Stock Markets EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US....

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. Stock Markets Emerging Markets, June 13 - Click to enlarge Singapore Singapore reports May...

Read More »Emerging Markets: Preview of the Week Ahead

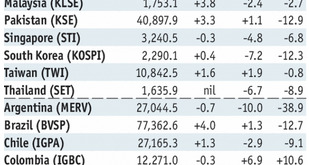

Stock Markets EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX. Stock Markets Emerging Markets, May 30 Source: economist.com - Click to enlarge Indonesia Indonesia reports May CPI Monday, which is expected to rise...

Read More »Emerging Markets: Week Ahead Preview

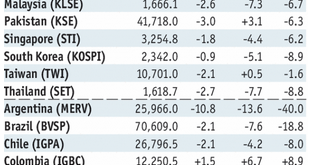

Stock Markets EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain. Stock Markets Emerging...

Read More »Emerging Markets Preview: The Week Ahead

Stock Markets EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure. Stock Markets Emerging Markets, May 08 - Click to enlarge Indonesia Indonesia reports Q1 GDP Monday,...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM. Stock Markets Emerging Markets, March 14 Source: economist.com - Click to enlarge Poland Poland reports February...

Read More »Die Lehren aus der Toilettenpapier-Krise

Panikkäufe verbindet man normalerweise eher mit Lebensmitteln. In Taiwan aber horten die Menschen gerade Toilettenpapier. Foto: David Chang (Keystone) Erwartungen spielen in der Ökonomie eine grosse Rolle. Auf Kapital- und Devisenmärkten sind sie sogar entscheidend. Aktuelle Langfristzinsen oder Devisenverhältnisse werden stark durch die Erwartungen an die Geldpolitik der Notenbanken bestimmt. Aktienkurse drücken künftige Gewinnerwartungen aus und solche zur weiteren Zinsentwicklung....

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely. Stock Markets Emerging Markets, March 03 Source: economist.com - Click to enlarge Malaysia Malaysia reports January...

Read More »Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump’s violating the “One China” policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office. Even Bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org