Swiss Franc The Euro has risen by 0.04% to 1.1766 CHF. EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the...

Read More »Great Graphic: Treasury Holdings

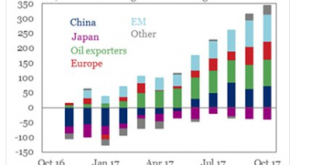

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed’s balance sheet shrinks, investors will have to step up their purchases. This Great Graphic was created by the Institute of International Finance (IIF). It is drawn from the US TIC data that tracks foreign holdings of US Treasuries. The most...

Read More »Punch-Drunk Investors & Extinct Bears, Part 1

The Mother of All Blow-Offs We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that...

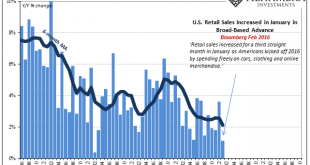

Read More »Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past. Spending and consumer sentiment used to track each other very closely and in terms of...

Read More »The Dea(r)th of Economic Momentum

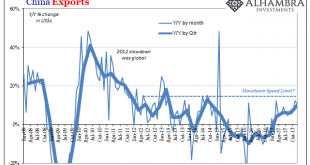

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape. China Exports,...

Read More »FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers. China The PBOC modified the way the reference rate is set. Currencies are allowed to trade in a band around...

Read More »Emerging Markets: Preview of the Week Ahead

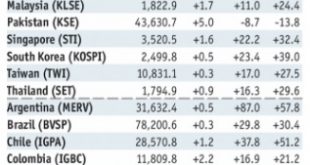

Stock Markets EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play. Stock Markets Emerging Markets, January 10 Source: economist.com - Click to enlarge...

Read More »Chinese bitcoin mining giant sets up Swiss hub

One of the world’s largest bitcoin miners is setting up a hub for European operations in Switzerland, a person familiar with company has confirmed to swissinfo.ch. The Chinese firm Bitmain Technologies is setting up in Zug just as the Chinese authorities move to shut down cryptocurrency miners. Bitmain Technologies builds and supplies machines for bitcoin mining and runs its super-scale mine in China. The company set...

Read More »The number of people on welfare continues to rise in Switzerland

In 2016, around 273,000 people, 3.3% of the population, received welfare in Switzerland. The number (not the rate) was 2.9% higher than the year before and 15.7% higher than 5 years earlier when the rate was 3.0%. Neuchâtel, the canton with the highest rate of beneficiaries © Olga Demchishina | Dreamstime.com - Click to enlarge Rates of those receiving government aid varied significantly by canton, ranging from 0.8% in...

Read More »Swiss want only five bilateral treaties under EU framework agreement

Switzerland recently suffered a setback in the negotiations when the EU decided to restrict Swiss stock exchange access to the EU market for a year (Keystone) - Click to enlarge According to an unpublished list that was revealed in some Swiss papers, Switzerland wants only five of around 120 bilateral treaties with the European Union to figure in a future institutional framework agreement. A reportexternal...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org