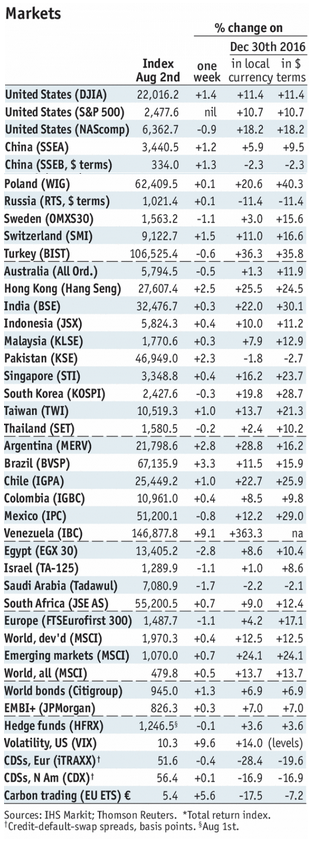

Stock Markets EM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM. Stock Markets Emerging Markets, August 2nd Source: economist.com - Click to enlarge Indonesia Indonesia reports Q2 GDP Monday, which is expected to grow 5.08% y/y vs. 5.01% in Q1. However, officials appear to be getting more concerned about growth. Bank Indonesia just turned more dovish after signaling that the easing cycle had ended.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM. |

Stock Markets Emerging Markets, August 2nd Source: economist.com - Click to enlarge |

IndonesiaIndonesia reports Q2 GDP Monday, which is expected to grow 5.08% y/y vs. 5.01% in Q1. However, officials appear to be getting more concerned about growth. Bank Indonesia just turned more dovish after signaling that the easing cycle had ended. Next policy meeting is August 22, and the odds of a cut then are rising. Czech RepublicCzech Republic reports June industrial (7.0% y/y expected) and construction output and trade (CZK18 bln expected) Monday. It reports July CPI Wednesday, which is expected to remain steady at 2.3% y/y. This would remain above the 2% target and justifies further rate hikes after the CNB started the tightening cycle last week. Next policy meeting is September 27, and another hike then seems likely. South AfricaSouth Africa reports Q2 unemployment Monday, which is expected at 27.5% vs. 27.7% in Q1. It then reports June manufacturing production Thursday. Moody’s is scheduled to issue a rating decision Friday. We expect a downgrade to its Baa3 rating, which is currently one notch higher than the BB+ from both S&P and Fitch. TaiwanTaiwan reports July trade Monday. Exports are expected to rise 10% y/y and imports by 3.3% y/y. It reports July CPI Tuesday, which is expected to rise 0.9 y/y vs. 1.0% in June. The central bank released minutes for the first time ever for its June meeting, which showed a dovish stance. Next quarterly policy meeting is in September, and no change is expected then. ChileChile reports July trade and June GDP proxy Monday. Economic growth is expected to slow to 1.1% y/y from 1.3% in May. It reports July CPI Tuesday, which is expected to rise 1.6% y/y vs. 1.7% in June. If so, this would be below the 2-4% target. The central bank has signaled an end to the easing cycle, but it may restart it if current trends continue. Next policy meeting is August 17, no change is expected then. ChinaChina reports July trade Tuesday. Exports are expected to rise 11% y/y and imports by 18% y/y. It reports July CPI and PPI Wednesday. The former is expected to remain steady at 1.5% y/y, while the latter is expected to tick up to 5.6% y/y. For now, markets remain comfortable with the mainland outlook. HungaryHungary reports July CPI Tuesday, which is expected to rise 2.0% y/y vs. 1.9% in June. If so, it would be right at the bottom of the 2-4% target range. The economy remains robust, but low inflation may lead the central bank to ease again with another tweak to its unconventional measures at the September 19 meeting. However, no change is expected at the August 22 meeting. BrazilBrazil reports July IPCA inflation Wednesday, which is expected to rise 2.64% y/y vs. 3.0% in June. If so, this would be the lowest since February 1999 and falls below the 3-6% target range. Next COPOM meeting is September 6, and dovish signals suggest another 100 bp cut to 8.25% is likely then. MexicoMexico reports July CPI Wednesday, which is expected to rise 6.40% y/y vs. 6.31% in June. Banco de Mexico then meets Thursday and is expected to keep rates steady at 7.0%. Price pressures are showing signs of topping out, and so we believe the tightening cycle is over for now. Mexico reports June IP Friday, which is expected to rise 0.2% y/y vs. 1.0% in May. PilipinasBangko Sentralng Pilipinas meets Thursday and is expected to keep rates steady at 3.0%. CPI rose 2.8% y/y in July, below the 3% target but within the 2-4% target range. We think the central bank will remain hold into 2018. PeruPeruvian central bank meets Thursday and is expected to keep rates steady at 3.75%. CPI rose 2.9% y/y in July, above the 2% target but within the 1-3% target range. Since the easing cycle started in May, the bank has been cutting every other meeting. Since it cut in July, it will likely remain on hold this month and cut at the September 14meeting. RussiaRussia reports Q2 GDP and June trade Friday. Growth is expected to pick up to 1.6% y/y from 0.5% in Q1. Inflation unexpectedly fell to 3.9% y/y in July, below the 4% target for the first time. The central bank paused its easing cycle in July after cutting three straight meeting. Next meeting is September 15, we think a cut then is likely. |

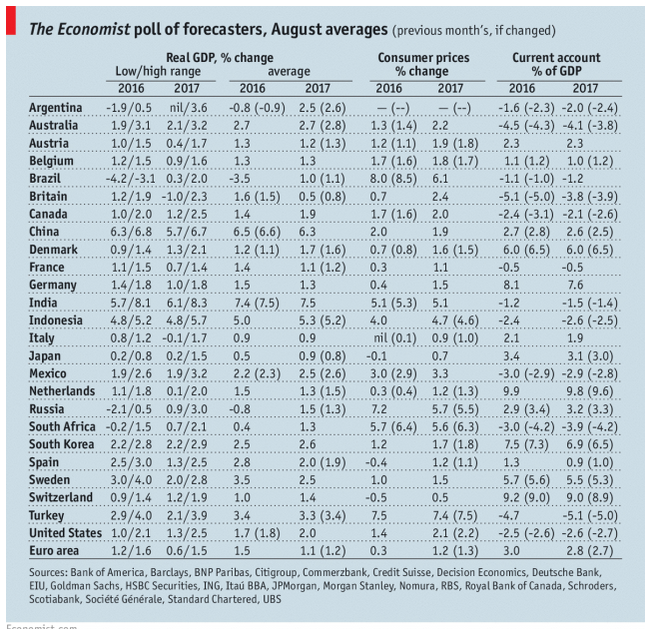

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin