Pension schemes are as diverse as the cultures of the countries whose working population they insure. Nevertheless, they all aim to guarantee a certain level of income in retirement. The UBS International Pension Gap Index, first released in 2017, analyses the sustainability and adequacy of the pension promises across 24 jurisdictions. This is done on the basis of the private savings rate required by an average person of 50 today to maintain their standard of living in retirement.

Private savings are imperative

Almost none of the pension schemes examined provides a guarantee that everything will be well, at least if one only considers the mandatory part. Some systems are in a better position and can promise their beneficiaries comparatively generous benefits.

Articles by UBS Switzerland AG

Results of the Annual General Meeting 2021 of UBS Group AG

April 9, 2021Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Claudia Böckstiegel and Patrick Firmenich as new members of the Board.

Shareholders approved a dividend distribution of USD 0.37 (gross) in cash per share. They also approved the new share buyback program 2021–2024.

Shareholders approved the proposals relating to the remuneration of the members of the Board of Directors and the Group Executive Board and accepted the Compensation Report 2020.

At the Annual General Meeting, the independent proxy represented 2,146,061,226 votes.

Zurich, 8 April 2021 – UBS Group AG shareholders approved all of the Board of Directors’ proposals at the Annual General Meeting (AGM).

Management report and consolidated and

Art Basel and UBS Global Art Market Report: Online sales reached record highs in 2020, doubling in value

March 16, 2021Zurich, 16 March 2021 – Art Basel and UBS announced today the publication of the fifth Art Basel and UBS Global Art Market Report, authored by renowned cultural economist Dr Clare McAndrew. The report integrates insight from a recent survey of 2,569 high-net-worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch, across ten markets: the United States, United Kingdom, France, Germany, Italy, Hong Kong, Taiwan, Singapore, Mexico, and for the first time Mainland China, as well as data from UBS Evidence Lab. A comprehensive and macro-level analysis of the global art market in 2020, the report analyzes how the COVID-19 pandemic has impacted the market and identifies key trends that will shape the market in 2021 and beyond.

The findings include:

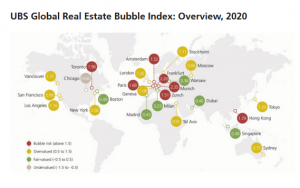

UBS Global Real Estate Bubble Index 2020: Munich and Frankfurt are the most overvalued housing markets globally

October 1, 2020Zurich, 30 September 2020 – The UBS Global Real Estate Bubble Index, a yearly study by UBS Global Wealth Management’s Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities.

Prices increased on average, with Europe showing most cities at risk

The Eurozone stands out as the region with the most overheated housing markets. Munich and Frankfurt top the ranking. Paris and Amsterdam closely follow suit, treading on bubble risk territory alongside the two German cities. Similarly, Zurich, Toronto, and Hong Kong also display high imbalances. In contrast to last year, Vancouver’s housing market is now on the overvalued range of the spectrum, sharing the same territory with London, San

Read More »Art Basel and UBS art market survey shows online sales and millennial collectors increasingly important to an art market hit hard by COVID-19

September 9, 2020Zurich, 09 September 2020 – Art Basel and UBS today published a 2020 mid-year survey ‘The Impact of COVID-19 on the Gallery Sector’ written by renowned cultural economist Dr. Clare McAndrew, Founder of Arts Economics. The survey findings present an analysis of how the COVID-19 pandemic has impacted 795 galleries operating in the Modern and contemporary gallery sector, representing 60 different markets across all levels of turnover, throughout the first six months of 2020.

In order to assess the level of collector participation and interaction with the gallery sector and art market during the first half of 2020, Arts Economics worked in collaboration with UBS to gather insights from 360 high net worth collectors across three different markets: the US, the UK, and

New UBS report reveals that joint financial participation is the key to gender equality

July 7, 2020Significant majority of men and women believe women need to be equally involved in long-term financial decisions to achieve true gender equality, yet half of women let their spouses take the lead

COVID-19 has worsened inequalities, with women more focused on household duties and men more focused on finances

Despite pre-marital intentions, millennial women are most likely to defer financial decisions to their spouses

New York, July 6, 2020 – According to UBS Global Wealth Management’s latest Own Your Worth report, 74% of men and 82% of women see joint participation in long-term financial decisions as a necessary step to create gender equality. The report, which surveyed 1,825 high-net-worth investors in the US, found that a significant majority believe equal

UBS raises USD 440 million for Rockefeller sustainable investment fund

June 25, 2020Zurich, June 24 2020 – UBS is investing in Rockefeller Asset Management’s Global Environmental, Social and Governance (ESG) Equity fund, broadening the sustainable investment opportunities that it offers to clients.

UBS, the world’s largest global wealth manager, has allocated directly to the fund through its 100% sustainable multi-asset portfolio, which surpassed USD 10 billion in size earlier this year. The fund is also available to UBS Global Wealth Management clients in specific locations as a standalone investment.

Across these channels, UBS has raised USD 440 million so far for the product, which remains open to investment from its clients in the relevant regions.

The Rockefeller Global ESG Equity strategy takes an “ESG improvers” approach, seeking to

UBS: Does Anyone Know What Is Happening?

April 1, 2020Does anyone know what is happening?

Economic data is likely to become increasingly unreliable as a result of the coronavirus lockdown. We know the global economy will be bad. We will not know, with much accuracy, just how bad.

Annualizing data is absurd in the current climate. What happens in the second quarter is not going to be repeated for the rest of the year. Time to stop annualizing numbers.

Most economic data is survey based. Industrial production, some unemployment numbers, inflation numbers, GDP and the various sentiment opinion polls need people to fill in surveys. If you are filling in survey forms in a lockdown you are likely to be an unusual person, and possibly not representative.

Social media spreads fear and affects sentiment. Sentiment affects

Changes to the UBS Board of Directors

January 12, 2020Zurich, 10 January 2020 – The Board of Directors of UBS Group AG announced today that it will nominate Nathalie Rachou and Mark Hughes for election to the Board at the Annual General Meeting on 29 April, 2020. David Sidwell and Isabelle Romy will not stand for re-election. David Sidwell will have completed a twelve year term of office and Isabelle Romy has decided to step down after eight years on the UBS Board.

Nathalie Rachou (born 1957) has been a member of the Board of Directors at Société Générale and will step down from that position on 19 May, 2020 – a position she has held for twelve years. In 1999, she founded Topiary Finance Ltd., an asset management company based in London that merged with the investment company Rouvier Associés in 2014. She retains a

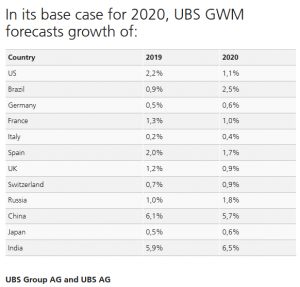

UBS unveils Year Ahead outlook for 2020 and a ‘decade of transformation’

November 21, 2019Zurich, 20 November 2019 – Stark political choices make the 2020 outlook more difficult to predict, but innovation driven by technology and sustainability will present new winners and losers over the decade ahead, according to UBS Global Wealth Management (GWM)’s new Year Ahead outlook.

UBS GWM’s core recommendations for the year are:

quality and dividend-paying stocks, as well as domestic and consumer-focused firms that are less exposed to trade and business spending;

a middle-of-the-road approach to bonds, given very low yields on the safest debt and rising credit risks among high-yield issuers;

a preference for: precious metals over cyclical commodities; a combination of safe and high-yielding currencies; for low sensitivity to market movements within

UBS Global Real Estate Bubble Index 2018

September 28, 2018The UBS Global Real Estate Bubble Index 2018 report is produced by UBS Global Wealth Management’s Chief Investment Office and analyzes residential property prices in 20 developed market financial centers around the world.

Hong Kong faces the greatest risk of a housing bubble, followed in descending order by Munich, Toronto, Vancouver, Amsterdam, and London.

Stockholm and Sydney moved out of bubble risk territory this year, while Geneva moved closer to fair value. Chicago was once again the only undervalued city in the report.

Zurich, New York, Singapore, 27 September 2018 – The UBS Global Real Estate Bubble Index 2018 from UBS Global Wealth Management’s Chief Investment Office indicates bubble risk or a significant

Results of the Annual General Meeting 2018 of UBS Group AG

May 6, 2018– Click to enlarge

UBS shareholders approved all the Board of Directors’ proposals at today’s Annual General Meeting in Basel. Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Jeremy Anderson and Fred Hu as new members of the Board. They approved the payment of an ordinary dividend of CHF 0.65 per share, an increase compared with the previous year. They approved the proposals relating to the remuneration of the members of the Board of Directors and the Group Executive Board and accepted the Compensation Report 2017. 1,160 shareholders attended the meeting, representing 2,211,306,377 votes.

Zurich, 3 May 2018 – UBS Group AG shareholders approved all

UBS publishes agenda for the Annual General Meeting of UBS Group AG on 3 May 2018

April 4, 2018– Click to enlarge

Zurich, 3 April 2018 – The Board of Directors of UBS Group AG is proposing Jeremy Anderson and Fred Hu for election as new members of the Board of Directors for a one-year term. Jeremy Anderson (born 1958) was Chairman of Global Financial Services at KPMG International from 2010 until November 2017. He previously held various senior positions at KPMG and was appointed to lead KPMG’s UK Financial Services Practice in 2004. He became European head of this area in 2006, and global head in 2010. Jeremy Anderson is a British citizen and graduated from University College London with a bachelor’s degree in economics. The firm announced Jeremy Anderson’s nomination to the Board of Directors of UBS

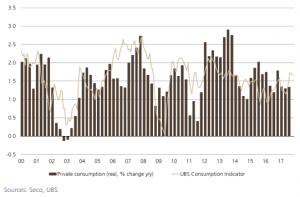

UBS consumption indicator: Solid private consumption in 2018

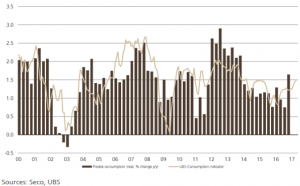

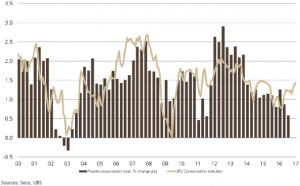

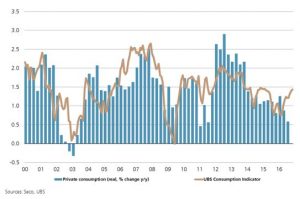

December 27, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

At 1.67 points, the UBS consumption indicator was above its long-term average in November, indicating solid consumption growth in 2018. Thanks to solid economic growth, private consumption will likely continue expanding despite rising inflation.

Zurich, 27 Dezember 2017 – The consumption indicator fell slightly in November, to 1.67 from 1.68 points. Values from previous months were revised upward by a significant margin in response to surprisingly strong summertime growth in overnight stays. New car

Switzerland UBS Consumption Indicator October: UBS consumption indicator trends sideways

November 29, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it.

Zurich, 29 November 2017 – The UBS consumption indicator inched up to 1.54 points in October from a corrected September figure of 1.51. New registrations for passenger cars and

Switzerland UBS Consumption Indicator September: Higher expectations in the retail industry

October 25, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator rose to 1.56 points in September, signalling consumption growth slightly above the long-term average. The indicator was supported by significantly higher expectations in the retail industry, but UBS still projects consumer spending to grow 1.3 percent for the year overall.

Zurich, 25 October 2017 – In September the UBS consumption indicator reached 1.56 points, while the August figure was revised slightly lower to 1.50. The consumption indicator currently shows slightly higher

Switzerland UBS Consumption Indicator August: A pleasant end to summer

September 27, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator increased to 1.53 points in August thanks to robust new car registrations and encouraging numbers of hotel stays by Swiss residents, indicating consumption growth slightly above the long-term average of 1.5%. However, the UBS economists still project 1.3% consumer spending growth for the year overall.

Zurich, 27 September 2017 – The UBS consumption indicator rose to 1.53 points in August. The original July value was revised up to 1.46 points. The consumption indicator was altered

UBS Consumption Indicator: Weaker Swiss Franc Offers a Ray of Hope

August 30, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Private consumption vs. UBS Consumption Indicator

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

The UBS consumption indicator came in at 1.38 points in July, suggesting that private consumption in Switzerland is growing at a subdued

Switzerland UBS Consumption Indicator June: Subdued Growth

July 26, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

Private consumption vs. UBS Consumption Indicator

Zurich, 26 July 2017 – The UBS consumption indicator stood at 1.38 points in June, pointing to subdued growth in consumption at the end of

Read More »UBS Outlook Switzerland: Generation Silver in the labor market

July 24, 2017A longer working life can counteract the demography-related shortage of skilled workers and spiraling social security expenditure. For this to happen, however, the reintegration of older employees must be improved and gainful employment made more attractive beyond the age of retirement. New, innovative concepts are needed that point the way toward a labor market that is more flexible and better-oriented to the needs older employed workers.

Zurich, 13 July 2017 – In the next 10 years, approximately 1.1 million people in Switzerland will turn 65 and as a result over 690,000 employed workers1 will exit the labor market. By contrast, without immigration, only 480,000 employed workers will enter it. Moreover, if

Read More »Switzerland UBS Consumption Indicator April: Late Easter slows down car sales

May 31, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator stood at 1.48 points in April, indicating average private consumption growth. The improved mood in the retail sector supported the indicator, while a decline in new car registrations had a negative effect. The index of consumer sentiment measured by the State Secretariat for Economic Affairs also fell slightly.

Late Easter effect

New car registrations in April were down 10% from the previous year, or by almost 3,000 vehicles. Owing to the late Easter, however, April this year

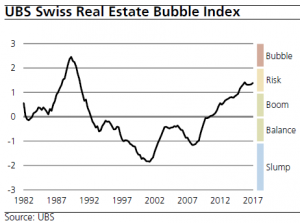

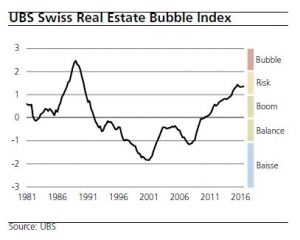

Swiss real estate market UBS Swiss Real Estate Bubble Index Q1 2017

May 5, 2017Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Major Findings

The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase.

The increase in home prices outpaced the increase in rents and income.

Demand for buy-to-let investments also rose, in spite of heightened market risks.

UBS Swiss Real Estate Bubble Index

The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks.

Switzerland UBS Real Estate Bubble Index(see more posts on Switzerland Real Estate Bubble Index, ) Source: static-ubs.

Read More »Switzerland UBS Consumption Indicator March: Problem child in retail

April 26, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator registered at 1.50 points in March, indicating private consumption growth around the long-term average. Solid automotive demand drove this figure. Domestic tourism, on the other hand, took a breather after a strong start in 2017. Pessimism still prevails in retail.

Zurich, 26 April 2017 – The UBS Consumption Indicator stood at 1.50 in March, and the February figure was revised downwards slightly to 1.45. Following strong growth at the beginning of the year (5.5%), domestic tourism fell by 0.8% in February compared with the same month in the previous year. New car registrations, on the other hand, increased by 4.8% compared with the previous year. A sour mood prevails among retailers, according to a survey conducted by the Swiss Economic Institute (KOF) at ETH Zurich. The sentiment index traded at –9 in March and was below the long-term average of 4.5 for the 32nd month in succession. It seems that the hoped-for adjustment by the retail sector to the new exchange rate realities is only taking place very slowly.

Switzerland UBS Consumption Indicator February: Domestic tourism rising

March 29, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator rose to 1.50 points in February from 1.44, indicating solid private consumption in the first quarter. Domestic tourism bottomed out and then rose significantly in January. On the other hand, dour sentiment in the retail trade is hemming further gains by the consumption indicator.

Zurich, 29 March 2017 – The UBS consumption indicator climbed to 1.50 points in February from 1.44. Domestic tourism drove the rise still recovering from the consequences of the franc shock in early 2015. The number of overnight hotel stays was up by 5.5% the same month in the previous year. In January, plenty of snow and the start of the skiing holidays lured many Swiss into the mountains. The tourist regions of Graubünden (+12.0%) and Valais (+7.5%) recorded strong growth, while the number of overnight stays fell significantly in the Basel region (-22.1%). However, in the light of the mild weather in the same month of the previous year, overall Swiss growth should not be overestimated.

Switzerland UBS Consumption Indicator January: Light and shade

March 2, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator rose from 1.38 to 1.43 points in January and continues to signal solid growth in private consumption. Swiss consumers view the economic and financial situation with considerably more optimism than in the last quarter. New car registrations and domestic tourism have, however, fallen compared with the previous January.

Zurich, 1 March 2017 – Following a comprehensive data revision, the UBS consumption indicator climbed from 1.38 to 1.43 points in January. The rise owes to a clear improvement in consumer sentiment as the Consumer Sentiment Index published by the State Secretariat for Economic Affairs climbed from -13 to -3 points. Compared with the previous year, new car registrations decreased 3.7%. At 48.9%, the share of new cars with four-wheel drive makes up the biggest proportion of the purchases, which may be due to the large amount of snow that fell in January. As expected, domestic tourism rose slightly from November to December, benefiting from Christmas business. But compared with the same month last year, the number of overnight hotel stays dropped 2.3%.

Read More »Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2016

February 3, 2017Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Major Findings

• The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016.

• The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks.

• The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth.

UBS Swiss Real Estate Bubble Index

The UBS Swiss Real Estate Bubble Index stayed in the risk zone in 4Q 2016 at 1.35 index points. The index increased only marginally over the slightly revised figure for the previous quarter. The sub-indicators price-to-earnings and price-to-rent increased slightly. On the other hand, the slower growth in mortgage debt had a dampening effect.

Interest rate risks continue to rise

In the meanwhile, the index has been moving in the range of 1.30 to 1.45 index points for one and a half years.

UBS Consumption Indicator: Automobile market with record year-end results

January 25, 2017The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator rose from 1.45 to 1.50 points in December. The positive trend of last fall continued and signalizes solid growth prospects for private consumption this year. New car registrations in the automobile sector, which are at an all-time high, are at the root of this positive outlook.

Zurich, 25 January 2017 – The UBS consumption indicator rose from 1.45 to 1.50 points in December due primarily to the strong year-end results of the Swiss automobile sector. Compared with the previous December, new car registrations were up by 8.2%. The mood in the retail sector remains pessimistic, though. Domestic tourism managed to maintain its robust November showing. Compared with December 2015, the number of overnight hotel stays rose 0.9%.

Private consumption vs. UBS Consumption Indicator

Following a relatively sluggish start to the winter season due to the lack of snow, hopes for a good winter have since grown thanks to the major snowfalls before the start of the sports holiday season. Nevertheless, a long-term recovery of the Swiss tourism sector is not expected.

Swiss Real Estate Focus 2017: Vacancy rates rising at the end of the real estate cycle

January 19, 2017Zurich, 19 January 2017 – Switzerland’s major cities saw net prime yields for multi-family homes drop to 2.6% in 2016 from an average of 2.8%. This is equivalent to a 6% increase in net present value. These low yields are creating additional incentives for investors to seek out higher returns in less central locations. Yet the number of vacant rental apartments – which has already doubled since 2009 – is likely to increase further still over the course of this year. At first glance, the projected loss of income appears moderate given a vacancy rate for rental apartments of 2% across Switzerland as a whole. However, one in four communities already has a vacancy rate higher than 5% for rental apartments.

Vacancy rate inadequate for measuring risk

Vacancy rates are not an exact measure of the risk of rent defaults. First, payment defaults by tenants and loss of rent due to renovation work are not recorded as vacancies. Second, vacant apartments are often found in properties at bad microlocations, in subsegments such as luxury apartments or vacation rentals, and in new buildings. For example, the vacancy rate for new builds stands at around 10%.

UBS Chief Investment Office WM publishes real estate market study UBS Real Estate Focus 2017: Vacancy rates rising at the end of the real estate cycle

January 19, 2017Zurich, 19 January 2017 – Switzerland’s major cities saw net prime yields for multi-family homes drop to 2.6% in 2016 from an average of 2.8%. This is equivalent to a 6% increase in net present value. These low yields are creating additional incentives for investors to seek out higher returns in less central locations. Yet the number of vacant rental apartments – which has already doubled since 2009 – is likely to increase further still over the course of this year. At first glance, the projected loss of income appears moderate given a vacancy rate for rental apartments of 2% across Switzerland as a whole. However, one in four communities already has a vacancy rate higher than 5% for rental apartments.

Vacancy rate inadequate for measuring risk

Vacancy rates are not an exact measure of the risk of rent defaults. First, payment defaults by tenants and loss of rent due to renovation work are not recorded as vacancies. Second, vacant apartments are often found in properties at bad microlocations, in subsegments such as luxury apartments or vacation rentals, and in new buildings. For example, the vacancy rate for new builds stands at around 10%.

UBS Consumption Indicator: Subdued private consumption in 2017 despite solid November figures

December 28, 2016The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid start is to be expected for 2017, but momentum is expected to subside.

Zurich, 28 December 2016 – The UBS Consumption Indicator rose to 1.43 points in November from 1.39. As already seen in prior months, the rise is due mainly to domestic tourism. According to the latest available figures, Swiss tourists provided for a happy ending to the summer season with an increase in the number of hotel stays in October of 4.9% year-on-year. Besides domestic tourism, the Swiss automobile market also blossomed in the end. The increase in new vehicle registrations by 0.4% compared to the already strong same month last year presented car dealers with a golden November.

Private consumption vs. UBS Consumption Indicator

The current value of 1.43 points lies within the long-term average, which indicates solid growth for the coming months.