By EconMatters We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary policies. I have news for you we already had the "Inflation Trade" from 2008 to 2016, now we are setting up for the Market Crash Trade from 2017 until Stocks find a bottom based upon fundamental valuations that are sustainable long term. Central Banks have all shot their wad, they are loaded to the gills with assets, which once the decline comes, and people (including central banks) start experiencing losses on their portfolio holdings, selling begets selling, and the Stock Markets around the Globe start crashing like the Tulip Market did, and every bubble market since the beginning of time. This always plays out the same way every single time.

Topics:

EconMatters considers the following as important: Business, Business cycle, Capitalism, Central Banks, Donald Trump, Economic bubbles, economy, Financial crises, Financial crisis, Financial market, inflation, Market Crash, Market timing, Real estate, Reality, Recession, S&P 500, Securities and Exchange Commission, stock market, Stock Market Bubble, Swiss National Bank, Systemic risk, Technical Analysis, Twitter, Zurich

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

By EconMatters

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary policies.

I have news for you we already had the "Inflation Trade" from 2008 to 2016, now we are setting up for the Market Crash Trade from 2017 until Stocks find a bottom based upon fundamental valuations that are sustainable long term. Central Banks have all shot their wad, they are loaded to the gills with assets, which once the decline comes, and people (including central banks) start experiencing losses on their portfolio holdings, selling begets selling, and the Stock Markets around the Globe start crashing like the Tulip Market did, and every bubble market since the beginning of time.

This always plays out the same way every single time. Silicon Valley has already started crashing, the Brick and Mortar Retailers are going through their own systemic recession, the financiers who own this real estate are headed for bankruptcy court, I think the Oil Market still has major systemic headwinds, the automobile industry I expect is next to enter a major decline period, and Healthcare and the Medical System is about to go into its own recession because Healthcare is unaffordable by a large margin. Throw in the added dynamic that all countries globally are carrying way too much debt since the financial crisis, and central banks have done all they could to inflate asset prices.

I put a recession starting this year at around 50%, and Donald Trump is the most unstable leader we have ever had as President of the United States. Economics and the Fundamentals matter and given my analysis the upside potential for stocks versus the downside risk has never been greater. The stock market and financial markets globally right now are like investing in the last stages of the Tulip Market Bubble right before it Crashed!

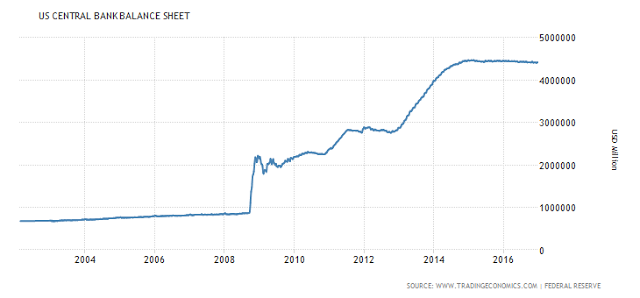

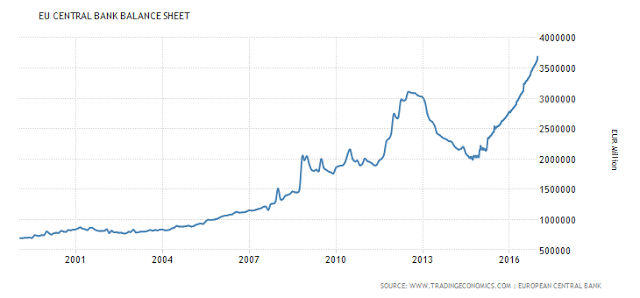

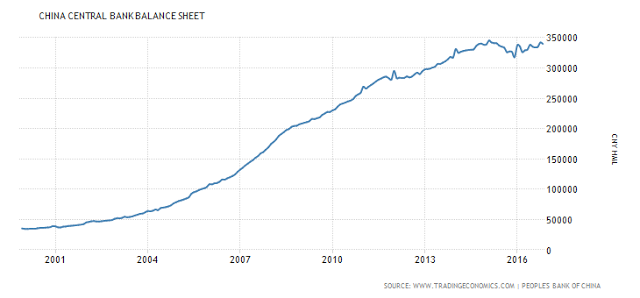

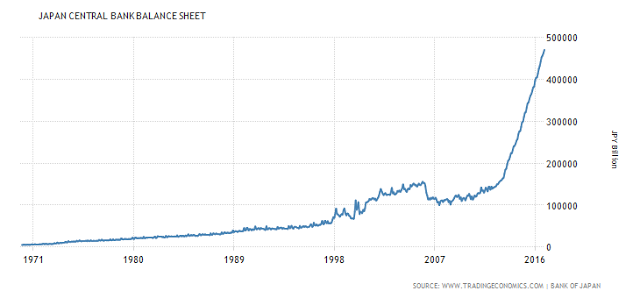

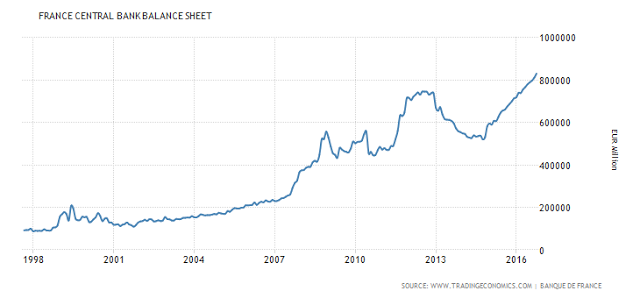

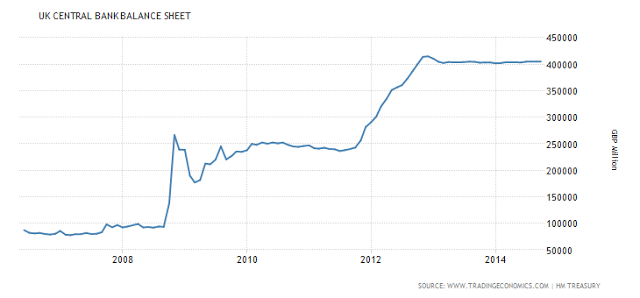

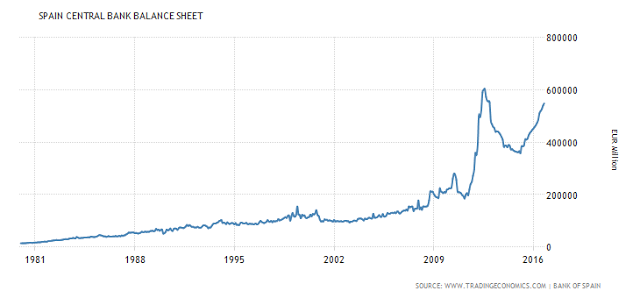

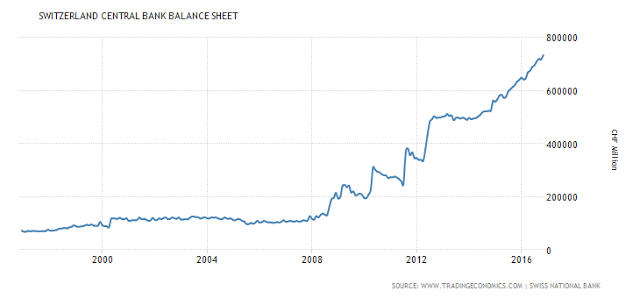

I repeat who is left to buy, do you really want to buy stocks after all this buying has taken place since the financial crisis by Central Banks? It isn`t whether the S&P 500 can go to 2300 or not? The reality is that stocks are in a bubble, and looking at all the central bank buying over the last 8 years it is no wonder; just look at all these central bank balance sheet charts. Stocks are overvalued, and not by just a little bit, but by at least 50% by my models and that is based upon current global economic growth. If we enter a global recession which I put at around 65% over the next 16 months, think in terms of taking out the 2000 and 2008 stock market bubble highs/support areas in the markets. In short, the downside risk exposure for long only investors has never been greater in the history of financial markets.

When I hear market pundits talk about the emergence of "The Inflation Trade" I just shake my head at how stupid people (professionals who make a living in the industry) are from a basic competency standpoint. What we have just witnessed in Financial Markets given the 2.5% global growth dynamics since 2007 is the "Greatest Inflation Trade" in the history of Modern Financial Markets. Professionals in my industry really lack basic critical thinking skillsets, just a little smarter on average than Sales personnel.

When it comes to Stock Market Bubbles, the crash always cleans out the industry carcasses, only to be replaced by equally dumb personnel, and the entire cycle that is 'financial markets stupidity' repeats itself similar to a standard business cycle. Given the basic IQ and Critical Thinking Abilities of most people in this industry, it should scare the hell out of you as an investor when you hear this "I don't see how you can't be bullish in this environment" given the considerable history of financial markets and their propensity for crashing, and the current valuations versus the fundamentals of most stocks right here, coming to the ending stages of an eight year business cycle.

We are long overdue for a good old fashioned recession to clean out the financial market excesses of the last 8 years of insane stupidity.

|

2,523

|

|

|

4

|

|

|

219

|

|

|

1,809

|

|

|

2,028

|

|

|

8

|

|

|

Total Mkt Value (in $ millions)

|

63,726

|

|

Energy

|

9.15%

|

|

Basic Materials

|

4.05%

|

|

Industrials

|

12.71%

|

|

Consumer Cyclicals

|

13.95%

|

|

Consumer Non-Cyclicals

|

10.5%

|

|

Financials

|

9.39%

|

|

Healthcare

|

13.32%

|

|

Technology

|

19.71%

|

|

Telecommunication Services

|

3.48%

|

|

Utilities

|

3.74%

|

This never ends well for Financial Markets, and this time will be no different, the fascinating psychology of asset bubbles and how fortunes are lost never gets old in my book! Capital Destruction is a fascinating concept, if you really think about it.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle