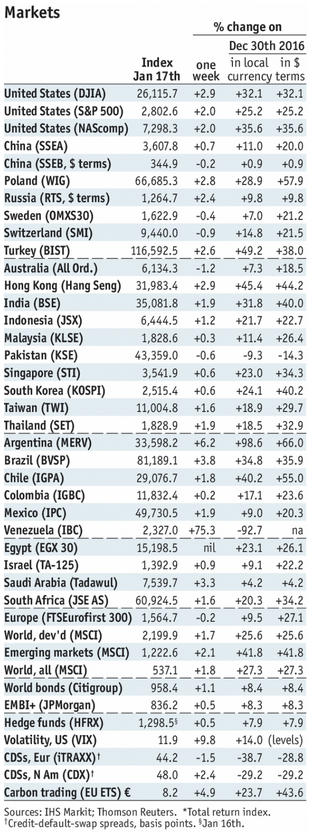

Stock Markets EM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM. Stock Markets Emerging Markets, January 17 Source: economist.com - Click to enlarge Korea Korea reports trade data for the first 20 days of January on Monday. It then reports Q4 GDP Thursday, which is expected to grow 3.4% y/y vs. 3.8% in Q3. The recovery continues, but the strong won poses a risk to exports and growth.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM. |

Stock Markets Emerging Markets, January 17 Source: economist.com - Click to enlarge |

KoreaKorea reports trade data for the first 20 days of January on Monday. It then reports Q4 GDP Thursday, which is expected to grow 3.4% y/y vs. 3.8% in Q3. The recovery continues, but the strong won poses a risk to exports and growth. BOK hiked in November but has signaled a cautious pace of tightening. Next policy meeting is February 27 and rates are likely to be kept steady at 1.5%. TaiwanTaiwan reports December export orders Monday, which are expected to rise 12.1% y/y vs. 11.6% in November. It then reports December IP Tuesday, which is expected to rise 1.2% y/y vs. 0.9% in November. The economy continues to improve, and low inflation should allow the central bank to remain on hold for much of this year, especially given TWD firmness. PhilippinesPhilippines reports Q4 GDP Tuesday, which is expected to grow 6.7% y/y vs. 6.9% in Q3. The economy remains robust, but central bank officials have sounded cautious recently. Governor Espanilla said the bank is not “itching” to hike and that it is still studying the impact of the recent tax hikes on inflation. Next policy meeting is February 8 and rates are likely to be kept steady at 3.0%. SingaporeSingapore reports December CPI Tuesday, which is expected to remain steady at 0.6% y/y. It then reports December IP Friday, which is expected to rise 0.2% y/y vs. 5.3% in November. The data have been a bit mixed lately. As such, it will likely be a close call for the MAS when it next meets in April. BrazilBrazil reports mid-January IPCA inflation Tuesday, which is expected to rise 3.06% y/y vs. 2.94% in mid-December. If so, it would still be below the 4.5% target. Price pressures are rising, albeit slowly. COPOM signaled another possible 25 bp cut to 6.75% at the next policy meeting February 7. It then reports December current account data Friday. MalaysiaMalaysia reports December CPI Wednesday, which is expected to rise 3.5% y/y vs. 3.4% in November. Bank Negara then meets Thursday and is expected to hike rates 25 bp to 3.25%. The market is split, however, with about a third of the analysts polled by Bloomberg looking for no hike. The bank does not have an explicit inflation target. South AfricaSouth Africa reports December CPI Wednesday, which is expected to rise 4.7% y/y vs. 4.6% in November. SARB just kept rates steady at 6.75% last week. The vote was 5-1, with the lone dissenter favoring a rate cut. Governor Kganyago said risks to inflation are still on the upside, adding that he also sees risks of further rating downgrades. If the rand remains firm, we think a rate cut is likely at the next policy meeting March 28. MexicoMexico reports mid-January CPI Wednesday, which is expected to rise 5.64% y/y vs. 6.69% in mid-December. The drop is due mostly to base effects from last January. As such, we believe the central bank will remain in hawkish mode. Next policy meeting is February 8 and another 25 bp hike to 7.5% seems likely. Mexico then reports December trade Friday. |

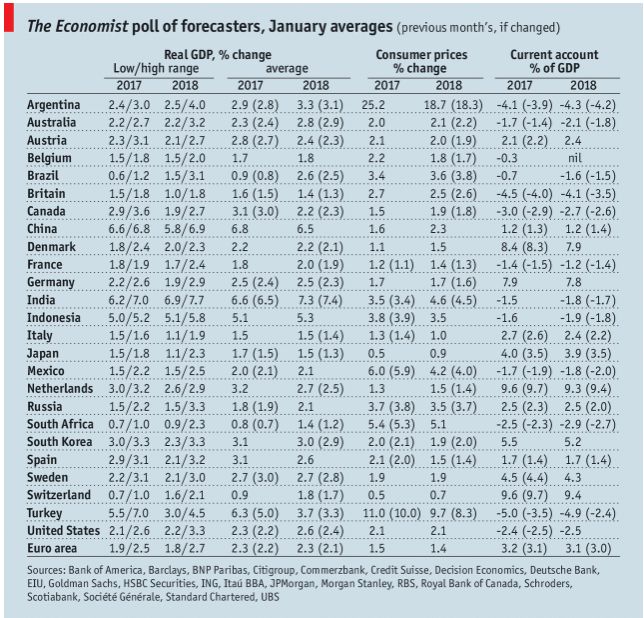

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin