An initiative demanding a ban on tobacco advertising has collected 109,969 valid signatures, more than the 100,000 minimum required to launch a popular vote, according to RTS. The planned vote entitled: “Yes to the protection of children and young people against tobacco advertising” demands the federal government ban all forms of tobacco advertising towards children and young people. In practice such a ban would include banning all tobacco advertising in public...

Read More »Cool Video: With Rick Santelli on CNBC

I was invited to Rick Santelli’s Exchange on CNBC earlier today. There is a 3.5-minute clip of the interview that can be found here. Despite being a dollar bull for nearly a decade (since around the time of my first book–Making Sense of the Dollar–), I do not think a strong or weak dollar is desirable. It is about the level that is appropriate depending on business conditions and the economic cycle. If the Fed is easing policy, as it is now, and the dollar...

Read More »Economic Decay Leads to Social and Political Decay

If we want to make real progress, we have to properly diagnose the structural sources of the rot that is spreading quickly into every nook and cranny of the society and culture. It seems my rant yesterday (Let Me Know When It’s Over) upset a lot of people, many of whom felt I trivialized the differences between the parties and all the reforms that people believe will right wrongs and reduce suffering. OK, I get it, there are differences, but if the “reform” doesn’t...

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

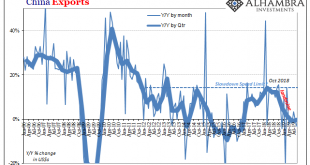

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More »Tidbits Of Further Warnings: Houston, We (Still) Have A (Repo) Problem

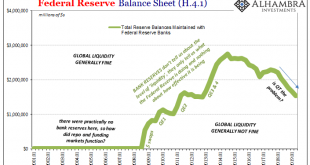

Despite the name, the Fed doesn’t actually intervene in the US$ repo market. I know they called them overnight repo operations, but that’s only because they mimic repo transactions not because the central bank is conducting them in that specific place. What really happened was FRBNY allotting bank reserves (in exchange for UST, MBS, and agency collateral) only to the 24 primary dealers. These were repos only between those entities and the Federal Reserve. It had...

Read More »Dollar Broadly Weaker as Brexit Deal Takes Shape

The dollar remains under pressure due to weak US retail sales and rising optimism on Brexit and the trade war Brexit negotiations remain tense and we should expect a higher than usual noise-to-signal ratio at this stage China said its goal is to stop the trade war and remove all tariffs US has a full data schedule; we remain constructive on the US economic outlook UK reported September retail sales; Sweden’s unemployment rate hit a 4-year high of 7.4% Australia...

Read More »FX Daily, October 17: EU-UK Deal Sends Sterling and the Euro Higher

Swiss Franc The Euro has fallen by 0.26% to 1.0983 EUR/CHF and USD/CHF, October 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A Brexit deal between the UK and the EU has been struck. Whether it can win Parliament’s approval is a horse of a different color. Meanwhile, US-Chinese relations continue to sour. The capital markets are narrowly mixed as investors await further developments. The MSCI Asia Pacific...

Read More »Commodities trader Gunvor held criminally liable for corruption

Gunvor was found to have taken no organisational measures to prevent corruption in its business activities (Keystone) The Geneva-based trading company Gunvor has been ordered to pay almost CHF94 million ($94.6 million), including a fine of CHF4 million over bribery in Africa. The commodities trader failed to prevent its employees and agents from bribing public officials between 2008 and 2011 in order to gain access to the petroleum markets in the Republic of Congo...

Read More »USD/CHF technical analysis: Breaks below 0.9940 confluence support, turns vulnerable

The pair remains under some selling pressure for the second straight session. The ongoing slide dragged it below a two-month-old ascending trend-channel. Bears might now aim towards challenging the 0.9900 round-figure mark. The USD/CHF pair extended this week’s rejection slide from the vicinity of the key parity mark and remained under some selling pressure for the second consecutive session. The ongoing slide to one-week lows has now dragged the pair below a...

Read More »Swiss Trade Balance Q3 2019: exports still rising thanks to chemistry-pharma

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More » SNB & CHF

SNB & CHF

-637068826263809659-310x165.png)