Summary Fitch upgraded Indonesia by a notch to BBB with stable outlook. EU-Poland tensions entered a new phase. Cyril Ramaphosa was elected as the new ANC President over opponent Nkosazana Dlamini-Zuma. Argentina’s lower house approved President Macri’s pension reform bill. Sebastian Pinera won the Chilean presidency in the second round vote. Mexico political risk is rising as the PRI slush money scandal widens. Peru’s Congress voted not to impeach President Kuczynski. Stock Markets In the EM equity space as measured by MSCI, Peru (+8.2%), Chile (+7.0%), and Qatar (+5.0%) have outperformed this week, while Korea (-1.5%), Russia (-1.4%), and Mexico (-1.2%) have underperformed. To put this in better context, MSCI EM

Topics:

Win Thin considers the following as important: emerging markets, Featured, FX Trends, newslettersent, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary

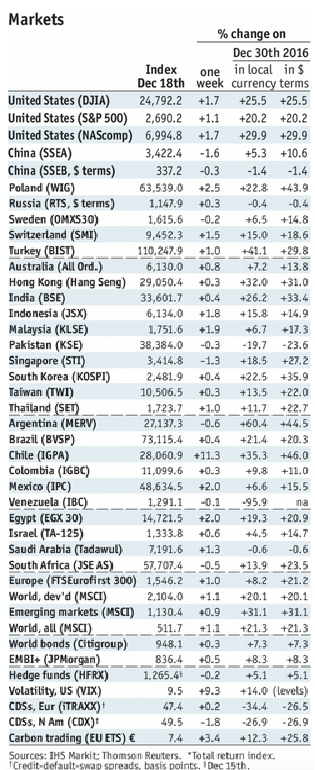

Stock MarketsIn the EM equity space as measured by MSCI, Peru (+8.2%), Chile (+7.0%), and Qatar (+5.0%) have outperformed this week, while Korea (-1.5%), Russia (-1.4%), and Mexico (-1.2%) have underperformed. To put this in better context, MSCI EM rose 2.0% this week while MSCI DM rose 0.7%. In the EM local currency bond space, South Africa (10-year yield -23 bp), Turkey (-15 bp), and Indonesia (-13 bp) have outperformed this week, while Mexico (10-year yield +27 bp), Colombia (+12 bp), and India (+10 bp) have underperformed. To put this in better context, the 10-year UST yield rose 13 bp to 2.49%. |

Stock Markets Emerging Markets, December 28 Source: ecnomies.com - Click to enlarge |

IndoesiaFitch upgraded Indonesia by a notch to BBB with stable outlook. Fitch noted that Indonesia’s resilience to external shocks is among the key factors behind the upgrade. Our own sovereign ratings model has Indonesia at BBB/Baa2/BBB and so we agree with the move and look for matching moves by both S&P and Moody’s. PolandEU-Poland tensions entered a new phase. The EU proposed sanctions under the so-called Article 7 option. This isn’t a huge surprise after the recent passage of the controversial judicial reforms in Poland. Right after the EU announcement, Polish President Duda signed those reforms into law. However, a unanimous EU vote is needed for sanctions and Hungary’s Orban has already pledged to block them. Market favorite Cyril Ramaphosa was elected as the new ANC President over opponent Nkosazana Dlamini-Zuma. The vote was 52-48% in favor of Ramaphosa. In a note of caution, three of the six officials elected to the ANC’s governing body are Zuma supporters, as do reports suggesting a slim majority in the ANC National Executive Council also lean Zuma. Ramaphosa may not see smooth sailing at the top. ArgetinaArgentina’s lower house approved President Macri’s pension reform bill. The final count was 128-116 with 2 abstentions. Lawmakers also passed a tax reform bill that cuts corporate taxes by a vote of 146-77 with 18 abstentions. So far, Macri is ChiliSebastian Pinera won the Chilean presidency in the second round vote. Chilean assets reacted positively to Pinera’s win. However, like South Africa, we note that Pinera does not have a magic solution to Chile’s current malaise. Recall that Pinera’s first term coincided with the mineral boom, and that no longer holds. Instead, he will struggle with the same problems that plagued his successor/predecessor Bachelet. MexicoMexico political risk is rising as the PRI slush money scandal widens. Reforma reports that the PRI funneled 250m MXN in 2016 from the Finance Ministry, at that time led by Luis Videgaray. Since the news broke, Alejandro Gutierrez, former treasurer of President Enrique Pena Nieto’s ruling PRI party, has been arrested in connection with the alleged funneling of public money to state elections, Reforma reports, citing Javier Corral, the governor of the Mexican state of Chihuahua. PeruPeru’s Congress voted not to impeach President Kuczynski. The vote was 78-19 with 21 abstentions. It looks like some got cold feet, as the number of votes to impeach were less than the number of votes to start the impeachment proceedings (93). Still, we think Peru is in a stalemate as the opposition-controlled parliament is likely to obstruct Kuczynski’s legislative agenda. |

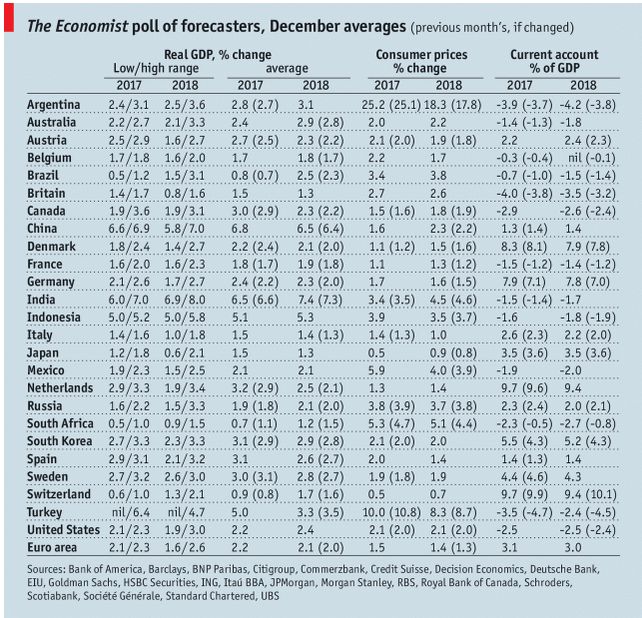

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, December 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent,win-thin