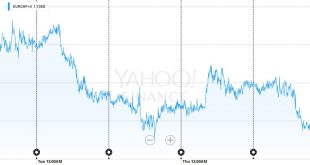

EUR/CHF The EUR/CHF moves lower, following the descent of EUR/USD. This happens often, when European and global growth is sluggish. USD/CHF But the Swiss franc weakened against the dollar. Continued by Marc Chandler: The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar. GBP/USD Many linked sterling’s outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU,...

Read More »How Elon Musk Helps Fools to Part Ways with Their Money

Image credit: Tesla Motors Tesla Goes Fishing Tesla Motors is up to something remarkable. But what it is, exactly, is unclear. According to the Tesla Motors website, the company’s mission is: to accelerate the world’s transition to sustainable transport. Tesla Model 3: the company’s first “mass market” entry so to speak, which is supposed to help the world to reach the nirvana of “sustainable” transport. On the side, it is helping a number of Wall Street firms to increase their...

Read More »The Power Elite: Bumbling Incompetents

Geniuses in Charge BALTIMORE, Maryland – Is there any smarter group of homo sapiens on the planet? Or in all of history? We’re talking about Fed economists, of course. Not only did they avoid another Great Depression by bold absurdity…giving the economy more of the one thing of which it clearly had too much – debt. They also carefully monitored the economy’s progress so as to avoid any backsliding into normalcy. And where do we get this penetrating appraisal? From the Fed economists...

Read More »First Skirmishes in Long Battle

For various reasons, well beyond the scope of this short note, China has amassed huge industrial capacity, well beyond its ability to absorb. In part, that is one of the challenges that the “One Belt One Road” addresses. Export the spare capacity by building infrastructure, networking east and central Asia (included parts of the former Soviet Union and the Middle East. Even that long-term project does not appear sufficient to absorb the existing surplus capacity. Many US and European...

Read More »Emerging Markets: What has Changed

Korea will extend trading hours for stock and FX markets by 30 minutes effective August 1 The Monetary Authority of Singapore said it will withdraw BSI Bank’s license for breaches of money-laundering rules The US lifted a decades-old arms embargo on Vietnam The Nigerian central bank said it would allow “greater flexibility” in the FX market Poland signaled a compromise over the judicial row that triggered EU scrutiny Brazil Budget Minister Romero Juca was forced to step down Banco de...

Read More »Gotthard 360

The longest rail tunnel in the world, the Gotthard, is set to open in Switzerland on June 1. An immersive video tour gives a behind-the-scenes look at one of the biggest engineering feats in Swiss history. (SRF, swissinfo.ch) For ten years, hundreds of workers braved tropical temperatures underground to get the tunnel finished. It has a system of two one-way tubes, linked by emergency escape routes every 325 metres. --- swissinfo.ch is the international branch of the Swiss Broadcasting...

Read More »FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday’s ranges while sterling and the Canadian dollar pushing through yesterday’s lows. Source Dukascopy Asian shares were mostly higher, though Chinese markets closed with slight losses. The MSCI Asia-Pacific Index rose (~0.7%) for a third session and secured a 2% gain for the week. European bourses are seeing some profit-taking...

Read More »Industrial Production Recovers in March: Strong Franc Digested?

The sector that got hit most by the sudden appreciation of the Swiss franc, was industrial production. They must compete with Germany, that benefits of the weak euro. The newest data from March show that this sector recovered. This opens the question again, if the Swiss franc is really overvalued. Certainly not against the dollar, other sectors like pharmaceuticals and chemicals export at lot to the United States. Further explanations on this press release: The secondary sector...

Read More »Democratic Fun in Tajikistan

Look at him! How can one not love him! Below the modestly sized image of dear leader Emomali Rahmon, the citizens of Dushanbe are partying to express their joy at the outcome of the recent referendum. Photo credit: AFP Capo for Life! The people of Tajikistan love their president Emomali Rahmon deeply. And as we now know, nearly all of them do. The last time a leader of similarly exalted stature enjoyed such unconditional and unshakable support from the entire citizenry was when comrade...

Read More »Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account. It can be a store of value, but the price fluctuates compared with other forms of money, or other commodities, like oil or silver. Some argue that it is a store of value because of the limited supply, but that argument applies to many other goods, including commodities and real estate (which Mark Twain said you have to...

Read More » SNB & CHF

SNB & CHF