We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them. A bank deposit comes with a risk. But instead of compensating you for the risk, the bank pays you nothing. So it’s a return-free...

Read More »Charles Hugh Smith – The Financial System is Headed for Collapse

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »Charles Hugh Smith – The Financial System is Headed for Collapse

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »All-Stars #72 Jeff Snider: The Supply-side of the Eurodollar equation

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »FX Daily, October 21: Dollar Soft, but Stage is being Set for Turn Around Tuesday

Swiss Franc The Euro has risen by 0.20% to 1.0989 EUR/CHF and USD/CHF, October 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The UK’s departure from the EU remains up in the air as a new attempt to pass the necessary legislation through Parliament continues today. Many market participants seem to remain optimistic that Prime Minister Johnson’s plan will ultimately succeed. After slipping to $1.2875...

Read More »USD/CHF technical analysis: 0.9900/10 challenges recovery from 61.8 percent Fibo.

USD/CHF bounces off from a multi-week low. 38.2% Fibonacci retracement, late-September bottoms can question the recent upside. The USD/CHF pair’s latest recovery is less likely to prevail for long unless clearing near-term key resistance area. The quote seesaws around 0.9860 by the press time of the pre-European session on Monday. While 50% Fibonacci retracement of late-August to the early-October upside, at 0.9870, can act as an immediate upside barrier, 0.9900/10...

Read More »Swiss railways see more demand for train trips abroad

Demand has been highest for train trips to France, and the TGV Lyria high-speed train is planning to offer 30% more seats on its routes. (© Keystone / Gaetan Bally) Travellers in Switzerland are increasingly taking to the rails for trips abroad, with the Swiss Federal Railways reporting a 10% increase in demand for international journeys and 25% more demand for trips by night train. According to a report in the NZZ am Sonntag newspaper, demand for night train...

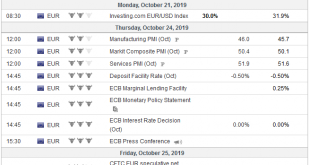

Read More »FX Weekly Preview: The Week Ahead Excluding Brexit

I feel a bit like the proverbial guy that asks, “Besides that, Mrs. Lincoln, how did you like the play?” in trying to discuss the week ahead without knowing the results of the UK Parliament’s decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate. Europe is front and center. Three...

Read More »What We’ve Lost

This is only a partial list of what we’ve lost to globalism, cheap credit and the Tyranny of Price which generates the Landfill Economy. A documentary on the decline of small farms and the rural economy in France highlights what we’ve lost in the decades-long rush to globalize and financialize everything on the planet— what we call Neoliberalism, the ideology of turning everything into a global market controlled by The Tyranny of Price and cheap credit issued to...

Read More »EM Preview for the Week Ahead

We are beginning to become more constructive on EM. The main trigger for some optimism is the shifting US-China dynamic. In our view, the partial trade deal reveals weakness on the part of the US. Reports suggest China will begin pushing for all existing tariffs to be dropped as part of Phase 2, which would be very positive for EM. That is still likely months away but this shifting dynamic bears watching. We will be putting out a longer MarketView piece on this topic...

Read More » SNB & CHF

SNB & CHF