Barely a day had passed since the historic admission of gold and silver price rigging by Deutsche bank, which as we reported on Thursday was settled with not only "valuable monetary consideration", but Deutsche's "cooperation in pursuing claims" against other members of the cartel, i.e., exposing the manipulation of other cartel members, and the class action lawsuits have begun. Overnight, two class action lawsuits seeking $1 billion in damages on behalf of Canadian gold and silver...

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

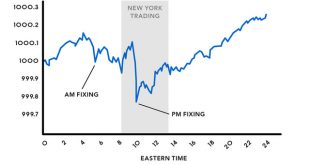

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where...

Read More »Gold Stocks Break Out

No Correction Yet Photo via Museo del Oro / Bogota Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for the move, it would normally be expected to do so, as Jordan Roy-Byrne argues here. The chart below shows the situation as of Friday (HUI, HUI-gold ratio and gold): The HUI and the HUI-gold ratio have broken...

Read More »The Precious Metals Conspiracy

Tricky and Dangerous Assumptions A metallic conspirator and his flying factotum… Image via sceptic.com For at least a few weeks now, we have noticed a growing drumbeat from a growing corps of analysts. Gold is going to thousands of dollars. And silver is going to outperform. Reasons given are myriad. Goldman Sachs apparently said to short gold, so if one assumes that the bank always advises clients to take the other side of its trades — a tricky and dangerous assumption at best — then...

Read More »Gold – The Best Defense Strategy

The War on Cash is on! If you are used to making visits to your bank to make your credit card payments, you may find this no longer an option in the future. Some banks are no longer accepting (or limiting their acceptance) of cash deposits. The war on cash forges on. Paper money, which is indeed more or less worthless, is slowly being taken out of circulation and being replaced by digital currency. This shift presents of course the same fundamental problem as paper money itself:...

Read More »Gold: Still Misunderstood

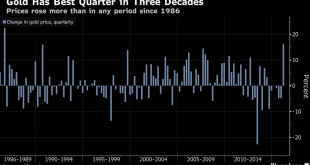

Myths That Just Won’t Die Gold just had its best quarter in 30 years. Not surprisingly, gold bears are coming out of the woodwork en masse in the mainstream media and the analyst community (see e.g. this recent write-up by Mish on the Goldman Sachs analyst who has been screaming “short gold” since right before it started rocketing higher in early February). Below we will discuss a specific assertion that tends to be repeated over and over again. Gold had a very strong quarter, but...

Read More »The Gold – Money Supply Correlation Report

A Spot of Irrational Exuberance There were some fireworks last week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up). A bit of verbal puppeteering…. Janet Yellen...

Read More »U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org