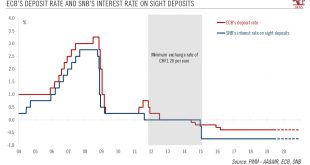

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates. At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit,...

Read More »Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020. The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can...

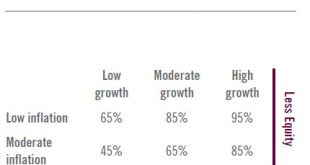

Read More »Avenues worth exploring in strategic asset allocation

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic...

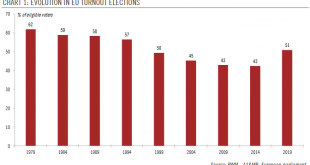

Read More »European elections – a more diverse but still pro-Europe parliament

Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged. Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected. A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this...

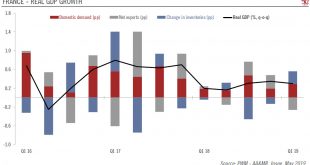

Read More »French tax cuts designed to reboot Macron’s presidency

The French government’s respond to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year. Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is...

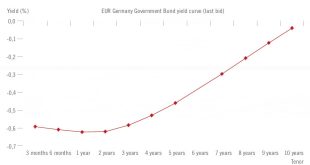

Read More »Is Europe turning Japanese?

European investment opportunities remain, despite financial repression in the region. The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now...

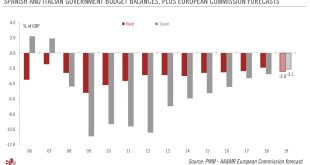

Read More »Peripheral bonds after the Spanish election

We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility. On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to...

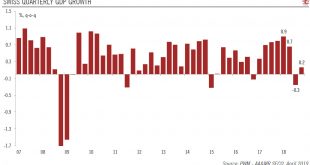

Read More »Switzerland: Lower growth, lower inflation

Growth and price rises should moderate in 2019. The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside. Looking ahead, we expect the Swiss...

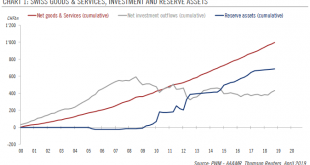

Read More »Limited room for Swiss franc depreciation

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings. The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org