Summary: Quiet week ahead. RBA and RBNZ policy meetings; no change is expected. US tax reform and the newest Fed governor, Quarles speaks. Q3 data renders September data too old to matter much. United Kingdom The week ahead does not have nearly the event risk of last week. It is difficult to compete with a BOE rate hike that spurred the largest sterling decline in five months, the nomination of a new Fed chair, and the unveiling of the initial tax reform proposals. The information set of investors’ is unlikely to change much in the coming days. The event schedule is light, and the economic data is mostly from Q3, which are the estimate of Q3 GDP is of less interest. The eurozone reports the service and

Topics:

Marc Chandler considers the following as important: AUD, EUR, Featured, FX Trends, GBP, newsletter, NZD, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Quiet week ahead.

RBA and RBNZ policy meetings; no change is expected.

US tax reform and the newest Fed governor, Quarles speaks.

Q3 data renders September data too old to matter much.

United KingdomThe week ahead does not have nearly the event risk of last week. It is difficult to compete with a BOE rate hike that spurred the largest sterling decline in five months, the nomination of a new Fed chair, and the unveiling of the initial tax reform proposals. The information set of investors’ is unlikely to change much in the coming days. The event schedule is light, and the economic data is mostly from Q3, which are the estimate of Q3 GDP is of less interest. The eurozone reports the service and composite PMIs for October, but the thunder was largely stolen by the flash readings that have already been reported. In many ways, the broad investment climate seems healthy. There seems to be a synchronized expansion underway. The US just strung together its best two-quarters of growth since 2014. The eurozone and Japan are growing above trend. The large emerging market economies and many others are participating too. For the most part in the high income countries price pressures continue to remain modest, and below targets, however, measured. Interest rates remain low in nominal and real terms. Credit is available, and lending is rising. Unemployment rates are falling. In a mixed overall report, the US underemployment rate fell to 7.9% from 8.3%, while the unemployment rate fell to new cyclical lows. Unemployment also continues to trend lower in the euro area. It stood at 8.9% in September, down from 9.9% in September 2016, and is the lowest since early 2009. Japan is also understood to be at full employment, while UK employment growth remains firm and unemployment stands at 4.3%. Labor markets in Canada and Australia are doing well. Canada has created 200k full-time positions in the past two months, which, proportionately, would be as if the US created two mln jobs in the same (in actuality is created 279k). Equity markets continue to race ahead. |

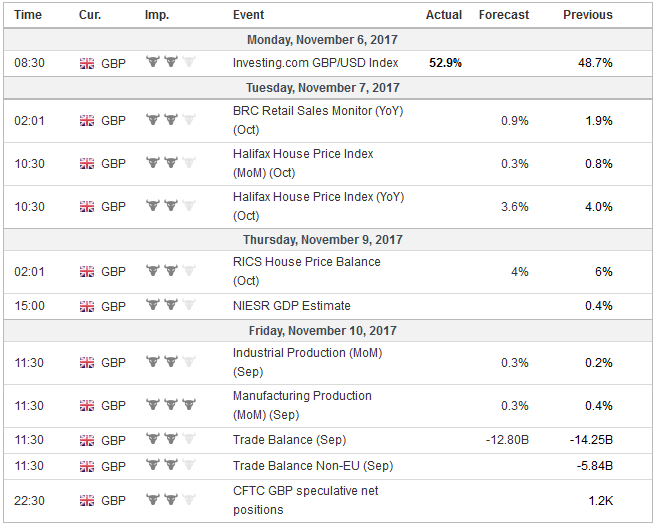

Economic Events: United Kingdom, Week November 06 |

EurozoneBelow the surface, there is much angst. Central bankers are concerned that price pressures are too low, leaving aside the Bank of England. This leads to unusually low policy rates and fears of the misallocation of capital and asset bubbles. Although populism-nationalism has not swept into power, the broader push against the elites continues. The ongoing resistance against male sexual predators may have been re-energized by the pushback against elite men. The seems to be a high degree of economic anxiety/insecurity and, while the disparity of wealth is part of the public discourse it has intensified. Measures of social trust appear to be deteriorating. In broad terms, we have suggested parallels between the current period and the period immediately following the breakdown of Bretton Woods in 1971. What was going to replace that order was not clear for nearly a decade. Six years later, there was still what US President Carter is said to have referred to as “malaise in America.” Nine years after Lehman failed, and eight and a half years after the US economic contraction ended, there remains a profound sense that things are not on a durable and desirable path. The elites in most of the high income countries have failed to deliver the goods, a rising living standard for the vast majority of people. Not only that, but they seem to lack a vision and a plan. |

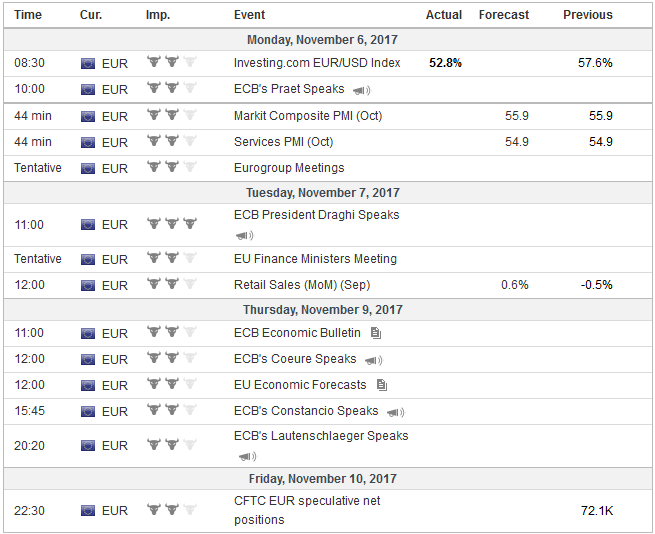

Economic Events: Eurozone, Week November 06 |

CanadaDespite the synchronized expansion, monetary policy divergence continues. Many have been tempted to consider convergence, but this has proven premature. The Bank of Canada assures investors that its two hikes in Q3 were not the beginning of a sustained monetary tightening cycle. The hikes were taking by the accommodation provided in 2015 in the face of the terms of trade shock. As participants gave up the idea of a tightening cycle, the Canadian dollar depreciated by about 4.8% over the past two months. The Bank of England’s rate hike last was in this vein as well. The rate cut provided after the 2016 referendum as taken back. The implied yield of the December 2018 short-sterling interest futures fell 15 bp in the face of the 25 bp rate hike. This illustrates that many participants viewed the rate hike as dovish. Is it any wonder that sterling sold off? |

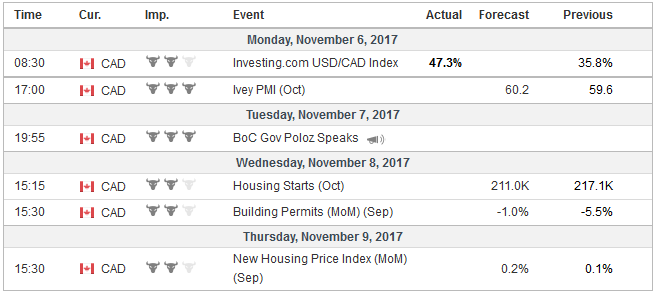

Economic Events: Canada, Week November 06 |

AustraliaNext week the Reserve Bank of Australia and the Reserve Bank of New Zealand hold policy meetings. Both central banks remain on hold. Soft inflation and retail sales in Australia keep the RBA on hold. The central bank continues to expect the overtime, continued above-trend growth and the strong labor market will boost inflation and buffer aggregate demand. Many market participants are less convinced. Speculators in the futures market have been paring long Aussie exposure for five consecutive weeks through October 31. The Australian dollar has fallen 5% since early September and has already given up about 50% of this year’s gains. |

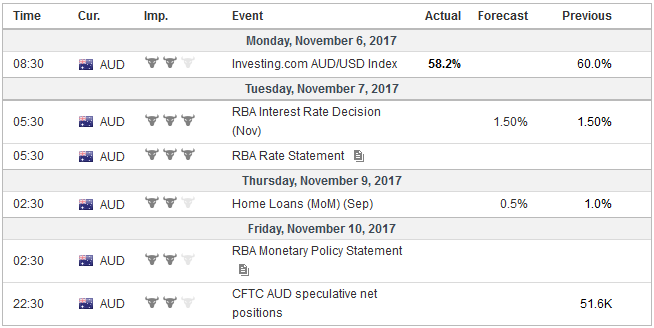

Economic Events: Australia, Week November 06 |

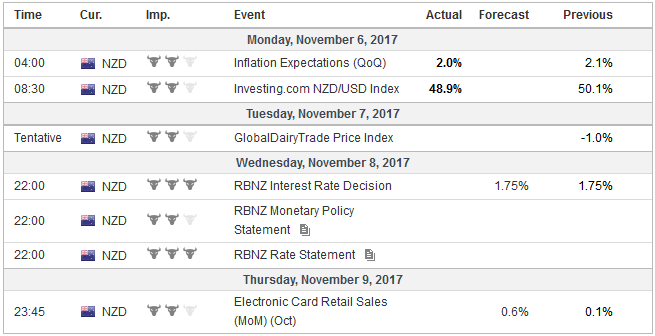

New ZealandThe New Zealand dollar has also lost about 5% over the past two months. The main drag is political, not economic. Investors are worried about the new Labour-New Zealand First government. There two immediate concerns. First, is the declared effort to give the central bank a “dual mandate” like the Fed where full-employment is given its due alongside price stability. Second, some government policies will be aimed to discourage foreign purchases of New Zealand homes. However, the macroeconomic situation seems constructive. Inflation is near 2% in Q3 (1.9%), and the labor market remains strong. While it may be a bit early to suggest an RBNZ hike, pressures may still mount on the RBA to cut rates. The New Zealand dollar was the strongest currency among high income countries last week with a 0.4% advance. It had fallen nearly 10% in the three months from late July. Last week’s upticks fizzled out in front of the minimum retracement of the last leg down that began on October 17. The Kiwi finished poorly ahead of the weekend, but additional losses into the $0.6950-$0.6970 area may offer a low-risk entry opportunity. |

Economic Events: New Zealand, Week November 06 |

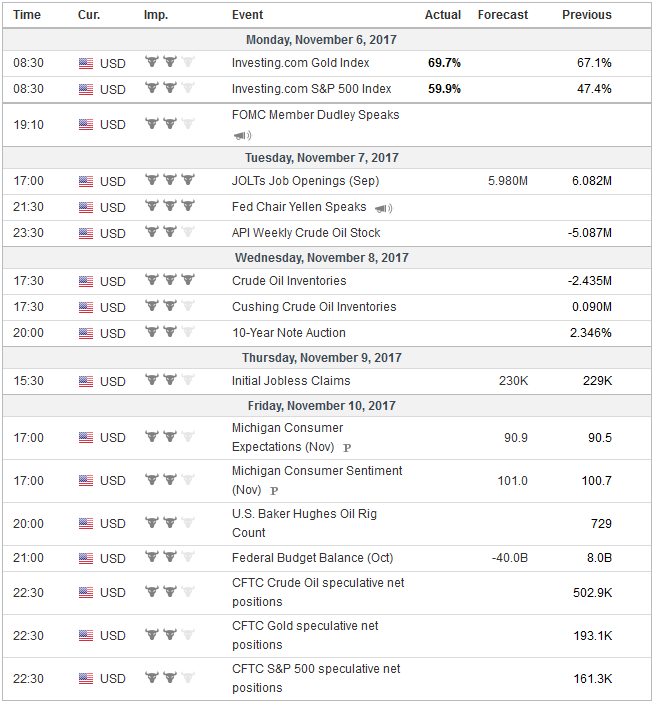

United StatesIn the US, the focus will remain very much on tax reform. Revisions to the bill are expected to be unveiled early in the new week so the House Ways and Means Committee can debate it, mark it up before voting on it. After the Committee votes on it and given the composition ( the majority of Republicans), the bill will eventually pass. Then it goes to the entire House floor. Meanwhile, the Senate is working on their own version. With the passing of the FOMC meeting, the quiet period ends and several Fed officials will be speaking next week. We do not anticipate new news, and the Fed funds futures market implies a December hike remains largely discounted. We estimate that the implied interest rate of the December contract of 1.295% would be fair value assuming a rate hike and the contract settled at 1.28% before the weekend. We suspect the market will be most keen to hear from the newest Fed Governor Quarles, whose views are not known, though he voted all the other FOMC members last week. Reports suggest Treasury Secretary Mnuchin convinced President Trump not to re-appoint Yellen. Similarly, reports suggested that Quarles threatened to resign if Warsh was picked as Chair. Given the light news stream, we suspect the week ahead will be largely consolidative in nature. Although we remain favorable the dollar based on continued divergence (peak is not a 2018 story but 2019), the technical condition makes us suspicious that near-term dollar gains might not be sustained without stronger interest rate support or negative developments abroad. |

Economic Events: United States, Week November 06 |

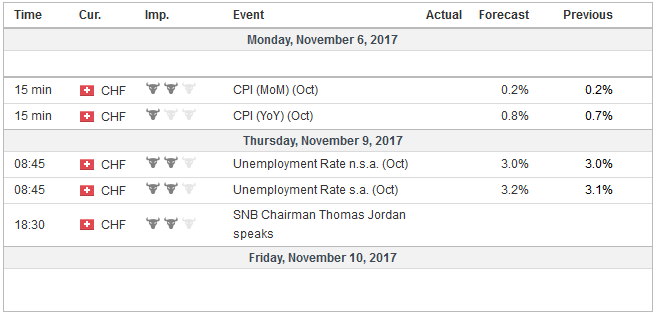

Switzerland |

Economic Events: Switzerland, Week November 06 |

Tags: #GBP,#USD,$AUD,$EUR,$TLT,Featured,newsletter,NZD