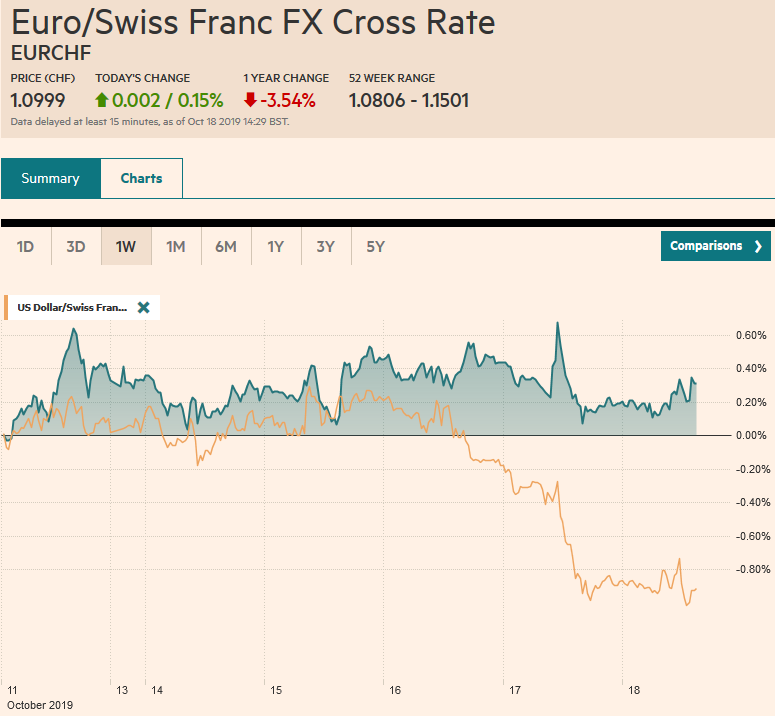

Swiss Franc The Euro has risen by 0.15% to 1.0999 EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift its threatened sanctions. Asia Pacific equities were mostly a little softer, though the Nikkei eked out a small gain, and India’s Nifty 50 extended its streak to a sixth advancing session, encouraged by strong earnings and anticipation of more. European and US shares are little changed but softer.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, EMU, EUR/CHF, Featured, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.15% to 1.0999 |

EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

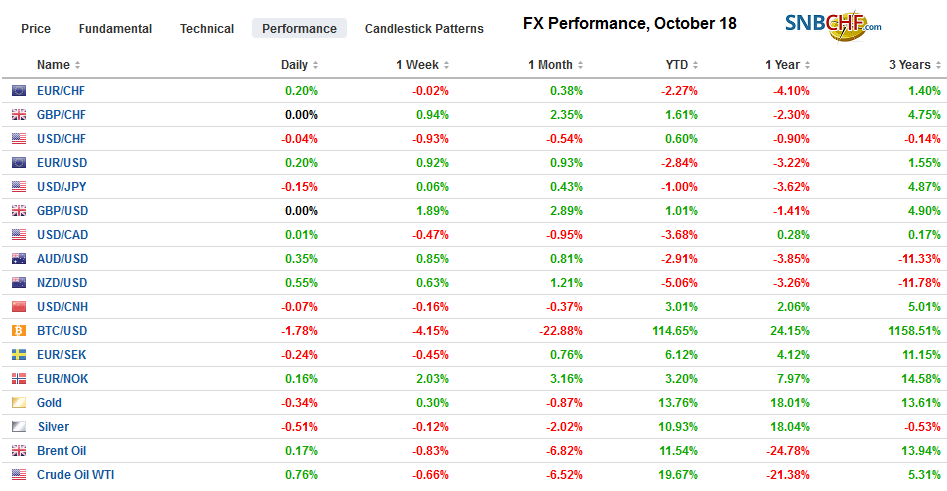

FX RatesOverview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift its threatened sanctions. Asia Pacific equities were mostly a little softer, though the Nikkei eked out a small gain, and India’s Nifty 50 extended its streak to a sixth advancing session, encouraged by strong earnings and anticipation of more. European and US shares are little changed but softer. Benchmark 10-year bond yields are slightly higher. The dollar is sporting a softer profile though sterling is consolidating after yesterday’s wild swings. Oil prices are higher for the third session but are still off a little more than 1% for the week. Gold’s small loss is enough to also push it slightly lower for the week. |

FX Performance, October 18 |

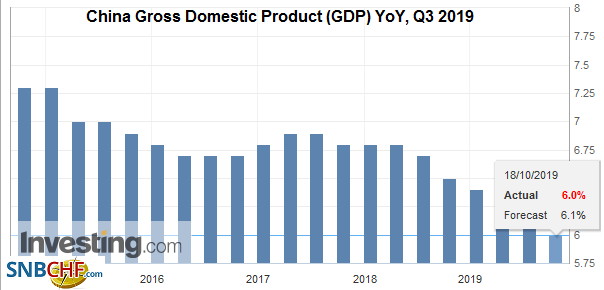

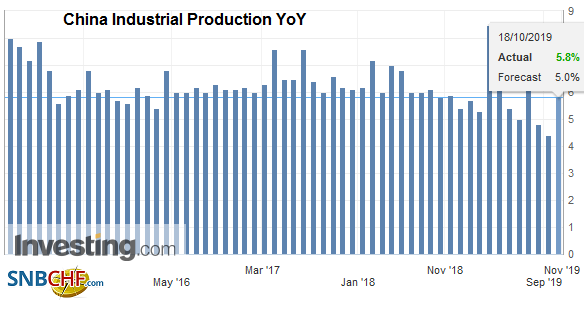

Asia PacificChina’s Q3 GDP slowed to 6.0%. It was a little more than expected, and the slowdown of the second-largest economy does not appear to have bottomed. That said, September industrial output and retail sales strengthened sequentially. |

China Gross Domestic Product (GDP) YoY, Q3 2019(see more posts on China Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| Estimates suggest that the trade conflict with the US may have shaved 0.5% of the year-over-year pace of activity. Reports indicate the swine herd may be poised for recovery, though the African swine flu appears to have struck other Asian countries. |

China Retail Sales YoY, September 2019(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

| While Chinese officials continue to seem reluctant to provide large-scale stimulus, the PBOC’s money market operation this week suggests pre-emptive efforts to head-off a money market squeeze as the late October tax season drains liquidity. Last week the dollar finished near CNY7.0885 and now is near CNY7.0825, slipping for the second consecutive week. |

China Industrial Production YoY, September 2019(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

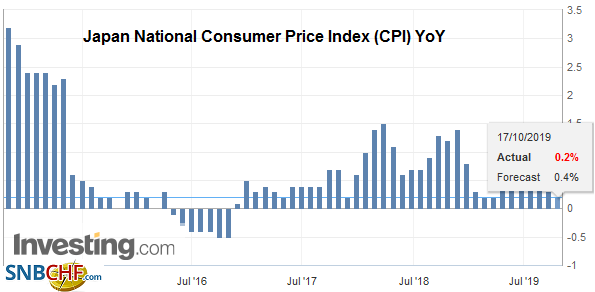

| Japan’s lowest CPI in a couple of years continues to encourage expectations that the Bank of Japan will take fresh action at its meeting later this month. Headline CPI eased to 0.2% year-over-year in September from 0.3% in August. |

Japan National Consumer Price Index (CPI) YoY, September 2019(see more posts on Japan National Consumer Price Index, ) Source: investing.com - Click to enlarge |

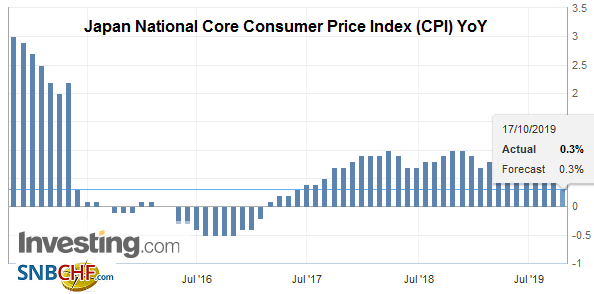

| The core rate, which excludes fresh food, fell to 0.3% from 0.5%. Separately, Japan’s Diet approved legislation that requires foreign investors to register if they intend to buy more than 1% of a listed Japanese company, down from 10% previously. This is another expression of economic nationalism that appears increasingly evident. Foreign investors continued to buy Japanese shares last week, and in the first two weeks of October, their purchases are at five-month highs. As the US TIC data showed, Japanese investors are taking advantage of a softer yen and large carry to buy foreign bonds. Last week, they bought more than JPY1 trillion of international bonds, the most since late August. |

Japan National Core Consumer Price Index (CPI) YoY, September 2019(see more posts on Japan National Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The dollar has been confined to less than a one yen range this week. Repeated attempts so far to take the greenback above JPY109 have faltered, but the market does not appear to have given up, but given the uncertainty over the UK Parliament’s vote tomorrow, it may be reluctant to do so in North America today. There is a $585 mln option at JPY109 that expires today. Another option for JPY108.75 (~$450 mln) that expires today is also in play. The Australian dollar is closing in on its third weekly advance, the longest in six months. Growth in full-time employment is helping it shrug off the impact of the soft Chinese data. RBA Governor Lowe claimed that negative interest rates in Australia were “extraordinarily unlikely,” which reinforces our sense that negative interest rates are associated with central bank decisions in current account surplus areas and are not merely the result of demographic factors, as some have argued. The Aussie is building on yesterday’s gains to reach a one-month high today near $0.6840 and is poised to close the week above a three-month downtrend found around $0.6790.

EuropeWith the UK-EU agreement, all attention shifts to the UK Parliament, which will sit tomorrow and consider the plan. In many ways, the agreement Johnson struck will make for a harder Brexit and one that arguably estranges Northern Ireland. There would be new trade barriers and additional border checks. The deal also rules out a new customs union and appears to block a close relationship with the Single Market. Without an activist government in the UK, this Brexit will entail extensive deregulation (i.e., environmental, worker, and consumer protections will be eroded). |

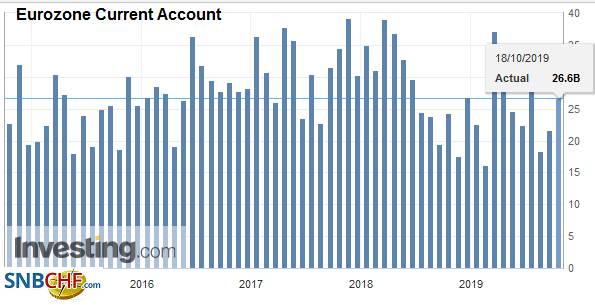

Eurozone Current Account, August 2019(see more posts on Eurozone Current Account, ) Source: investing.com - Click to enlarge |

| The issue is will it pass Parliament. Johnson has lost several votes in the House of Commons and does not have a majority. It may be close, but our guess is that the bill is shy by maybe a couple dozen votes. Part of it rests on the 21 Tory MPs that lost the whip for not supporting the government in a prior vote to restrict a no-deal exit. There are also a few Labour MPs and independents that could go either way. The Democratic Unionists are opposed, and some Tory MPs said their (DUP) support was key for their votes. The Scottish Nationalists want an immediate extension and election. Labour wants a referendum for the people to ratify the agreement. If the bill does not pass, Johnson is required to request a three-month extension. Although EC President Juncker said it is this agreement or no agreement, he was speaking for himself as it is not his call. |

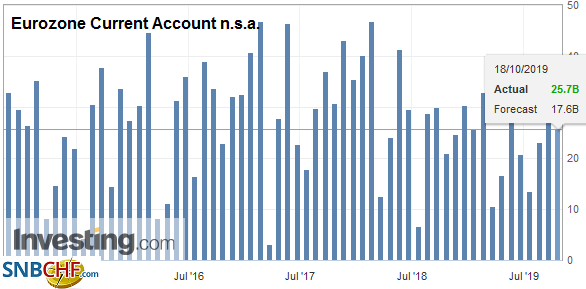

Eurozone Current Account n.s.a., August 2019(see more posts on Eurozone Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The US tariffs on $7.5 bln of Europea goods start today. The tariffs cover a range of products, including consumer goods, like wine, cheese, and Scotch whiskey. Unlike most other US trade action, these tariffs were sanctioned by the WTO for the harm caused by illegal subsidies for Airbus. Europe has threatened to retaliate, which risks an escalation of the conflict, and the US would likely strike back Europe’s case against Boeing subsidies is still working its way through the WTO, and a ruling is not expected until well into next year. The US decision on auto tariffs is expected by the middle of next month. We note that the tariffs are coming on top of elevated shipping costs as IMO 2020 that requires lower sulfur emissions are forcing retrofitting the large ocean liners and reducing operational capacity, while US sanctions on Chinese oil transport companies also squeeze costs on oil shipment as well.

The euro is edging higher today to extend its advance for the fourth session. It is consolidating yesterday’s gains and has remained above $1.11 today. Yesterday’s high was just shy of the $1.1145 retracement level. Caution ahead of the weekend will likely prevail, not only ahead of the UK vote tomorrow, but also it is above the upper Bollinger Band (~$1.1115) set two standard deviations above the 20-day moving average. Sterling remains well off the nearly $1.30 high seen yesterday. It found support a little below $1.2840 today, and the intraday technicals warn that it is likely to be tested again in North America today. We see better chart support near $1.2750. The euro traded GBP0.9000 last week and is finding support near GBP0.8600 in recent days. There is an option there for about 720 mln euros that expires today.

America

The North American economic calendar is light today. It features the US Leading Economic Indicator. It is expected to be unchanged for the second consecutive month and the third time in the past four months. It follows a recent string of disappointing data. Inflation gauges last week were softer than expected, and yesterday’s slew of data all missed on the downside. This includes housing starts (the decline was three times more than the median forecast in the Bloomberg survey, industrial and manufacturing output contracted (though the August series was revised higher), and the Philadelphia Fed survey fell to 5.6 from 12.0.

The market is pricing in around an 80% chance of a Fed cut later this month. Three Fed officials speak today: Kaplan, George, and Clarida. Kaplan does not vote this year, and George has dissented from the past two cuts but seems to be softening her opposition as the economic data disappoints. Clarida’s views are the most important, and we see the Board of Governors united in favor of another cut.

The US dollar is hovering around last month’s low near CAD1.3135 and is probing the lower Bollinger Band that is near there too. Initial resistance is seen around CAD1.3160-CAD1.3180. Canada goes to the polls next week, and the race has tightened as the election approaches. We suspect Trudeau will return as Prime Minister. The dollar is consolidating its recent losses against the Mexican peso. It has fallen for the past seven sessions, but that streak may end today, not so much in a reversal as consolidation. We see scope for the dollar to recover toward MXN19.26-MXN19.28 today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,EMU,EUR/CHF,Featured,newsletter,USD/CHF