The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index is the third largest in history. The graph below shows that a similarly high level of retail investor bearishness occurs most often when the market has already declined significantly. Some may argue that political sentiment may dramatically impact the current reading. While we certainly have seen that

Topics:

RIA Team considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

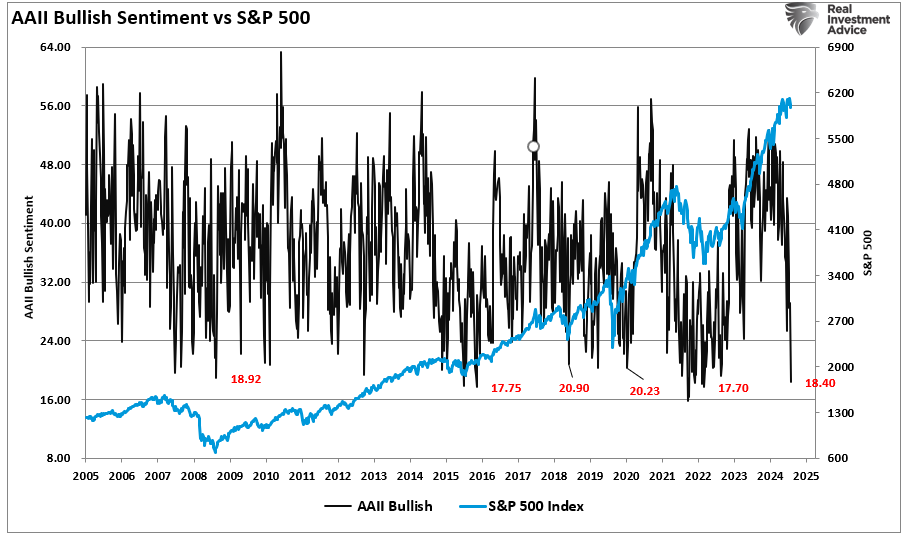

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index is the third largest in history.

The graph below shows that a similarly high level of retail investor bearishness occurs most often when the market has already declined significantly. Some may argue that political sentiment may dramatically impact the current reading. While we certainly have seen that in other surveys, the jump in bearishness occurred over the past week, not when Donald Trump became President.

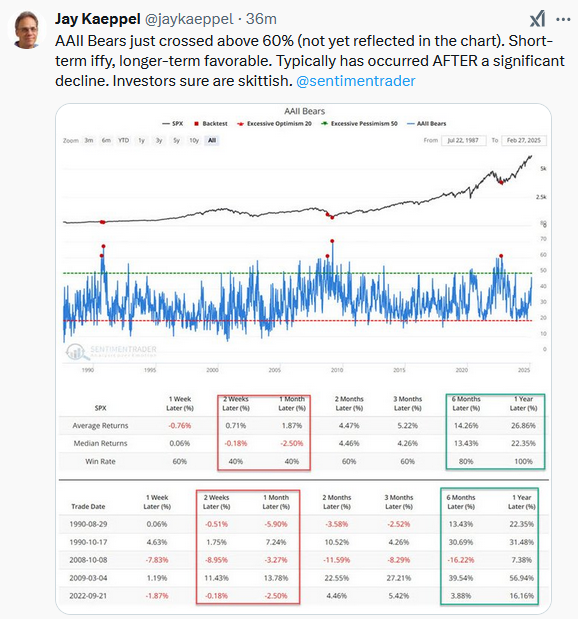

An old Wall Street adage goes, "When everyone is on one side of the boat, go to the other." Sentimentrader qunatifies whether the advice is worth following. In its analysis, as shown in the Tweet of the Day, of the other five times bearishness was above 60%, the average return six months later was +14.26%, increasing to 22.35% for twelve months. The S&P 500 was up six months later in four of the five instances. Moreover, the market was positive in all instances, looking out for a full year.

What To Watch Today

Earnings

- No notable earnings releases

Economy

Market Trading Update

Yesterday, we discussed how to navigate stop loss levels in the market. Most importantly, we noted that when markets trigger stop loss levels, they are oversold and due for a reflexive bounce. That selling pressure also reverses investor sentiment, often a contrarian indicator for a market rally. Such is particularly the case today.

As noted above, retail investor sentiment is at levels that have normally aligned to more severe market corrections like the Financial Crisis and the Pandemic in 2020. Surprisingly, the recent market correction has been only about 3%, yet investors are acting as if it has been a major mean reverting event.

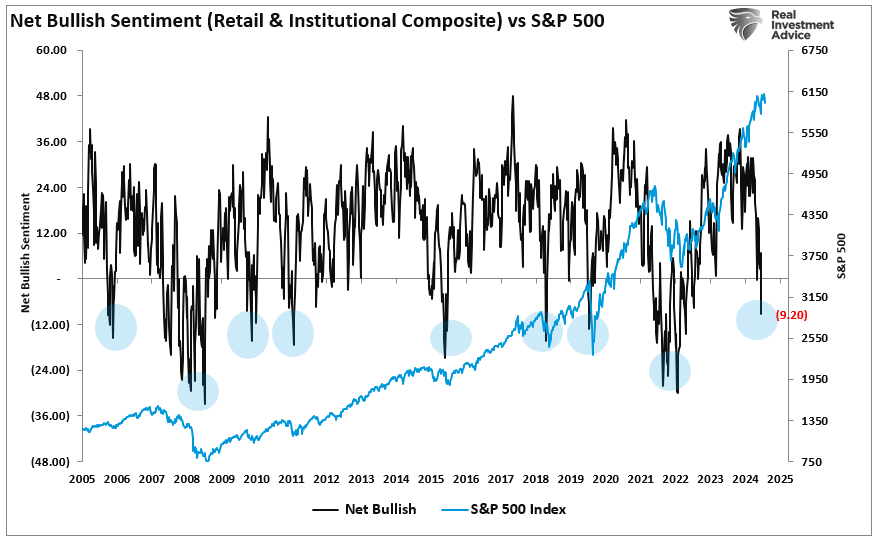

However, it is not just retail investors who are suffering. Our composite index of both professional and retail investors shows a similar decline. Sentiment among the majority of investors has, again, reached levels more associated with significant market corrections and market bottoms, as identified by the blue-shaded areas.

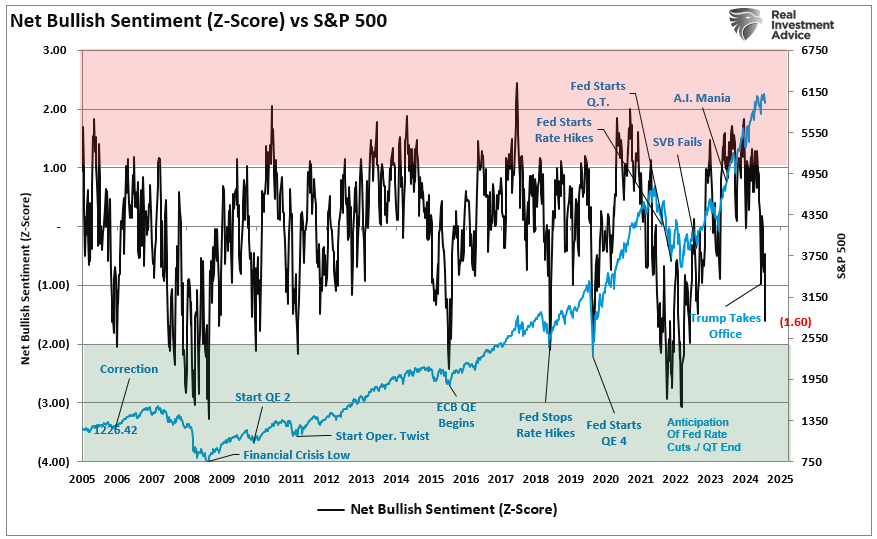

If we convert that sentiment score into a Z-score, sentiment is approaching two standard deviations below its average level. As noted, such levels are more coincident with market bottoms than the beginning of a corrective cycle. I have labeled some events along the way. The lesson is that headlines drive sentiment, and when sentiment becomes too negative, as may be the case today, such allows for rallies to form.

Does this mean the next major bull market rally is set to begin? No. But it does suggest that there are such high levels of negative sentiment that selling today will likely be a mistake. Loss avoidance is one of the psychological factors that leads investors to long-term underperformance. With market sentiment very negative and becoming decently oversold, be patient and wait for a tradeable rally to rebalance portfolio positions as needed. For traders, there is a decent tradable opportunity setting up near term.

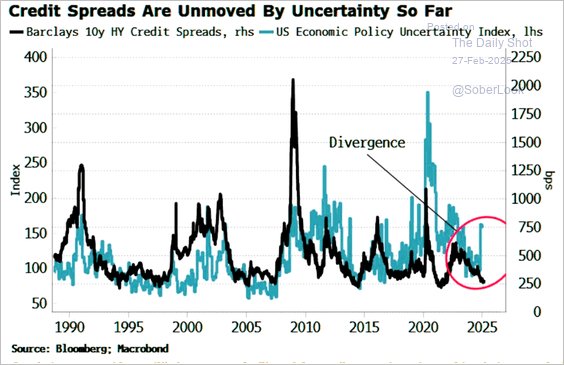

Corporate Bond Investors Stay Calm

While retail investors are skittish, corporate bond investors appear unperturbed. Credit spreads, or the yield premium an investor gets paid for taking the credit risk of corporate bonds, are at record-low levels. In other words, they harbor few economic concerns.

Political opinions are much less likely to impact credit spreads as institutional investors primarily drive them. Therefore, credit spreads give us an unbiased sentiment indicator. This may be why credit spreads point to little fear, unlike the recent consumer and investor confidence sentiment data.

Is It Time To Buy Foreign Stocks?

The answer may depend on your views of the dollar. Crescat Capital shares the graph below, which shows the strong correlation between the dollar index and the relative returns of the S&P 500 versus the MSCI, excluding the US. While not a perfect timing indicator, there is undoubtedly a strong relationship between a rising dollar and the relative outperformance of the S&P 500. Conversely, periods of dollar weakness have led to the outperformance of foreign stocks versus US stocks.

To answer our question, what's your view of the dollar? Is the dollar index starting to top, as the annotations in the graph allude to? Or will tariffs and a relatively stronger US economy keep the dollar index well bid?

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Retail Investors Are Suddenly Bearish appeared first on RIA.

Tags: Featured,newsletter