A New Bull Market in Gold? On April 10, the Incrementum Fund’s advisory board held its quarterly meeting. Two of the regulars (Zac Bharucha and Rahim Taghizadegan) were unable to attend this time, but we were joined by special guest Brent Johnson, the CEO of Santiago Capital. The transcript of the meeting with all charts can be downloaded further below. Gold, June futures contract, daily As indicated, the main (but not the only) topic of the discussion was gold. This was an obvious choice...

Read More »Gold and Gold Stocks – Is the Correction Finally Beginning?

Triangle Thrust and Reversal In mid April, we discussed weekly resistance levels in the HUI Index. Given the recent almost blow-off like move in the index and its subsequent reversal, we decided to provide a brief update on the situation. First, here is a daily chart comparing the HUI, the HUI-gold ratio and gold: After building another triangle, the HUI has delivered an upside thrust in the direction of the preceding trend. This is quite normal, and so is the subsequent move back to its...

Read More »Financial Revolution: ECB Blames You For Negative Interest Rates

Just after sunrise on April 19, 1775, a large contingent of British military troops arrived to the town of Lexington, Massachusetts. They were under orders to search for and confiscate all weapons and munitions from the colonials– something the British army had done countless times before. In many ways it was a routine operation. And yet, that morning, roughly 80 local militiamen stood blocking their path. Paul Revere had ridden through Lexington only hours before to warn residents of the...

Read More »Gold Stampede

Better get out of the way… stampeding bisons Stampeding Animals The mass impulse of a cattle stampede can be triggered by something as innocuous as a blowing tumbleweed. A sudden startle, or a perceived threat, is all it takes to it set off. Once the herd collectively begins charging in one direction it will eliminate everything in its path. The only chance a rancher has is to fire off a pistol with the hope that the shot turns the herd onto itself. If the rancher is successful, it...

Read More »Gold and Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »Getting it Wrong on Silver

Erroneous Analysis of Precious Metals Fundamentals We came across an article at Bloomberg today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right? At first, we thought to just put out a short Soggy Dollars post highlighting the error. Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of...

Read More »“The Men Behind The Curtain Are Being Revealed” – CEO Says Real-World Pricing To Return To Gold & Silver Markets

Submitted by Mac Slavo via SHTFPlan.com, Astute observers of financial markets, especially in the precious metals sector, have long argued that small concentrations of major market players have been manipulating asset prices. Last week those suspicions were confirmed when Deutsche Bank, one of the world’s leading financial institutions, not only admitted to regulators that they have been involved in the racket, but that they were prepared to turn over records implicating many of...

Read More »Silver is on Fire

The Prices of Gold and Silver Drift Apart Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%. Inside the Sierra silver mine in Wallace, Idaho Photo credit: silverminetour.org We get the trading thesis, that if the precious metals are in a bull market, then silver should go up more than gold. Silver is the high-beta gold. It’s a smaller market, less liquid, and at the same time it’s the...

Read More »A Historic Rally in Gold Stocks – and Most Investors Missed It

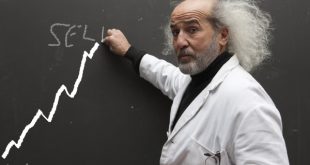

Buy Low, Sell High? It is an old truism and everybody has surely heard it more than once. If you want to make money in the stock market, you’re supposed to buy low and sell high. Simple, right? As Bill Bonner once related, this is how a stock market advisor in Germany explained the process to him: Thirty years ago, at an investment conference, there was a scalawag analyst from Germany. He showed a chart where a stock had gone up steadily for 10 years. He pointed to the bottom, left...

Read More »Monetary Metals Report: Gold – Silver Opposites

What Differentiates Gold from Silver? Well that was an interesting week. Gold went down over thirty bucks and silver went up over thirty cents. How much longer can this silver rally continue in the face of gold’s non-participation? Will speculators really be comfortable bidding silver up to $20 while gold sits at $1200? Do the fundamentals support a higher silver price? Gold, active June futures contract over the past week – click to enlarge. How is silver different from gold? Aside...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org