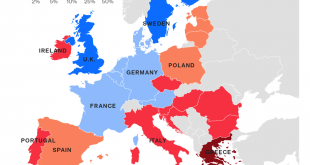

Bank Bail-In Risk In Europe Seen In 5 Charts – Nearly €1 trillion in non-performing loans poses risks to European banks’– Greece has highest non-performing loans as a share of total credit – Italy has the biggest pile of bad debt in absolute terms– Bad debt in Italy is still “a major problem” which has to be addressed – ECB– Level of bad loans in Italy remains above that seen before the financial crisis – Deposits in...

Read More »Swiss medical students follow their dream in Romania

It's notoriously difficult to gain university places in medicine and veterinary science in Switzerland, so a growing number of Swiss are going to Romania to study instead. (RTS/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »FX Daily, February 21: Markets Mark Time

Swiss Franc The Euro has fallen by 0.02% to 1.1544 CHF. EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has...

Read More »Great Graphic: S&P 500 vs Euro Stoxx 600 and Exchange Rates

Summary: S&P 500 stalled near 61.8% retracement of decline. Dow Jones Stoxx 600 stopped at 38.2% retracement. U.S. corporate earnings growth has been much more impressive than that of Europe. The different performance does not appear to be a function of FX rates. Today is an important day for equities. After a sharp sell-off earlier this month, stocks staged a recovery last week. The recovery has stalled...

Read More »Cool Video: Bloomberg Interview-Rates, Dollar, and Equites

- Click to enlarge In large gatherings of people, from airplanes to theater to conferences, we are often told to know the closest exit. The same is true for investing. No matter one’s confidence when they buy a security, someone is just as convinced on the other side who is selling the security. Well into this 4.5-minute interview (click here for the link) on Bloomberg’s “What’d You Miss” show, Lisa Abramowicz...

Read More »Vaud – vote on divisive dental tax and care plan

On 4 March 2018, voters in Vaud will vote on a plan to provide basic universal dental care funded by a tax on salaries. - Click to enlarge The initiative entitled: Reimbursement of dental care, Pour le remboursement des soins dentaires in French, claims that 10% of the population avoid the dentist because of the cost. They also claim links between poor dental health and cancer, diabetes and premature births. Their...

Read More »Swiss financial watchdog publishes ICO guidelines

ICO's have been fuelled particularly by bitcoins (Keystone) - Click to enlarge The Swiss financial watchdog has published guidelines on digital currency fundraisers – known as initial coin offerings – under which it will regulate some ICOs, either under anti-money laundering laws or as securities. The Financial Market Supervisory Authority (FINMA) says the guidelines “also define the information FINMA...

Read More »US-China Trade War Escalates As Further Measures Are Taken

US-China Trade War Escalates As Further Measures Are Taken – Trade war between two superpowers continues to escalate– White House likely to impose steep tariffs on aluminium and steel imports on ‘national security grounds’– US may impose global tariff of at least 24% on imports of steel and 7.7% on aluminium– China “will certainly take necessary measures to protect our legitimate rights.”– China is USA’s largest...

Read More »Brown Brothers’ Chandler Says Low Yields Aren’t Driving Stock Market

Feb.20 -- Marc Chandler, global head of currency strategy at Brown Brothers Harriman, discusses markets, yields, inflation and the dollar on "What'd You Miss?"

Read More »Brown Brothers’ Chandler Says Low Yields Aren’t Driving Stock Market

Feb.20 -- Marc Chandler, global head of currency strategy at Brown Brothers Harriman, discusses markets, yields, inflation and the dollar on "What'd You Miss?"

Read More » SNB & CHF

SNB & CHF