in Galicia

People commonly believe that a society without central political authority will dissolve into chaos. But a small kingdom within Spain existed peacefully for seven hundred years under what we would call anarchy. Original Article: "Coto Mixto: Anarchy in Galicia" [embedded content] Tags: Featured,newsletter

Read More »Is the Banking Crisis Being Orchestrated?

As a banker and economist, I am riveted by the expeditious demise of Silicon Valley Bank and other institutions. Were these crashes due to bank mismanagement, as many pundits as well as regulators have posited? Were they due to not managing risk, not hedging, and unfettered exposure to sectors of concern? Or maybe something else is afoot, a movement that may have begun a decade ago. Recall the Great Recession (2008–10), buoyed by a housing and mortgage crisis created...

Read More »Week Ahead: Greenback Looks Set to Bounce after the Recent Drubbing

The week ahead is less eventful than the week that just passed, which saw the anticipated hike by the ECB and the small cut by the PBOC. The Fed delivered the widely tipped hawkish hold and the US CPI continued to decelerate. The dollar fell against the G10 currencies last week but the yen. Sterling, and the Canadian dollar rose to new highs for the year, Momentum indicators are stretched. This coupled with risk-reward considerations suggest that the dollar could...

Read More »Voters Hate CBDCs. Why Do Governments Keep Pushing Them?

Governments worldwide are trying to replace cash with CBDCs, and people worldwide are starting to wake up, but we need a lot more. A CBDC is a government-run crypto-token that replaces the national currency with a tracking ledger—a list of who owns what—that lets government surveil, control, and mandate every dollar you spend. They could prevent you from buying the wrong thing, whether raw milk or gas stoves, or self-defense. They could stop you from donating to the...

Read More »Why ChatGPT Failed an Economics Exam

University of Rochester economist Steve Landsburg joins Bob to discuss the abysmal performance of ChatGPT on his undergraduate exam. They also discuss the importance of market prices in guiding behavior and the unexpected problems with the government handing out "free" goodies. Bob's article "Superman Needs an Agent:" Mises.org/HAP400a Steven's Book The Armchair Economist: Mises.org/HAP400b More Economic brainteasers: Mises.org/HAP400c Why...

Read More »The G7 in Hiroshima: The Latest Attempt to Impose a Unipolar World

The last Group of Seven (G7) summit that took place May 19–21, 2023, in Hiroshima deserves attention because it exposes the latest Western attempt to impose its unipolar worldview. But first, a bit of background on the G7. The G7 is the group of seven nations (USA, Japan, France, Germany, Italy, Canada, and the United Kingdom) that in the ’70s comprised the major industrialized countries of the capitalist world. But because of the enrichment of a large part of the...

Read More »Misreading Mill

In his just-published book Regime Change: Toward a Postliberal Future (Sentinel, 2023), the political theorist Patrick J. Deneen indicts modern liberalism, in which he includes both classical liberalism and progressive liberalism. One of his main charges against liberalism is that it rejects the view, taught both by Christianity and classical political philosophy, that true liberty consists of virtuous conduct. In this view, people must hold their passions in check...

Read More » SNB & CHF

SNB & CHF