The Federal Council believes that the change would not increase the risk of crime. (Keystone) - Click to enlarge The deadline of 20 years to exchange recalled banknotes should be abolished, the Federal Council suggested on Wednesday. The current system, which was introduced in 1921, operates under the assumption that discontinued notes which are not returned to the bank within the exchange deadline have...

Read More »Geneva to Zurich for half the price of a Swiss train

Switzerland’s transport authority (OFT) recently gave Domo Swiss Express SA, a Zurich-based bus company, a green light to run three routes across Switzerland. Domo bus_source_Facebook_Domo.Reisen - Click to enlarge The first will run from Zurich to Lugano, via Basel and Luzern, the second from St. Gallen to Geneva airport, via Zurich and Bienne, and the third from Chur to Sion, via Zurich and Bern. Services are...

Read More »Venezuela’s New Cryptocurrency: Just Another Form of Control Fraud

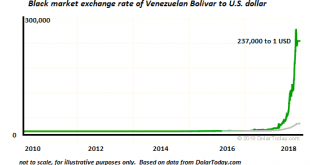

If a currency can’t be converted on demand into the underlying commodity, it’s not “backed by oil,” it’s just another form of control fraud. The broke and broken country of Venezuela appears to be the first nation-state to issue a cryptocurrency token (the petro) as a means of escaping the financial black hole that’s consuming its economy: Maduro Launches Oil-Backed Crypto “For The Welfare Of Venezuela”. For context,...

Read More »Market Efficiency? The Euro is Looking Forward to the Weekend!

Peculiar Behavior As I have shown in previous issues of Seasonal Insights, various financial instruments are demonstrating peculiar behavior in the course of the week: the S&P 500 Index is typically strong on Tuesdays, Gold on Fridays and Bitcoin on Tuesdays (similar to the S&P 500 Index). Several readers have inquired whether currencies exhibit such patterns as well. Are these extremely large markets also home...

Read More »Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc. Indeed, both currencies are characterised by structurally large domestic current...

Read More »2017 sees big boom in internet shopping

Pallets in the warehouse of the logistics center of one of Switzerland's main online shops (Keystone) - Click to enlarge Swiss consumers are increasingly turning to the internet for shopping. Online sales were up by 10% in 2017, with a 23% increase in online purchases from abroad. The total sales generated from online shopping in 2017 was CHF8.6 billion ($9.2 billion) last year, with CHF1.6 billion going to...

Read More »Switzerland’s Gotthard Base Tunnel wins European Railway Award

Running for 57 kilometres under the Swiss Alps, the Gotthard Base Tunnel is the longest rail tunnel in the world and took 17 years to build. (Keystone) - Click to enlarge The 2018 European Railway Award has been awarded to two pioneers of the Gotthard Base Tunnel, the longest rail tunnel in the world that runs under the Gotthard massif in the Swiss Alps. Peter Jedelhauser of Swiss Railways and Renzo...

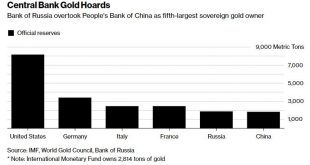

Read More »Russian Central Bank Buys Gold – 600,000 Ounces Or 18.7 Tons In January As Venezuela Launches ‘Petro Gold’

– Russian central bank buys gold – large 600,000 ounces or 18.7 tons of gold in January– Russia increased its holdings to 1,857 tons, topping the People’s Bank of China’s ‘reported’ 1,843 tons – Russia surpasses China as 6th largest holder of gold reserves – after U.S., Germany, IMF, Italy and France– Turkish central bank added 205 tons “over 13 consecutive months” – Commerzbank– Meanwhile, Russian ally Venezuela is...

Read More »Emerging Markets: What Changed

Summary China regulators have taken over Anbang Insurance. Group for at least one year RBI minutes from this month’s meeting were more hawkish than expected. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index. Israeli Prime Minister Netanyahu is coming under increasing...

Read More »Strange Economic Data

Economic Activity Seems Brisk, But… Contrary to the situation in 2014-2015, economic indicators are currently far from signaling an imminent recession. We frequently discussed growing weakness in the manufacturing sector in 2015 (which is the largest sector of the economy in terms of gross output) – but even then, we always stressed that no clear recession signal was in sight yet. US gross output (GO) growth...

Read More » SNB & CHF

SNB & CHF