Neuchâtel, 07.08.2017 (FSO) – The hotel sector registered 17.6 million overnight stays in Switzerland in the first half of 2017, representing an increase of 4.4% (+738,000 overnight stays) compared with the same period a year earlier. With a total of 9.5 million overnight stays, foreign demand rose by 4.7% (+428,000). Domestic visitors registered 8.1 million overnight stays, i.e. an increase of 4.0% (+310,000). In all...

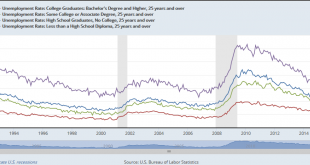

Read More »Great Graphic: Unemployment by Education Level

The US reports the monthly jobs data tomorrow. The unemployment rate stood at 4.4% in June, after finishing last year at 4.7%. At the end of 2015 was 5.0%. Some economists expect the unemployment rate to have slipped to 4.3% in July. Recall that this measure (U-3) of unemployment counts those who do not have a job but are looking for one. There are several other measures, and which one is right depends on what question...

Read More »FX Daily, August 07: Outlaw Mondays

Swiss Franc The Euro has risen by 0.17% to 1.1469 CHF. EUR/CHF and USD/CHF, August 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing...

Read More »Dying men generate higher health costs

Pills with a bill – the CHF200 note (Keystone) Both gender and location influence the cost of end-of-life healthcare in Switzerland, finds a study funded by the Swiss National Science Foundation. In their analysis of 113,277 people who died between 2008 and 2010, researchers studied regional variations in cost of care during the last 12 months of life in Switzerland. Per person, the mean cost of care during that final...

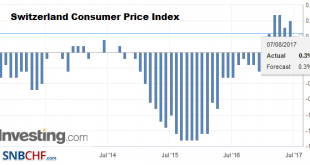

Read More »Swiss Consumer Price Index in June 2017: Up +0.3 percent against 2016, -0.3 percent against last month

The consumer price index (CPI) fell by 0.3% in July 2017 compared with the previous month, reaching 100.6 points (December 2015=100). Inflation was 0.3% compared with the same month of the previous year. Switzerland Consumer Price Index (CPI) YoY, July 2017(see more posts on Switzerland Consumer Price Index, ) Source: investing.com - Click to enlarge Download press release: Swiss Consumer Price Index in July 2017...

Read More »Weekly Speculative Positions (as of August 01): Speculators Press Ahead with Dollar-Bloc Currencies, but Hesitate with Euro and Yen

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Moving Toward September

Summary: The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France’s Macron and Japan’s Abe have sunk in the polls lower than Trump. The release of the US employment data before the weekend ushers in a three-week period before the Jackson Hole confab at the end of the month that will start the new phase. In September, the FOMC is likely to...

Read More »Emerging Markets: The Week Ahead

Stock Markets EM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM. Stock Markets Emerging Markets,...

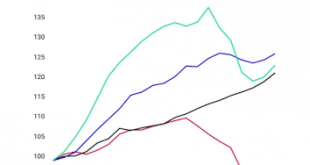

Read More »Great Graphic: Italy-It is Not Just about Legacy

A little while back I was part of a small exchange of views on twitter. It was about Italy. I was arguing against a claim that Italy’s woes are all about its past fiscal excesses. It is not just about about Italy’s legacy. It is true that Italy runs a primary budget surplus. The primary budget surplus has averaged in excess of 2% for nearly two decades. Over this period, Italy debt has soared. I took exception with a...

Read More »Median Swiss salaries by occupation, region, gender and immigration status

© Shaunwilkinson – Dreamstime If you have ever wondered how much employees in Switzerland get paid you can check with the online tool Salarium, created by the Swiss government. The information is compiled from a database of numbers from a salary survey done in 2014. After entering five required bits of information: region, business sector, occupation, professional position and working hours, the tool calculates the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org