Swiss Franc The Euro has risen by 0.71% at 1.1045 EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are...

Read More »FX Daily, July 15: Marking Time on Monday

Swiss Franc The Euro has fallen by 0.10% at 1.108 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed...

Read More »FX Daily, July 12: Greenback Limps into the Weekend

Swiss Franc The Euro has fallen by 0.48% at 1.1086 EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in...

Read More »FX Daily, June 24: Slow Start to Important Week

Swiss Franc The Euro has risen by 0.12% at 1.1099 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Trump-Xi meeting at the G20 this coming weekend and heightened tensions in the Gulf, with the US set to impose new sanctions on Iran’s crippled economy are keeping investors on edge. News the opposition won the re-do of the...

Read More »FX Daily, April 01: China Reanimates the Animal Spirits, While Europe Finds New Ways to Disappoint

Swiss Franc The Euro has risen by 0.20% at 1.1188 EUR/CHF and USD/CHF, April 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China’s official PMI and Caixin’s manufacturing reading. However, the spillover from China was limited in Asia....

Read More »Emerging Markets: Preview of the Week Ahead

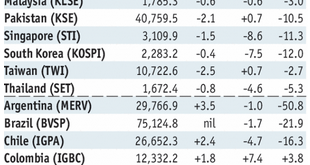

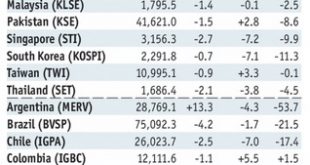

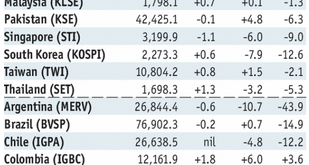

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

Read More »Emerging Markets: What has Changed

Summary Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly. Moody’s cut its 2018...

Read More »As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to...

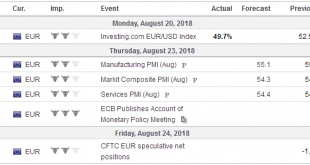

Read More »FX Weekly Preview: Five Traps in the Week Ahead

Turkey Officials have taken steps to make it more difficult and more expensive to short the lira, but that did not prevent a 5% slide ahead of the weekend. There is no interest rate, within reason, that can compensate for such currency risk. When S&P cut its sovereign credit rating to B+ from BB- and retained a stable outlook, it did not cite the dispute over the pastor. Moody’s cut Turkey’s rating to Ba3 from Ba2...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org