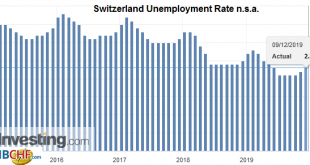

Unemployment Rate (not seasonally adjusted) Unemployment registered in November 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of November 2019, 106,330 unemployed were registered at the regional employment agencies (RAV), 4,646 more than in the previous month. The unemployment rate rose from 2.2% in October 2019 to 2.3% in the month under review. Compared to the same month last year, unemployment fell by 4,144 people...

Read More »USD/CHF Technical Analysis: Forms bearish flag on hourly chart

USD/CHF sellers await confirmation of the bearish technical pattern. 200-hour EMA limits immediate upside. Following its heavy declines on Monday, USD/CHF trades near 0.9880 while heading into the European session on Tuesday. The pair forms a bearish flag on the hourly chart while staying near the pattern support by the press time. With this, sellers will wait for a downside break of flag support, near 0.9870, to aim for the theoretical target of 0.9700. However,...

Read More »You Will Never Bring It Back Up If You Have No Idea Why It Falls Down And Stays Down

It wasn’t actually Keynes who coined the term “pump priming”, though he became famous largely for advocating for it. Instead, it was Herbert Hoover, of all people, who began using it to describe (or try to) his Reconstruction Finance Corporation. Hardly the do-nothing Roosevelt accused Hoover of being, as President, FDR’s predecessor was the most aggressive in American history to that point, economically speaking. Roosevelt just took it a step (or seven) further....

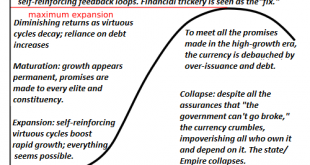

Read More »The Taxonomy of Collapse

The higher up the wealth-power pyramid the observer is, the more prone they are to a magical-thinking belief that the empire is forever, even as it is crumbling around them. How great nations and empires arise, mature, decay and collapse has long been of interest for a self-evident reason: if we can discern a template or process, we can predict when the great nations and empires of today will slide into the dustbin of history. One of the justly famous attempts to...

Read More »The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days...

Read More »Why this Boom Could Keep Going Well Beyond 2019

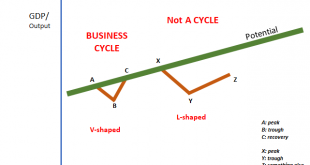

The Austrian business cycle theory offers a sound explanation of what happens with the economy if and when the central banks, in close cooperation with commercial banks, create new money balances through credit expansion. Said credit expansion causes the market interest rate to drop below its “natural level,” tempting people to save less and consume more. Credit expansion also drives firms to increase investment spending. The economy enters into a boom phase....

Read More »All-Stars #83 Jeff Snider: Objective analysis of global USD liquidity yields a different story…

All-Stars #83 Jeff Snider: Objective analysis of global USD liquidity yields a different story than financial media are telling Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »FX Daily, December 09: China’s Steps-Up Import Substitution Strategy while USMCA Comes Down to the Wire

Swiss Franc The Euro has risen by 0.05% to 1.0949 EUR/CHF and USD/CHF, December 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for...

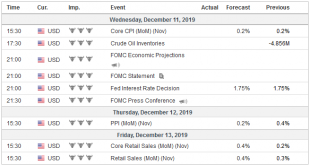

Read More »FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI...

Read More »Swiss asset managers linked to Austrian corruption scandals

Austria is still investigating massive corruption scandals involving far-right politicians, including Heinz-Christian Strache (Left) and the late Jörg Haider (Right), seen here in 2008. (Keystone) Swiss asset managers are involved in some of Austria’s biggest corruption scandals, according to the SonntagsZeitung newspaper. The paper writes that in ongoing cases involving far-right politicians Jörg Haider, Karl-Heinz Grasser and Heinz-Christian Strache, the trail...

Read More » SNB & CHF

SNB & CHF