Battle of Wits BALTIMORE – On Wednesday, the Dow rose over 18,000, for the first time since April. Hillary is riding high, too. She is a pro. She has the entire Deep State behind her – including almost every crony and zombie in the country – and a political machine that can turn out more claptrap than any in history. While her opponent rambles incoherently and mindlessly, every phrase from Hillary’s mouth is a...

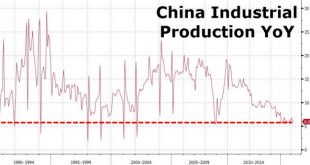

Read More »China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better. Economic Data from China Then Chinese data largely disappointed. A “meet” in Industrial Production – hovering at multi-year lows… *CHINA MAY INDUSTRIAL OUTPUT RISES 6.0% FROM YEAR EARLIER...

Read More »Central Banks & Governments and their gold coin holdings

Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week under pressure. With two potentially disruptive events (FOMC meeting and Brexit vote) still in play, we think that EM softness should carry over into this week. Markets remain jittery about the June 23 Brexit vote, as a vote to leave would be very negative for risk assets such as EM. No action is expected at the FOMC meeting Wednesday. However, we think July remains very much in play and the FOMC...

Read More »FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials were preparing the market for a summer hike. Risks of a new downturn in Japan spurred speculation that BOJ would ease policy. On the other hand, the neither the Bank of England nor the Swiss National Bank were expected to move ahead of the UK referendum on June 23. Besides...

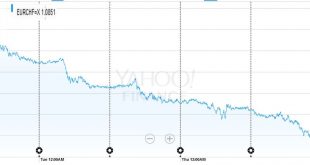

Read More »FX Weekly Review: June 06 – June 10: EUR/CHF Down 2%

EUR/CHF The SNB has about 280 billion CHF in euro. Hence the loss of 2% in the EUR/CHF rate will cost the SNB around 14 billion Swiss francs.We explained that the main reason for the stronger CHF was the bad Non Farm Payrolls Report in the United States. FX Rates June 06 to June 10, 2016 click to enlarge USD/CHF As Marc explains, the dollar recovered a bit in the second part of the week. Still enough so that the...

Read More »Weekly Speculative Positions after Uneventful ECB and Surprisingly Weak US Jobs

On the Swiss Franc: Price action shows a increase of the Swiss franc after the bad US payrolls report. Commitments of traders, however, indicate a move to a short CHF position of 9600 x 100k contracts against the dollar. Chandler: “Although Swiss franc speculative position adjustment was not large, it was counterintuitive. The market has been rife with talk of Swiss franc buying, and the euro-franc cross has fallen...

Read More »Faber: “Switzerland is doing much better than any other country in Europe. So maybe Britain would do the same?”

The European Union is an “empire that is hugely bureaucratic,” warns Marc Faber, telling CNBC that he thinks that “a Brexit would be bullish for global economic growth,” because “it would give other countries incentive to leave the badly organized EU.” The Gloom, Boom & Doom-er explained that Brexit is a risk Britain should be willing to take, and that it would not be a disaster, “on the contrary, it would be the...

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

Read More »Chart up-date: Stocks, Bonds, Copper, Bonds

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org