According to an article in Bloomberg on November 5, 2019, Milton Friedman’s business cycle theory seems to be vindicated. According to Milton Friedman, strong recoveries are just natural after particularly deep recessions. Like a guitar string, the harder the string is plucked down, the faster it should come back up. Bigger recessions should lead to faster growth rates during the recoveries, to get the economy back to the pre-recession level of activity. In...

Read More »Congressman Prods Attorney General on Gold, Silver Trading Questions Ignored by CFTC

A U.S. representative who has been pressing the Treasury Department, Federal Reserve, and Commodity Futures Trading Commission (CFTC) with questions about the gold and silver markets has asked Attorney General William P. Barr to try intervene and get answers from the commission. In a letter dated November 1 and made public today, the U.S. representative, Alex W. Mooney, Republican of West Virginia, commends Barr for the Justice Department’s recent criminal...

Read More »Monetary Metals Leases Platinum to Money Metals Exchange

Scottsdale, Ariz, October 25, 2019—Monetary Metals® announced today that it has leased platinum to Money Metals Exchange® to support its U.S.-based business of selling precious metals at retail and wholesale. Investors earn 3% on their platinum, which is held in Money Metals’ inventory vault in the form of platinum coins, bars, and rounds. The lease fee is paid in gold. Monetary Metals has a disruptive model, leasing gold and silver—and now platinum—from investors...

Read More »FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Swiss Franc The Euro has fallen by 0.17% to 1.0876 EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five...

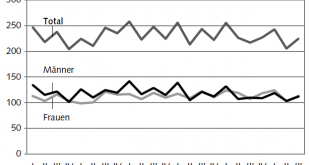

Read More »Swiss Labour Force Survey in 3rd quarter 2019: 0.3percent increase in number of employed persons; unemployment rate based on ILO definition rose to 4.6percent

14.11.2019 – The number of employed persons in Switzerland rose by 0.3% between the 3rd quarter 2018 and the 3rd quarter 2019. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) increased from 4.4% to 4.6%. The EU’s unemployment rate decreased from 6.5% to 6.2%. These are some of the results of the Swiss Labour Force Survey (SLFS). Download press release: 3rd quarter 2019: 0.3% increase in number of employed...

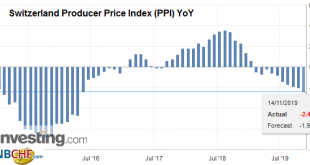

Read More »Swiss Producer and Import Price Index in October 2019: -2.4 percent YoY, -0,2 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

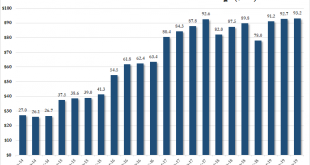

Read More »Swiss National Bank Now Owns Record $94 Billion In US Stocks After Q3 Buying Spree

In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump’s “trade optimism” tweets. It seemed quite evident over the quarter that President Trump’s tweeting of constant...

Read More »Banknoten können künftig unbegrenzt umgetauscht werden

Der Bundesrat hat am Mittwoch beschlossen, die Teilrevision des Bundesgesetzes über die Währung und Zahlungsmittel (WZG) auf den 1. Januar 2020 in Kraft zu setzen. Das Parlament hatte diese im Juni verabschiedet. Bisher galt für Notenserien, die von der Nationalbank (SNB) zurückgerufen wurden, eine Umtauschfrist von 20 Jahren. Während dieser Zeit konnten diese Noten zwar noch bei der SNB umgetauscht, aber nicht mehr für Zahlungen verwendet werden. Der unbefristete...

Read More »Telecom operator Sunrise to pay up for failed deal

Sunrise had planned to acquire UPC for CHF6.3 billion. (© Keystone / Christian Beutler) Following shareholder pushback, Swiss telecom operator Sunrise has cancelled the purchase contract for the cable network operator UPC, officially burying the controversial deal. This is another failed attempt to challenge industry leader Swisscom. “Yesterday evening we cancelled the purchase agreement,” Sunrise CEO Olaf Swantee said on Wednesday. “The deal proposed by management...

Read More »Stock Market Cheerleading: Why Do We Celebrate the Super-Rich Getting Richer?

It’s not too difficult to predict a political rebellion against the machinery of soaring wealth and income inequality. The one constant across the media-political spectrum is an unblinking focus on the stock market as a barometer of the national economy: every major media outlet from the New York Times to Fox News prominently displays stock market action, and TV news anchors’ expressions reflect the media’s emotional promotion of the market as the end all to be all:...

Read More » SNB & CHF

SNB & CHF