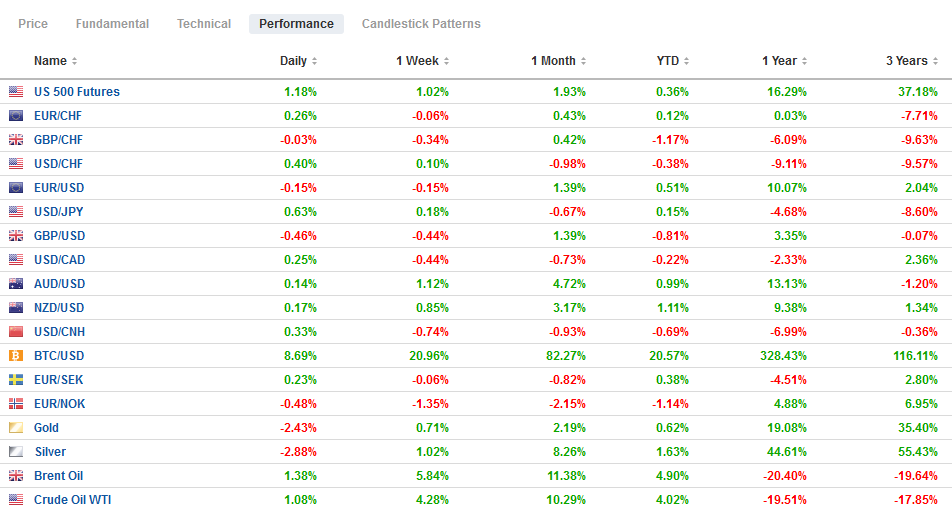

Swiss Franc The Euro has risen by 0.23% to 1.0823 EUR/CHF and USD/CHF, January 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: One of the two Georgia Senate contests remains too close to call, but the market appears to be pricing in a Democrat sweep. The 10-year yield has punched above 1% but has offered the greenback little support. Yesterday, the dollar-bloc currencies rose to highs since early Q2 2018 and are extending those gains today. The Scandis are also tracking higher. The yen is the laggard, but the greenback remains below JPY103.00 Emerging market currencies have not been deterred by the higher US rates. The JP Morgan Emerging Market Currency Index is higher for the third consecutive day. The

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, newsletter, Oil, PMI, Politics, USD

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Swiss FrancThe Euro has risen by 0.23% to 1.0823 |

EUR/CHF and USD/CHF, January 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

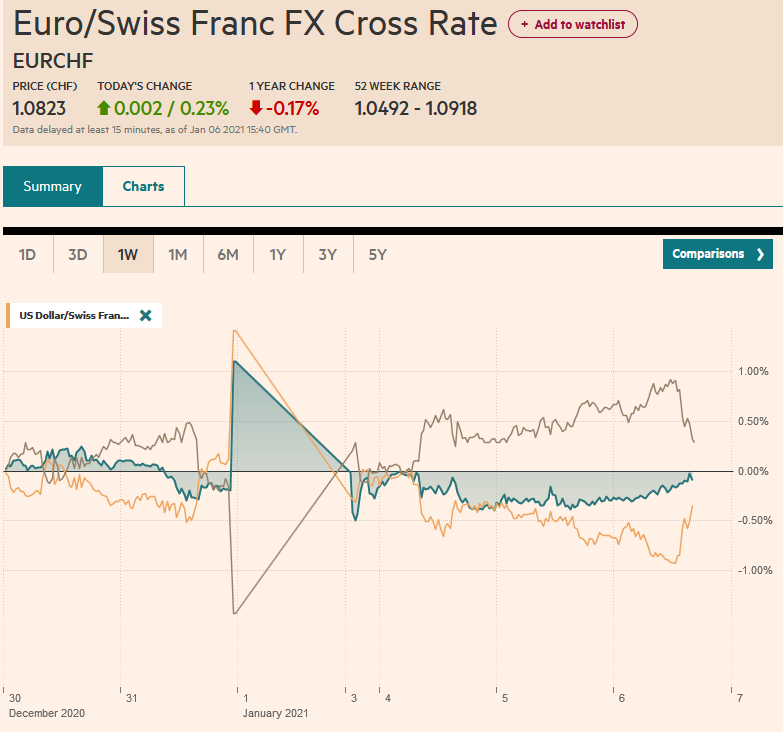

FX RatesOverview: One of the two Georgia Senate contests remains too close to call, but the market appears to be pricing in a Democrat sweep. The 10-year yield has punched above 1% but has offered the greenback little support. Yesterday, the dollar-bloc currencies rose to highs since early Q2 2018 and are extending those gains today. The Scandis are also tracking higher. The yen is the laggard, but the greenback remains below JPY103.00 Emerging market currencies have not been deterred by the higher US rates. The JP Morgan Emerging Market Currency Index is higher for the third consecutive day. The nine-day rally in the MSCI Asia Pacific Index halted today. European shares are doing better and have recouped yesterday’s 0.2% decline and the Dow Jones Stoxx 600 is challenging the week’s high. US shares are mixed, with the NASDAQ suffering most. The S&P is about 0.5% lower, while the Dow futures are up by nearly as much. The US Treasury sell-off appears to be triggering a global rise in yields. The 10-year yield has broken above 1.0%. Australia’s benchmark jumped 8 bp, while European yields are 1-3 bp higher. Gold is firm as it extends its rally for the seventh consecutive session and approaches $1960. Oil, which jumped yesterday on the back of Saudi Arabia’s surprise unilateral cut of one million barrels a day of output in February and March, is consolidating today, with the February WTI contract hovering around $50 (in a range of about 40-50 cents on either side of that threshold). |

FX Performance, January 6 |

Asia Pacific

The week began off with the NYSE reversing a previous decision to delist four Chinese telecom companies. However, after complaints from several officials, including Treasury Secretary Mnuchin, who was not understood to be a leading advocate of the policy, the NYSE appears to be reversing itself again. The telecoms in question are subsidiaries of Chinese companies and were not explicitly cited, so normally would be excluded until specified. Meanwhile, S&P/Dow Jones is now suggesting it will not drop Chinese telecom companies from its index re-jig. However, the Trump administration has opened another front against China, and this is a ban on the use of transaction apps of 8 Chinese companies, including Alipay, Tencent’s QQ, and WeChat Pay. These are not widely used by Americans, but it would contribute to the fragmentation if implemented by Biden’s administration. As China moves more to such payment vehicles, if one does not have the proper app, it will become increasingly difficult for Americans to operate in China without a local phone and apps. Meanwhile, China has stepped up its crackdown on dissent in Hong Kong and made more than 50 arrests, including a US lawyer that acted as the treasurer for the main organizers.

Separately, China’s Caixin service PMI softened more than expected, to 56.3 from 57.8. Given that manufacturing also slowed, the composite eased to 55.8 from 57.5. The recovery is still solid but appears to have slowed marginally. The December reserve figures are out tomorrow. Another rise is expected after the $50.5 bln increase in November. Given the strong capital inflows and current account surplus, the less than 1% appreciation of the yuan in December seems too modest, which is why many see officials’ hand behind the scenes. The yuan has strengthened seven-months through the end of last year. The direction alone does not satisfy many critics who want to see faster adjustment.

Australia also reported softer service and composite PMIs than the flash readings, but still an improvement from November. The services PMI is at 57.0, not the 57.4 of the flash, but well above the 55.1 seen in November. The composite reading was revised to 56.6 from 57.0 of the preliminary estimate and 54.9 in November. Tomorrow, Australia reports building approvals, but more importantly, the November trade figures, where the impact of China’s boycotts may be evident in softer exports.

The dollar slipped to a new 9-month low against the yen near JPY102.60. It has recovered in the European morning but remains in a tight range, unable to resurface above JPY103. Even in last March’s chaos, when the dollar reached JPY101.20, it did not spend an entire session below JPY103. The Australian dollar’s run higher continues as it trades above $0.7800 in Europe. It has not been this high since April 2018. The same is true of the New Zealand dollar. Initial support for the Aussie is seen near $0.7780. Resistance to further Chinese yuan gains is being seen. Late yesterday, Chinese banks were seen as dollar buyers, and today, the PBOC’s dollar reference rate was weaker than the models suggested. The fixing was set at CNY6.4604, while the Bloomberg survey’s median model forecast was for CNY6.4563.

| Europe

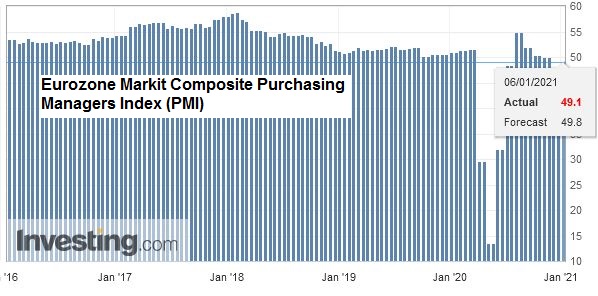

Amid new lockdowns and the developments in Asia and the US, Europe is sidelined. The main economic news is in the form of the final service and composite PMI readings. A couple general patterns have emerged. First, on the aggregate level, the bounce from November was not quite as strong as the flash readings suggested. The EMU service PMI stands at 46.4, not 47.3 after the 41.7 reading in November. |

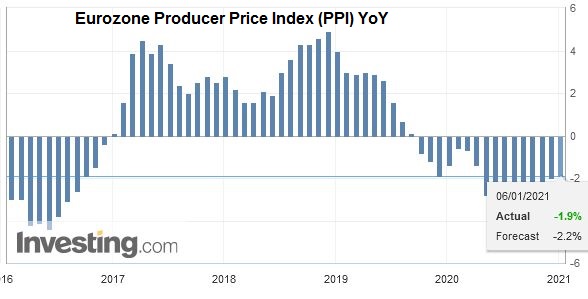

Eurozone Producer Price Index (PPI) YoY, November 2020(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

| The composite is at 49.1, not 49.8. It was 45.3 in November. Germany and France saw downward revisions to the flash, but the second point is the periphery’s weakness. The improvement from November was considerably more muted. Italy and Spain saw weakness in employment, and while Italy saw an uptick in orders, Spain did not. |

Eurozone Markit Composite Purchasing Managers Index (PMI), December 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

Separately, German state inflation readings are largely in line with expectations and will likely translate into slight improvement to -0.6% year-over-year under the EU-harmonized methodology from -0.7%. France’s EU-harmonized CPI fell to 0 year-over-year from 0.2% in November. The aggregate December CPI estimate is due tomorrow, and the headline rate is expected to remain below 0 while the core stays at 0.2%.

The UK’s final PMI also follows the general pattern. Since the flash reading conditions have deteriorated. The service PMI was revised to 49.4 from 49.9 and 47.6 in November. The composite was trimmed to 50.4 from 50..7. It has fallen to 49.0 in November, the first break below the 50 boom/bust level since June. On a different front, we note the nearly $3 bln rise in UK reserves in December. Reserve growth in 2020 accelerated to an average of $1.64 bln a month, up from almost $1.46 bln in 2019 and $708-$720 mln in 2017-2018. While valuation plays a role, we suspect the UK may prefer higher reserves to cushion Brexit disruptions.

The euro’s New Year advance continues, and as the single currency is bid to almost $1.2350. Initial support is seen near $1.2320. There is a 1.1 bln euro option at $1.23 that expires today, and only a break of it will bring it back into play. Sterling is firm, but it has remained below Monday’s high, a little above $1.3700. The first level of support is seen around $1.3620. Since Monday’s recovery, the euro has been in a narrow range against sterling, roughly GBP0.9015-GBP0.9055.

America

The focus is on the results of the second senatorial race in Georgia. The market appears to be acting as if the Democratic Party will secure it, which would split the Senate evenly and allow the new Vice President to cast the tie-breaking vote. Still, to get important legislation through, 60 votes are often necessary. The other drama that will play out today is the certification of the electoral college results. There has been a lot of debate about what can happen, but besides some grandstanding, Biden’s victory will become official today. ,

Yesterday’s manufacturing ISM was stronger than expected, and new orders rose, but what captured the market’s attention was the jump in the prices paid index. This saw measures of inflation expectations, like the 10-year break-even (the difference between the convention yield and the inflation-protected security jump above 2% to its highest level since late 2018. The two-break even rose to 2.11%, its highest since March 2018. Another gauge, the five-year forward-forward rose to 2.3%, its highest since the end of 2018. Separately, note that US December auto sales were considerably stronger than expected at 16.27 mln vehicles (seasonally-adjusted annual pace). It is the first increase in three months and is the second-highest since last February. It may bode well for retail sales.

Today’s there is a full slate of reports. The ADP private-sector employment estimate kicks it off, and a dramatic slowing is expected (75k vs. 307k in November). The final service and composite PMIs are also on tap. November factory and final durable goods orders come next but are unlikely to be market movers. The FOMC minutes late in the day are probably more for economists than investors or businesses. Canada and Mexico’s economy calendars are light.

The US dollar is slumping to new lows against the Canadian dollar since early 2018. It finished last year near CAD1.2725 and traded near CAD1.2630 in Europe today. It is finding a bid prior to the North American open. Nearby resistance is seen around CAD1.2680. After spiking to MXN20.10 yesterday, the greenback retreated and settled below MXN19.90. It is now pushing below MXN19.80. The recent lows are near MXN19.70.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,China,Currency Movement,Featured,newsletter,OIL,PMI,Politics