The Economist magazine placed Switzerland first in a recent ranking of currency manipulators. According to the analysis, China, commonly thought of as the world’s champion at keeping its currency’s value artificially low, appears to be doing the opposite: actively trying to push the value of its currency up. On the other hand, Switzerland that has been working hardest to artificially devalue its money. © Ginasanders | Dreamstime.com Every six months America’s Treasury looks at a country’s...

Read More »Switzerland ranked world’s worst currency manipulator

The Economist magazine placed Switzerland first in a recent ranking of currency manipulators. According to the analysis, China, commonly thought of as the world’s champion at keeping its currency’s value artificially low, appears to be doing the opposite: actively trying to push the value of its currency up. On the other hand, Switzerland that has been working hardest to artificially devalue its money. © Ginasanders | Dreamstime.com Every six months America’s Treasury looks at a country’s...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

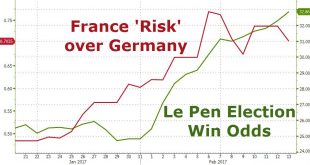

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More »Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos’ elites discussed why the world needs to “get rid of currency,” the European Commission has introduced a proposal enforcing “restrictions on payments in cash.” With Rogoff, Stiglitz, Summers et al. all calling for the end of cash – because only terrorists and...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »Macro Surprises and their Effects on the CHF

On VoxEU, Adrian Jäggi, Martin Schlegel and Attilio Zanetti report that the safe-haven currencies Swiss franc and Japanese yen react strongly to non-domestic macro surprises, and did so especially during the financial crisis. For European macro surprises, only German data influence safe-haven currencies.

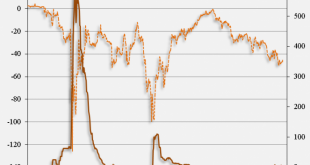

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those...

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those observed in the spot market, while trading in the Swiss franc options...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org