Speculators appeared mostly interested in reducing exposure in the run-up to the US jobs data and the Italian referendum. They liquidated gross longs in the currency futures market and covered shorts. Of the eight currencies we track there were two exceptions, the Japanese yen and the Swiss franc. Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K...

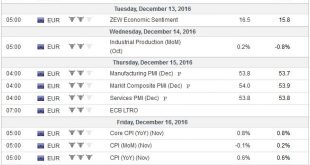

Read More »FX Weekly Preview: What the FOMC Says may be More Important than What it Does

Summary: FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM. Provided that the Federal Reserve delivers the widely tipped and expected 25 bp hike in the Fed funds target range, the key to investors’ reaction will be a function of the FOMC statement and...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also...

Read More »200 Russian Propaganda Sites, or simply alternative media?

The following is the list of “Russian Propaganda sites”, as published by PropOrNot. Several articles by the Washington Post refer to this list. Many sites on that list are based on libertarian ideas and Austrian economics. Those are in favor of a free market economy, they reject central banks, the big state and the establishment. Examples are davidstockmanscontracorner.com beforeitsnews.com lewrockwell.com...

Read More »Pension payments could become compulsory for self-employed in Switzerland

© Katatonia82 | Dreamstime.com - Click to enlarge Switzerland’s Federal Council is looking at a proposal to make pension payments compulsory for self-employed workers in the same way that they are for salaried workers. In Switzerland there are three elements to pensions. A universal state pension, funded from social security payments, a second element, known as a second pillar, which is a pot built up from sums...

Read More »Richemont cuts send shockwaves from Geneva to mountain valleys

Richemont’s plan to slash 210 watchmaking jobs in Switzerland is sending shockwaves from Geneva to some of the country’s remote mountain villages, the cradle of high-end watch manufacturing. In Le Sentier, a town perched in the middle of the Jura mountain range, straddling the border between France and Switzerland, some 400 people protested Thursday against plans to cut the workforce of Vacheron Constantin and Piaget....

Read More »Washington Post: Russian Propaganda Sites

In case you missed it, The Washington Post’s criminally careless publishing of “fake news” about purported “Russian propaganda” created a backlash -and the Post’s attorney-approved bleating to sidestep responsibility for publishing “fake news” failed to calm the waters. Here’s The Washington Post’s “fake news” article in case you missed it: Russian propaganda effort helped spread ‘fake news’ during election, experts...

Read More »Emerging Markets: What has Changed

Summary Hong Kong Chief Executive Leung Chun-ying said he won’t seek a second term. Korea’s parliament voted 234-56 to impeach President Park. Czech National Bank raised the possibility of negative rates to help manage the currency. A Brazilian Supreme Court justice removed Senate chief Renan Calheiros from his post, but was later overturned by the full court. Brazil central bank signaled a possibly quicker easing...

Read More »Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

Submitted by Michael Shedlock via MishTalk.com, For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change. But leading experts say the...

Read More »FX Daily, December 09: Euro Chopped Lower before Stabilizing

Swiss Franc EUR/CHF - Euro Swiss Franc, December 09(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The euro has stabilized after extending yesterday’s ECB-driven losses. The euro’s drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org