Swiss Franc The Euro has fallen by 0.13% to 1.0796 EUR/CHF and USD/CHF, February 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite a soft close in US indices yesterday, global shares are on the march again today. Led by China and Hong Kong, most large markets in the Asia Pacific region advanced today. Officials gave approval for a new game from Tencent, which helped lift the Hang Seng. Europe’s Dow...

Read More »FX Daily, February 8: Limited Follow-Through Dollar Selling to Start the Week

Swiss Franc The Euro has risen by 0.05% to 1.0832 EUR/CHF and USD/CHF, February 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the...

Read More »FX Daily, February 4: Negative Rates and the Bank of England: Having Your Cake and Eating it Too

Swiss Franc The Euro has risen by 0.01% to 1.0817 EUR/CHF and USD/CHF, February 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro has been sold through $1.20 for the first time since December 1 and has now given back roughly half of the gains scored from the US election (~$1.16) to the early January high (~$.1.2350). More broadly, the greenback is bid against most of the major currencies, with the...

Read More »FX Daily, January 6: High Drama Weighs on the Greenback and Lifts Yields

Swiss Franc The Euro has risen by 0.23% to 1.0823 EUR/CHF and USD/CHF, January 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: One of the two Georgia Senate contests remains too close to call, but the market appears to be pricing in a Democrat sweep. The 10-year yield has punched above 1% but has offered the greenback little support. Yesterday, the dollar-bloc currencies rose to highs since early Q2 2018 and...

Read More »Oil market outlook: Land in sight but rough seas ahead

In November, new vaccines showed great promise in fighting Covid-19, and the exhilaration was clear in markets around the world. However, the enthusiasm was not sustained. Many experts and political leaders rushed to warn that while a vaccine could mean the end of the health crisis, the economy – and oil markets in particular – are still in for a rough ride. The previous mechanism whereby the virus drove the economy,...

Read More »FX Daily. October 29: Markets Continue to Struggle

Swiss Franc The Euro has fallen by 0.11% to 1.0681 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and...

Read More »FX Daily, September 30: Nervous Calm

Swiss Franc The Euro has risen by 0.05% to 1.0798 EUR/CHF and USD/CHF, September 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Quarter and month-end considerations could be overwhelming other factors today. Turnaround Tuesday saw early gains in US equities fade. Asia Pacific shares were mixed, with the Nikkei (-1.5%) and Australia (-2.3%) bear the brunt of the selling, while China, Hong Kong, Taiwan, and...

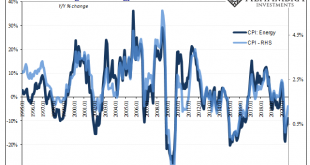

Read More »Inflation Karma

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements. CPI Changes on Energy, 1995-2020 - Click to enlarge And that’s a huge problem…if you are Jay Powell. We’ve been making a big deal out of him making a huge deal out of...

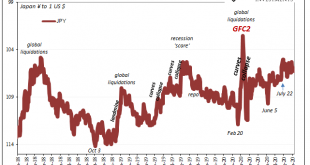

Read More »Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening. A dollar crash, or even just a true reflationary dollar drop, would be JPY negative (like 2017). Ever since the last one, during...

Read More »FX Daily, July 13: Risk Appetites Firm, but the Greenback is Mixed

Swiss Franc The Euro has risen by 0.46% to 1.068 EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org