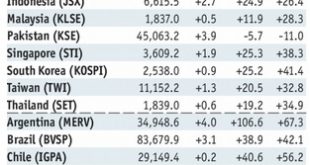

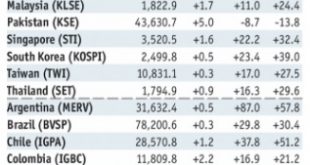

Stock Markets EM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves. Stock Markets Emerging Markets, January 27...

Read More »Emerging Markets: What Changed

Summary Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia’s central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM. Stock Markets Emerging...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play. Stock Markets Emerging Markets, January 10 Source: economist.com - Click to enlarge...

Read More »Emerging Markets: What Changed

Summary China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year. Hungary announced general elections on April 8....

Read More »Emerging Markets: What has Changed

Summary Fitch upgraded Indonesia by a notch to BBB with stable outlook. EU-Poland tensions entered a new phase. Cyril Ramaphosa was elected as the new ANC President over opponent Nkosazana Dlamini-Zuma. Argentina’s lower house approved President Macri’s pension reform bill. Sebastian Pinera won the Chilean presidency in the second round vote. Mexico political risk is rising as the PRI slush money scandal widens....

Read More »Emerging Market Preview: Week Ahead

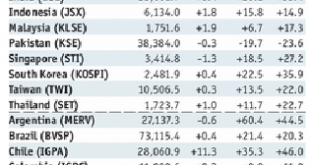

Stock Markets EM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018. Stock Markets Emerging Markets, December 18 Source: economist.com - Click to enlarge Brazil Brazil reports October monthly GDP proxy Monday, which is expected to rise 2.8% y/y vs. 1.3% in September. Brazil then reports...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM. Stock Markets Emerging Markets, December 06 Source: economist.com - Click to enlarge China China reports November money and loan data this week, but no schedule has been set. China reports...

Read More »Emerging Markets: What Changed

Summary China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks. Stock Markets Emerging Markets, November 29 Source:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org