The Swiss Franc net position was reduced from 4.0 contracts long to 0.1 thousand contracts long. Apart from the yen., other speculative position barely changed. We are keen on next week’s data that should reflect the dismal US jobs report. Even recognizing a holiday-short week, speculative position adjustments were minor in the days before the ECB meeting and the US jobs report. There were no gross position adjustments that met the 10k contract threshold. The largest gross...

Read More »Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term The incoming Philippine government is signaling looser fiscal policies ahead Polish President Duda’s team of experts may present several plans for consideration A second cabinet minister in Brazil was forced to resign Colombia eliminated its FX intervention program The IMF boosted Mexico’s Flexible Credit Line (FCL) from $67 bln to $88 bln Equities In the EM equity space, China (+4.1%), Brazil...

Read More »Saudi-Arabia: Peg or Banking Crisis?

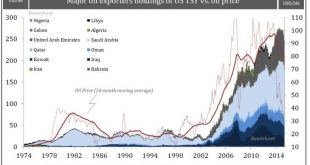

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More »Swiss Referendum: The new World of Bread and Circuses

Preposterous Initiative BALTIMORE – No whining and kvetching about the Deep State today. Instead, we sit at its feet, admire the cut of its jaw, and sing its praises. We are grateful to it… and not just as a source of amusement. In short, we delight in its incompetence. What brings this to mind is a small item in the news, which, like a pool ball careening across a felted table, knocked two or three others in their pockets before coming to rest. We had to go pluck each one out of its...

Read More »FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

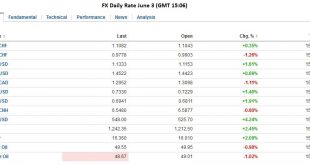

Surprise NFP visible in FX rates The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc. Click to enlarge. Longer term...

Read More »Twitter’s Other Growing Problem – A Surging Share Count

Home of the Anti-Bubble It seems like almost everybody has an opinion about Twitter (TWTR) – both the company and the stock. As for the company it seems that their “window of opportunity” to massively succeed has essentially closed as user growth and revenue have both slowed, quite dramatically, over the past 18 months. Plus management turnover is clicking at a rapid pace. Company executives typically do not leave if the firm’s future seems bright. Even the ubiquitous Co-Founder/CEO,...

Read More »Turning Stones Into Bread – The Japanese Miracle

Stuffing the Futon Our friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen”? We will return to that question further below, but first a few words on the new Samurai futon. Apparently the Japanese are becoming more than a little antsy about Kuroda-san’s negative interest rate policy (and the threats of more of the...

Read More »Guided By Nonsense

Seven Year Achievement “Read the directions and directly you will be directed in the right direction.” — Lewis Carroll U.S. consumers are at it again. After a seven year hiatus they’re once again doing what they do best. They’re buying stuff. PCE: personal consumption expenditures up 1% According to the Commerce Department, personal consumption expenditures (PCE), which is the primary measure of consumer spending on goods and services in the U.S. economy, increased $119.2 billion in...

Read More »Three Political Events before the UK Referendum

“Every thinking person in America is going to vote for you Governor Stevenson,” said an enthusiastic voter.“I am afraid that won’t do. I need a majority,” reportedly quipped Stevenson (1952 or 1956). The UK referendum on June 23 is the most important political event of the first half of the year. A decision to leave could be a significant disruptive force. No one knows for sure. It is precisely that uncertainty that is fueling the demand for insurance in the options market that...

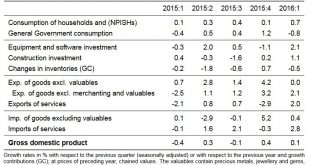

Read More »Swiss GDP Q1/2016, more Insights

Key points: Q/Q GDP growth: +0.1%, YoY GDP growth: +0.7% Until 2014, Swiss GDP was driven by net exports: Exports were rising more quickly than imports, which improved GDP. Positive change in the trade balance in goods: Recently only the trade balance of goods continued to increase (+8.1% YoY exports, +1.4% YoY imports in Q1/2016) Negative change in the trade balance for services (+6.7% YoY) increased more than the export of services (+2.0%). Exports of services are for example banking...

Read More » SNB & CHF

SNB & CHF