There is an ongoing tug-of-war between trade tensions and fundamentalsDue to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US Treasuries returning 2.3% over the same period. Meanwhile, the US reporting season provided some reassurance, with better corporate results than generally feared. Current preannouncements remain in line with average Q3 2019 earnings growth expectations.Developed market earnings growth expectations for the full

Read More »Articles by Wilhelm Sissener and Jacques Henry

Update to our earnings scenario

April 12, 2019After a stellar 2018, earnings expectations for the S&P 500 have been ratcheted down for this year. Total returns will increasingly come from sources other than earnings.Earnings estimates in developed markets have been cut continuously over the past six months. The consensus expectation for earnings growth in 2019 for the S&P 500 is now around 3.5%. This compares with stellar earnings growth of 24.1% in the US in 2018, thanks in large part to the end-2017 US tax cuts announced by the Trump administration.Although year-on-year earnings are expected to have declined by 4% in Q1 19 and to be relatively flat in the following two quarters, expected US earnings growth is just below 3.5% for the full year (see chart). This means that most of the earnings growth is expected in the final quarter

Read More »The US tax bill will boost 2018 earnings forecasts

December 20, 2017The 21% corporate tax rate could cause 2018 expected earnings growth for US stocks to more than double. We see some upside risk to our US equity scenario.Last night, the US Senate approved the tax bill. It has since returned to the House of Representatives for administrative reasons, but, in line with an earlier vote, a green light looks now highly likely. Shortly thereafter, President Trump should sign it formally into law. If the tax reform is adopted, the statutory tax rate is expected to fall from 35% to 21% in January 2018. Ahead of the tax cuts, the expected effective tax rate for the S&P 500 stood at 29% for 2018.All US sectors will benefit from the fiscal boost, even the technology sector, which prior to the bill’s passage had an effective 2018 expected tax rate of 23%.The real

Read More »Developed-market equities continue to price hard data

November 29, 2017Recent hard macro data confirm the resiliency of the business cycle into year end and 2018.The momentum behind hard macro data is improving investors’ visibility on corporate profit growth in developed markets (DM), which we expect to be the main market risk factor driving equity markets over 2018.According to our analysis, 96% of year-to-date returns of the Stoxx Europe 600 have been due to earnings growth and 59% of the S&P 500’s (see chart). By way of comparison, only 37% of the MSCI Emerging Market Index’s year-to-date returns and 35% of the MSCI AC Asia (ex Japan)’s have been been due to earnings growth.Going into 2018, our central scenario is for the same trend to remain in place, i.e. DM equity returns should continue to be driven mainly by earnings growth rather than by shifts in

Read More »The BoJ’s ETF purchases mark a major shift for Japanese equity market

October 17, 2017Through its asset purchase programme, the Bank of Japan owns 4% of the TOPIX’s market capitalisation and two-thirds of Japanese equity ETFs.Although it has made no major monetary policy announcement since September 2016, the Bank of Japan (BoJ) has actually been tapering its government bond purchases ever since. As a result, equity ETF purchases have steadily increased over the past year from 3% of total BoJ purchases to 9% recently, above the initial implicit target of 7%.The central bank now has a 65% share of Japanese ETFs’ assets under management. While this may look significant, it represents only about 4% of the current TOPIX market capitalisation. However, the BoJ’s involvement in ETF purchases represents a major shift in the Japanese equity market.So far in 2017, foreign investors

Read More »High equity valuations leave no room for disappointment

September 21, 2017Our updated core scenario for global equities foresees earnings growth as the primary driver of returns over the next 18 months. We expect current high valuations to persist.Our core scenario for global equities for the next 18 months is built on three active risk factors (drivers): earnings growth, valuations and currency fluctuations. Of the three, earnings growth will be the most significant for return generation.After two strong quarterly reporting seasons, the positive base effect that boosted earnings growth in Europe in the first half of 2017 is fading. In 2018, earnings growth in developed equity markets will be capped at around 10%, with an even split between sector groups. This trend contrasts with the annual growth rates of over 20% that investors got used to in the immediate

Read More »Positive margin dynamics, but stretched equity valuations

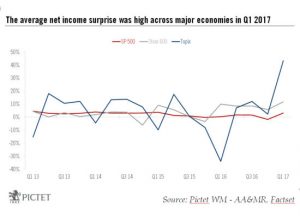

August 28, 2017Second-quarter results were well above estimates, but average earnings surprises were modest in the US and consensus estimates for 2018 have stalled.The Q2 2017 reporting season demonstrated that corporate results dynamics remain robust across developed economies. Sales and profit figures came in well above estimates in the US, Europe and Japan. The trend for profit growth has sustained equity markets’ total returns year to date. But due to the weakness of the US currency, returns in that currency are stronger in Europe and Japan than in the US.In Q2 2017, two thirds of US companies posted positive earnings surprises. Nearly 60% of S&P 500 companies surprised positively in terms of sales and 66% beat profit estimates. But the average surprise was fairly small at 1.2% in terms of net

Read More »Resilient earnings growth across all regions

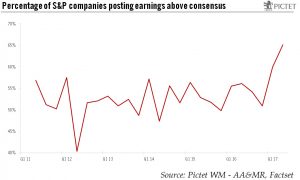

May 30, 2017Analysis suggests that earnings growth should reach double digits in most major markets, helping to underpin equity markets.Corporate earnings growth for Q1 2017 surprised positively across major economies. Among the key trends of this earnings season has been the synchronisation not only of the macroeconomic cycle, but also the earnings cycle. Indeed, all markets exhibited strong trends in corporate profit growth. In particular, Japan and Europe provided significant positive surprises. The strong Q1 2017 reporting season has anchored full year earnings growth estimates at more than 10% most major economic areas. On the S&P 500, 62% of companies’ earnings came in above expectations, making it the best reporting season of the 2010s so far. Whereas just 45% of companies on the Stoxx Europe

Read More »Profit dynamics support further upside for equity markets

March 27, 2017Corporate results are in keeping with our central scenario of 10% total returns for global equities this year.Our 2017 scenario, drawn up last December, called for a total annual return of 10% for global equities this year. We attributed the bulk of this performance to a double-digit rise in estimated corporate profits. As the Q4 2016 reporting season draws to a close, 2017 earnings expectations are proving resilient or are being revised upwards. Yet the earnings cycle is turning out to be desynchronised across regions, making it difficult to identify a unique common risk factor for equity markets.Current 2017 US earnings growth expectations are proving resilient. A large part of this estimated growth is attributable to the oil sector, which is expected to contribute 3.2 percentage points. This means that the growth in 2017 earnings for all other sectors on the S&P500 excluding oil is expected to be 6.3%. But these factors still do not factor in either potential supply-side reforms or fiscal stimulus.In Europe, 2017 earnings growth forecasts have skyrocketed, mainly driven by a base effect triggered by European financials. Even when excluding financials, expected 2017 growth in Europe remains above 10%. Despite upward revisions in corporate operating margins, Europe has not bridged the gap with the US.

Read More »Equity total returns could reach double digits in 2017

December 21, 2016According to our risk factor-based analysis, equities are likely to provide a total return of around 10% on average next year.Major equity markets are likely to deliver a total return of around 10% in 2017 according to our risk factor-based analysis framework. This projection is contingent on two market risk factors, i.e. equity and interest rates.We use four building blocks in our calculation of projected equity returns: dividend yield, buyback yield, valuation and earnings growth.The dividend yield and the buyback yield produce shareholders’ cash return. Dividend yield tends to be fairly stable over time. We do not expect any significant shift in this trend in the foreseeable future. Our expected dividend yields for major equity markets in 2017 are close to the 10-year median. Forecasting the buyback yield is more challenging. However, in spite of rising US interest rates, US companies should continue to buy back their shares in 2017, although at a slower rate than before. In Europe, buyback yields may remain only slightly above zero as European companies still tend to favour dividends over buybacks, unlike US companies. In Japan, regulatory incentives for buybacks are strong and buyback yield is expected to stand at around 1% in 2017.

Read More »Arbitraging between equity investment strategies

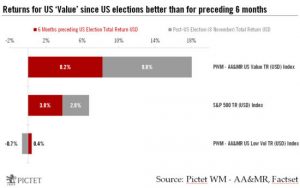

December 1, 2016The market leadership of US ’Value’ has strengthened considerably in the aftermath of the US elections.The US Value equity strategy’s outperformance has accelerated since the US elections on November 8. Over the 15 trading days following the elections, our Value index returned 9.8% (in US dollars), compared with 8.2% during the preceding six months.Current economic and equity market dynamics reveal an opportunity to arbitrage between two distinct equity investment strategies: US ‘Low Vol’ (low price volatility equities) and US ‘Value’ (stocks that have lower relative valuations and more sensitivity to economic shocks).Among macro factors, inflation expectations are among the most relevant for explaining the regime shift toward US Value since July 2016. As inflation expectations rise, Value gains traction. Since July 2016, Value equities have not only significantly outperformed Low Vol, but also the S&P 500 benchmark. The regime shift also coincided with recovery in sentiment in the aftermath of the UK’s Brexit vote and better-than-expected US employment data.An investor can further dissect the US equity market according to Value and the Low Vol risk, which also suggests an early July 2016 shift in market dynamics. Investors are now clearly eschewing US Low Vol equities in favour of US Value.

Read More »