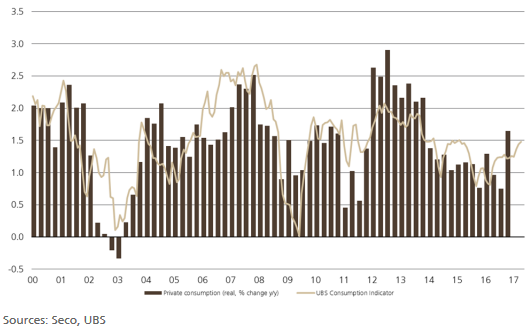

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator stood at 1.48 points in April, indicating average private consumption growth. The improved mood in the retail sector supported the indicator, while a decline in new car registrations had a negative effect. The index of consumer sentiment measured by the State Secretariat for Economic Affairs also fell slightly. Late Easter effect New car registrations in April were down 10% from the previous year, or by almost 3,000 vehicles. Owing to the late Easter, however, April this year

Topics:

UBS Switzerland AG considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Private Consumption, Switzerland UBS Consumption Indicator

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator stood at 1.48 points in April, indicating average private consumption growth. The improved mood in the retail sector supported the indicator, while a decline in new car registrations had a negative effect. The index of consumer sentiment measured by the State Secretariat for Economic Affairs also fell slightly.

Late Easter effect

New car registrations in April were down 10% from the previous year, or by almost 3,000 vehicles. Owing to the late Easter, however, April this year had three fewer working days than last year, when Easter fell in March. Thus, the demand for cars may have been greater than the number of new car registrations would suggest, since more than 1,200 new vehicles were registered on average per working day in 2016. On the other hand, tourism may have benefited from the additional public holidays in April, after the number of overnight stays in hotels by Swiss residents fell by 0.3% this March compared to the previous year.

Consumer sentiment still cautious

Although the index for the mood in the retail sector, as measured in a survey by the Swiss Economic Institute (KOF) at ETH Zurich, still points to pessimism among retailers, the index improved to -2.6 points in April, significantly higher than the March reading of -9 (before revision). By contrast, the index of consumer sentiment measured by the State Secretariat for Economic Affairs declined slightly. While consumers did not change their assessment of the future labor market compared with the last survey in January, they revealed a more cautious attitude on the general economic outlook, their own financial position, and the possibility of saving money next year.

Impact of the French elections

Emmanuel Macron’s victory in the French presidential elections has considerably reduced the political uncertainty in the Eurozone. As a result, the growth prospects for Swiss exporters have also improved this year. Swiss consumption should also benefit from solid economic growth and a drop in unemployment. The increase in consumer prices, however, could moderate consumption as rising inflation will lead to lower growth in real income.

Private consumption vs. UBS Consumption IndicatorZurich, 31 Mai 2017 – The UBS consumption indicator stood at 1.48 points in April, marginally below its long-term average. The March figure was revised slightly lower, from 1.50 to 1.44. |

Switzerland Private Consumption and UBS Consumption Indicator, April 2017(see more posts on Switzerland Private Consumption, Switzerland UBS Consumption Indicator, ) Source: ubs.com - Click to enlarge |

How the UBS Consumption Indicator is calculated

The UBS Consumption Indicator signals private consumption trends in Switzerland with a lead time of one to three months on the official figures. At more than 50%, private consumption is by far the most important component of Swiss GDP. UBS calculates this leading indicator from six consumer-related parameters: new car registrations, business activity in the retail sector, the number of domestic overnight hotel stays by Swiss residents, the consumer sentiment index, employment figures and credit card transactions made via UBS at points of sale in Switzerland. With the exception of the consumer sentiment index and employment figures, all of this data is available monthly.

Tags: Featured,newsletter,Switzerland Private Consumption,Switzerland UBS Consumption Indicator