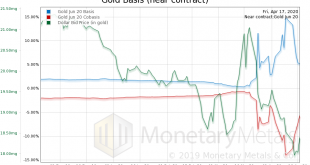

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19. One does not need to look to the gold-silver ratio, which is currently off the charts, to see that the world has gone mad. Silver, it has long...

Read More »FX Daily, April 16: Markets Brace for another Jump in US Weekly Jobless Claims

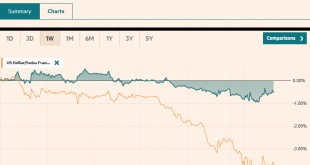

Swiss Franc The Euro has fallen by 0.06% to 1.0513 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares...

Read More »The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations. If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility. There’s also the potential for the engine to overheat and maybe even...

Read More »Cool Video: CNBC Asia

As the markets were re-opening in Asia earlier today, I joined Martin Soong and Sir Jegarajah on CNBC Asia. I had returned from a business trip and visited our summer house on the Jersey shore for what I thought was going to be a weekend more than a month ago. Oil prices had initially reacted positively to the OPEC+ agreement. Still, I was skeptical as the cuts seemed inadequate to meet the dramatic compression in demand, let along the notorious non-compliance by...

Read More »FX Daily, April 6: Glimmer of Hope Lifts Markets

Swiss Franc The Euro has risen by 0.01% to 1.0554 EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the...

Read More »FX Daily, April 03: Oil Firm, Greenback Extends Gains

Swiss Franc The Euro has fallen by 0.17% to 1.0551 EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are finishing the week on a soggy tone despite the 2%+ gains seen in the US yesterday. The extension of shutdowns, rising contagion and fatality rate, and imploding economies weigh on prices. In Asia, Korea and Indonesia bucked the trend to most minor gains. Europe...

Read More »FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Swiss Franc The Euro has fallen by 0.34% to 1.0547 EUR/CHF and USD/CHF, April 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly...

Read More »FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Swiss Franc The Euro has fallen by 0.26% to 1.056 EUR/CHF and USD/CHF, March 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today....

Read More »FX Daily, March 11: US Over-Promises and Under-Delivers, while BOE Steps Up with 50 bp Rate Cut

Swiss Franc The Euro has fallen by 0.21% to 1.0577 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and Dow Jones Industrials sold off after the higher open and briefly traded below yesterday’s lows. Investors seemed disappointed that the Trump Administration was not ready with specific policies after Monday’s tease that had initially helped lift Asia Pacific and...

Read More »FX Daily, March 9: Monday Meltdown

Swiss Franc The Euro has risen by 0.07% to 1.059 EUR/CHF and USD/CHF, March 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities plunged, and yields sank as the coronavirus threatens a global recession. The oil price war signaled by Saudi Arabia and Russia aggravates the desperate situation. Equities markets in the Asia Pacific region slumped 3-7%. The Shanghai Composite was fell 3%. The Nikkei was off by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org