The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock index. “Brexit” fears continue to grow, which has apparently been the driving force behind this move. The “Brexiteers” are gaining support as the referendum date draws closer – global financial markets are getting somewhat upset over this. Photo credit: Neil Hall / Reuters Monday’s move in the VIX has achieved a short term technical breakout: We have discussed the significance of the VIX in yesterday’s market update (see “Brexit Paranoia Creep Into the Markets” for details). We neglected to mention yesterday that this week is an options expiration week as well. If there are any big downside moves in the market in coming days, this fact is bound to exacerbate them, as writers of naked put options may be forced to delta-hedge their positions by selling the underlying stocks or indexes short. As we have pointed out, the move in the VIX could by itself generate additional selling pressure, as a number of systematic investment strategies use it as an important input.

Topics:

Pater Tenebrarum considers the following as important: 10 year yield, Chart Update, Credit Markets, Debt and the Fallacies of Paper Money, Euro Stoxx 50, Featured, Germany 10-year Bond yield, Germany 5-year yield, newsletter, On Economy, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Sharp Move in the VIX AcceleratesIn Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock index. “Brexit” fears continue to grow, which has apparently been the driving force behind this move. |

|

| Monday’s move in the VIX has achieved a short term technical breakout:

We have discussed the significance of the VIX in yesterday’s market update (see “Brexit Paranoia Creep Into the Markets” for details). We neglected to mention yesterday that this week is an options expiration week as well. If there are any big downside moves in the market in coming days, this fact is bound to exacerbate them, as writers of naked put options may be forced to delta-hedge their positions by selling the underlying stocks or indexes short. As we have pointed out, the move in the VIX could by itself generate additional selling pressure, as a number of systematic investment strategies use it as an important input. It will be very interesting to see what transpires over coming days and how important the influence of the volatility gauge really is. |

|

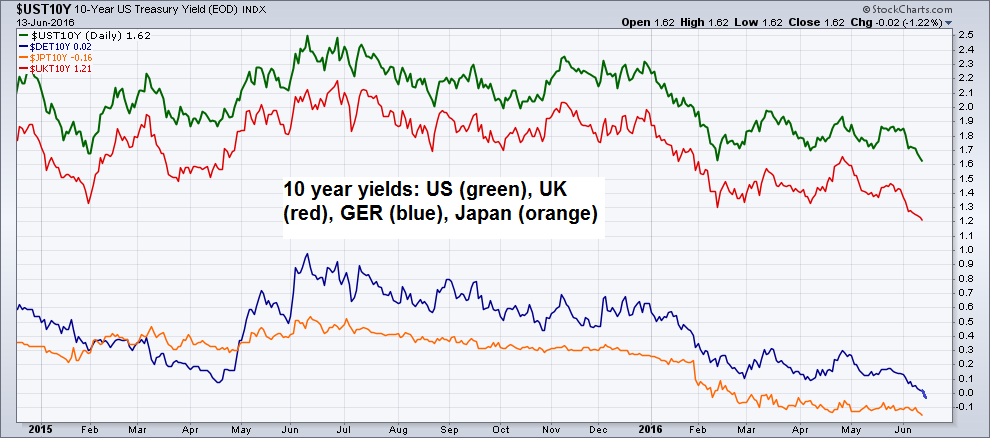

Government Bond Yields Collapse FurtherAs mentioned above, “Brexit” fears continue to escalate, as support for the “leave” campaign seems to be growing the closer the day of the referendum comes. Funny enough, investors are still opting to flee to the perceived “safety” of government bonds the world over – even British ones! Yields on gilts have been falling to new lows along with those on nearly every other developed market government bond. Since it is actually the current political and economic status quo that is coming into question, it seems rather strange that people are buying government bonds of all things. We are not so sure that the debt incurred by an increasingly embattled system and political class is the best imaginable “safe haven” right now. At some point perceptions on this particular point may well change noticeably, but obviously this is a bridge that has yet to be crossed. |

|

Germany 5-year yieldGerman bond yields are becoming thoroughly “Japanized” in the process. We show Germany’s 5-year and 10-year government bond yields below. The former stands in the meantime at almost minus 0.5%, while the latter has declined below the “zero bound” for the first time ever: |

|

Germany’s 10-year Bond yield– below zero for the first time ever. Both this bond and every German bond with a maturity of less than ten years produces a guaranteed nominal loss for investors holding these bonds to maturity. It is probably not a very good sign when yields are falling ever further into the interest-free risk zone. As noted above, it also represents utterly bizarre behavior on the part of investors. They are not only guaranteed a nominal loss if they hold any of these bonds to maturity, they are actually also taking on enormous risk in order to “flee from risk”. How stupid is that? Maybe they have a masochistic streak… |

|

European Stocks Down, but Recovering by the CloseIt could well be that the stock market stabilizes today, as European stocks have staged a small recovery attempt by the close. However, it should be kept in mind that the wild options expiration week of August 2015 also saw the stock market rise on Tuesday – this didn’t keep the panic over China’s forex reserves from unfolding over the remainder of the week. We are not saying the same thing has to happen again, far from it. We obviously cannot know whether or not that will happen. We are merely pointing out that short term risk is currently uncommonly high. This is no guarantee that it will actually materialize, but it is surely a good thing to be aware of this fact. |

Conclusion

Market risk continues to increase. Not only is the Brexit referendum dead ahead, but the FOMC decision is likely to exacerbate market volatility as well. This may well involve both upside and downside volatility, as the trading days surrounding FOMC meetings are usually strong. For nimble traders, many short term trading opportunities could potentially arise in coming days.

Charts by: StockCharts, BigCharts