Swiss Franc EUR/CHF - Euro Swiss Franc, December 14(see more posts on EUR/CHF, ) - Click to enlarge The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data...

Read More »Friction and Gravity

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Lawsuit Makes Waves The price action was mixed last week. Those hoping for dollar declines in gold terms were disappointed. However, silver gave them a sop as the price of the buck declined by one one-hundredth of a gram of silver. In Monetarist terms, gold went down $18 and silver up 11 cents. Monetarism, in its...

Read More »Swiss banks probed at home over Brazil’s ‘Carwash’ bribe scandal

© Kevkhiev Yury | Dreamstime.com - Click to enlarge The Switzerland attorney general’s office is shifting its focus to banks operating in the country as it continues to investigate Brazil’s bribery scandal, after plea deals with individual executives provided fresh insights into how the illicit funds flowed through the financial system. Attorney General Michael Lauber said in an interview that he’s reviewing how Swiss...

Read More »Swiss Producer and Import Price Index, November 2016: +0.1 percent MoM, -0.6 percent YoY

The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »“Fake News”, Censorship, Darwin and Democracy

Censorship is not helpful to democracy–rather, it is the death of democracy. The mainstream media is awash with hyper-active headlines about “fake news.” How can we make sense of this sudden obsession? Perhaps we can start by separating “news” from “analysis” from “commentary.” “News” is “he said this, she did that, this happened.” Analysis tries to make sense of trends that are apparent in the news longer-term–for...

Read More »FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

Swiss Franc EUR/CHF - Euro Swiss Franc, December 13(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is little changed against most of the major currencies. The dollar finished yesterday’s North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. ...

Read More »Busy Week for the UK

Summary: The UK reports inflation, employment and retail sales this week. The BOE meets but will keep rates steady. The US 2-year premium over the UK is the highest since at least 1992 today. United Kingdom While the Federal Reserve meeting is the highlight this week, the UK has a number economic reports and the Bank of England’s Monetary Policy Committee meets. The UK reports inflation tomorrow, followed...

Read More »Migros Bank could pass on negative interest rates

20 Minutes. Because of negative interest, even a savings account earning 0% interest is earning too much reckons the bank’s boss. Source: Facebook Migros Bank - Click to enlarge Soon many banks will be passing on some of the cost of negative interest to their clients, reports 20 Minutes. Migros Bank will need to seriously consider doing the same in 2017. The bank’s boss Harald Nedwed told the NZZ am Sonntag that the...

Read More »The Climate Changes Back – What Comes Next?

Surface Temperatures Plunge – the Great Pause Continues Last year’s El Nino phenomenon temporarily provided succor to climate alarmists, who were increasingly bothered by the “Great Pause” – the fact that the tiny amount of warming experienced since the last cooling cycle ended in the late 1970s had apparently stopped. Despite trace amounts of CO2 in the atmosphere continuing to climb, mother nature decided to disobey...

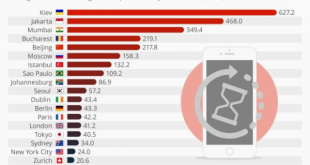

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org