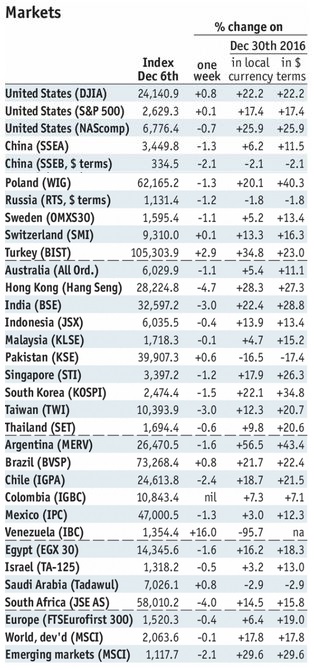

Stock Markets EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM. Stock Markets Emerging Markets, December 06 Source: economist.com - Click to enlarge China China reports November money and loan data this week, but no schedule has been set. China reports November retail sales and IP Thursday. The former is expected to rise 10.3% y/y and the latter by 6.2% y/y. The markets appear to be comfortable with China’s economic outlook right now. Turkey Turkey reports October current account and Q3 GDP data Monday. Growth is expected at 8.5% y/y, though this

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM. |

Stock Markets Emerging Markets, December 06 Source: economist.com - Click to enlarge |

ChinaChina reports November money and loan data this week, but no schedule has been set. China reports November retail sales and IP Thursday. The former is expected to rise 10.3% y/y and the latter by 6.2% y/y. The markets appear to be comfortable with China’s economic outlook right now. TurkeyTurkey reports October current account and Q3 GDP data Monday. Growth is expected at 8.5% y/y, though this reflects a low base from 2016 due to the negative impact of the coup attempt. The central bank meets Thursday and is expected to rise the Late Liquidity Lending Rate by 100 bp to 13.25% while keeping all other rates steady. CPI rose 13% y/y in November, the highest reading since November 2003 and further above the 3-7% target range. Czech RepublicCzech Republic reports November CPI Monday, and is expected to rise 2.7% y/y vs. 2.9% in October. Some bank officials have already come out in favor of another rate hike at the December 21 meeting. However, it’s not yet a done deal, especially if inflation eased in November. Tightening should continue in 2018. MalaysiaMalaysia reports October IP and manufacturing sales Tuesday. IP is expected to rise 4.0% y/y vs. 4.7% in September. The economy remains robust, raising expectations of imminent tightening by Bank Negara. Next policy meeting is January 25, no move then is expected. SingaporeSingapore reports October retail sales Tuesday, which are expected to rise 1.0% y/y vs. -0.5% in September. The economy remains sluggish, while price pressures are low. We believe the MAS will maintain its current accommodative policy at the next policy meeting in April. South AfricaSouth Africa reports October manufacturing production Tuesday, which is expected to rise 1.1% y/y vs. -1.6% in September. It then reports November CPI and October retail sales Wednesday. Headline CPI is expected to rise 4.7% y/y vs. 4.8% in October, while retail sales are expected to rise 5.5% y/y vs. 5.4% in September. Next policy meeting is January 18, no change is likely then. Q3 current account data will be reported Thursday, and the deficit is expected to narrow to -2.0% of GDP from -2.4% in Q2. IndiaIndia reports November CPI and October IP Tuesday. The former is expected to rise 4.26% y/y and the latter by 2.8% y/y. November WPI will be reported Thursday, which is expected to rise 3.8% y/y vs. 3.6% in October. The RBI kept rates steady last week, as expected. The bank has warned of accelerating inflation and if that continues, we see no more rate cuts in this cycle. Next policy meeting is February 7, no change is likely then. MexicoMexico reports October IP Tuesday, which is expected to rise 0.6% y/y vs. -1.2% in September. Banco de Mexico meets Thursday and is expected to hike rates 25 bp to 7.25%. Some analysts expect no change. It’s a close call, but we think it will hike by 25 bp to make a strong statement under new Governor Diaz de Leon. November CPI was higher than expected at 6.63% y/y and has accelerated two straight months. Not only will the Fed have likely hiked on December 13, but the inflation trajectory in Mexico warrants a resumption of the tightening cycle. Banco de Mexico has been on hold since its last 25 bp hike back in June. BrazilBrazil reports October retail sales Wednesday, which are expected to rise 5.2% y/y vs. 6.4% in September. The economic recovery is picking up, even as price pressures are rising. Yet COPOM surprised markets with a dovish statement that suggests a 25 bp cut to 6.75% at the next meeting February 7. IndonesiaBank Indonesia meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.3% y/y in November, below the 4% target but within the bottom half of the 3-5% target range. Official comments suggest a “wait and see” approach for now. November trade data will be reported Friday. PhilippinesPhilippines central bank meets Thursday and is expected to keep rates steady at 3.0%. A small handful of analysts look for a 25 bp hike. CPI rose 3.3% y/y in November, above the 3% target but within the 2-4% target range. Official comments suggest a “wait and see” approach for now. ChileChile central bank meets Thursday and is expected to keep rates steady at 2.5%. Inflation was steady at 1.9% y/y in November, still be below the 3% target as well as the 2-4% target range. The bank’s latest minutes left the door open for resumed easing, as it cut its inflation forecasts and noted it will remain alert to the possibility that “a more expansionary monetary policy would be required.” This month seems too soon to cut. ColombiaColombia central bank meets Thursday and is expected keep rates steady at 4.75%. However, a handful of analysts look for a 25 bp cut to 4.5%. The bank has delivered two dovish surprises in a row, and we think there is risk of another one this month. Colombia reports October IP and retail sales Friday. The former is expected to contract -0.7% y/y and the latter is expected to rise 1.6% y/y. PeruPeru central bank meets Thursday and is expected to keep rates steady at 3.25%. CPI rose 1.5% y/y in November, below the 2% target but within the 1-3% target range. Since the easing cycle started this year, the bank has been cutting rates every other month. Since it just cut in November, we believe it will remain on hold this month and resume cutting in 2018. RussiaCentral Bank of Russia meets Friday and is expected to cut rates 25 bp to 8.0%. CPI rose 2.5% y/y in November, the lowest reading on record and further below the 4% target. We believe the easing cycle will continue into 2018. |

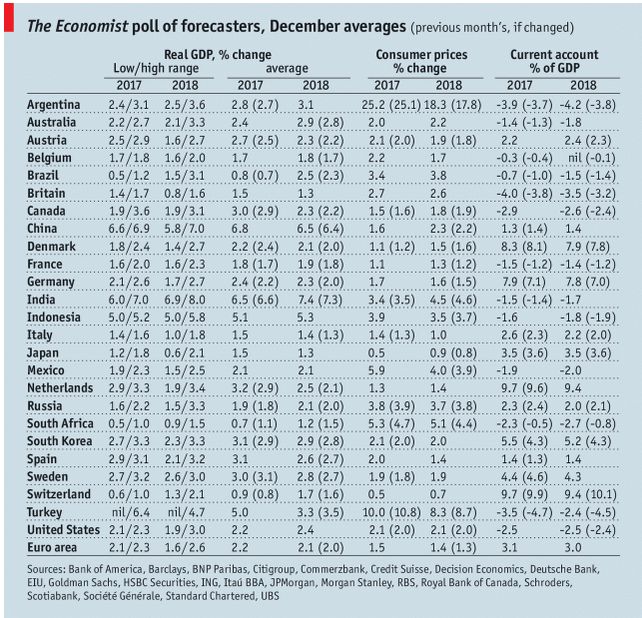

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, December 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin