That changes our perspective on the wonderfulness of ever-expanding household wealth. The assets of U.S. households recently topped $100 trillion, yet another sign that everything is going swimmingly in the U.S. economy. Let’s take a look at the Federal Reserve’s Household Balance Sheet, which lists the assets and liabilities of all U.S. households in very big buckets (real estate: $25 trillion). (For reasons unknown,...

Read More »Risk Reward Analysis for Financial Markets

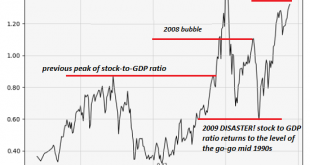

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble...

Read More »Risk Reward Analysis for Financial Markets

By EconMatters We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary...

Read More »Where Will All the Money Go When All Three Market Bubbles Pop?

Since the stock, bond and real estate markets are all correlated, it’s a question with no easy answer. The Everything Bubble Everyone who’s not paid to be in denial knows stocks, bonds and real estate are in bubbles of one sort or another. The Housing Bubble Real estate is either an echo bubble or a bubble that exceeds the previous bubble, depending on how attractive the market is to hot-money investors. S&P /...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org