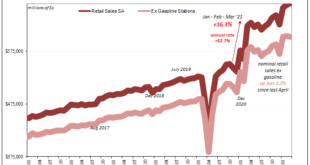

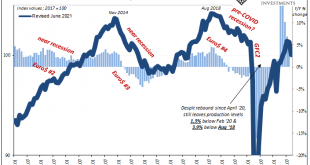

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go. Combine those two factors, however, the necessary supply squeeze surge in prices along with the artificiality behind it wearing off,...

Read More »Gold Price Today – Gareth Soloway

Dave Russell of GoldCore TV welcomes back Gareth Soloway of InTheMoneyStocks.com where we ask if the bull market for stocks is back and if $2,500 on gold is still on the cards for 2022? What role does the inversion of the yield curve play in signaling a US recession? [embedded content] [embedded content] You Might Also Like Gold Gives You Personal Sovereignty 2022-03-09 Dave Lukas of Misfit...

Read More »Vladimir Nogoodnik Roils Markets

Overview: The economic disruption seen since the US warning of an imminent Russian attack on February 11 continue to ripple through the capital and commodity markets. Equities are being slammed. Most Asia Pacific bourses were off 2-3% today. Europe’s Stoxx 600 gapped lower ad has approached February 2021 levels, orr about 2.6% today. US futures are around 1.5% lower. The reaction in the major bond markets is subdued. The US 10-year yield is near 1.72%, off...

Read More »FX Daily, January 26: Federal Reserve and Bank of Canada Meet as Risk Appetites Stabilize

Swiss Franc The Euro has risen by 0.04% to 1.0378 EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe’s Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the...

Read More »Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix. It may take the better part of the next couple of weeks for scientists to get a handle on what the new mutation means and the efficacy of the current vaccination and pill regime.The initial net impact has been to reduce risk, as seen in the sharp sell-off of stocks. Emerging market currencies extended their losses. ...

Read More »Markets Await Fresh Developments

Overview: Last week's bond market rally has stalled. Benchmark 10-year yields are up 1-3 bp in Europe, and the three bp increase in the US puts the yield slightly below 1.50%. Equities were mixed in the Asia Pacific region. Japan, Hong Kong, South Korea, and Australia nursed losses after the regional benchmark (MSCI) rose 0.65% last week. The Stoxx 600 had a seven-session rally in tow, but it is little changed in the European morning. It rose 1.65% last week. ...

Read More »Far Longer And Deeper Than Just The Past Few Months

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States. While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and...

Read More »FX Daily, May 19: Now What Does Bitcoin say About the Dollar and the US?

Swiss Franc The Euro has risen by 0.27% to 1.0999 EUR/CHF and USD/CHF, May 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A setback in commodities and technology are roiling equity markets today. The inability of US equities to sustain yesterday’s rally provided an initial headwind to trading in the Asia Pacific region today. Hong Kong and South Korea markets were closed for holidays, but most of the...

Read More »FX Daily, March 11: Risk Extends Gains Ahead of the ECB

Swiss Franc The Euro has fallen by 0.18% to 1.1065 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Even though the NASDAQ closed lower yesterday and the reception of the 10-year Treasury auction did not excite, market participants are growing more confident. Led by China, the major markets in the Asia Pacific region rallied. The Shanghai Composite’s 2.35% gain not only snaps a...

Read More »FX Daily, February 15: Sterling Continues to Run Higher and US Winter Storm Gives Oil Another Boost

Swiss Franc The Euro has fallen by 0.07% to 1.0792 EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: US and Greater Chinese markets are closed today, but the markets are moving. Equities are bid. The Nikkei led the Asia Pacific region with a 2% gain and pushed above 30000 for the first time since 1990. Korea’s Kospi advanced 1.5%, and Australia’s ASX tacked on 1%. The Dow Jones...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org