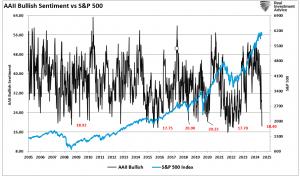

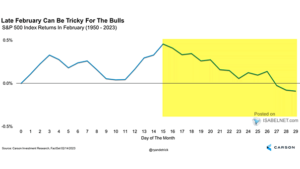

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index is the third largest in history.

The graph below shows that a similarly high level of retail investor bearishness occurs most often when the market has already declined significantly. Some may argue that political sentiment may dramatically impact the current reading. While we certainly have seen that

Read More »