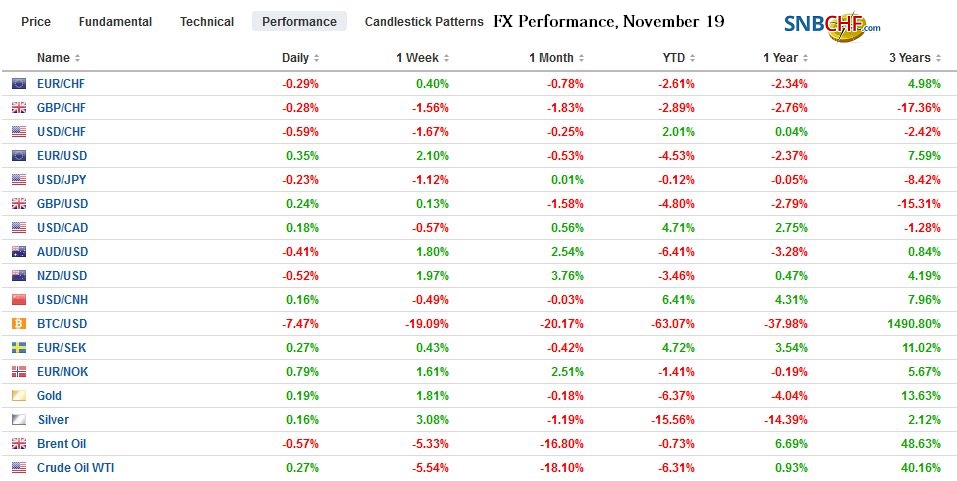

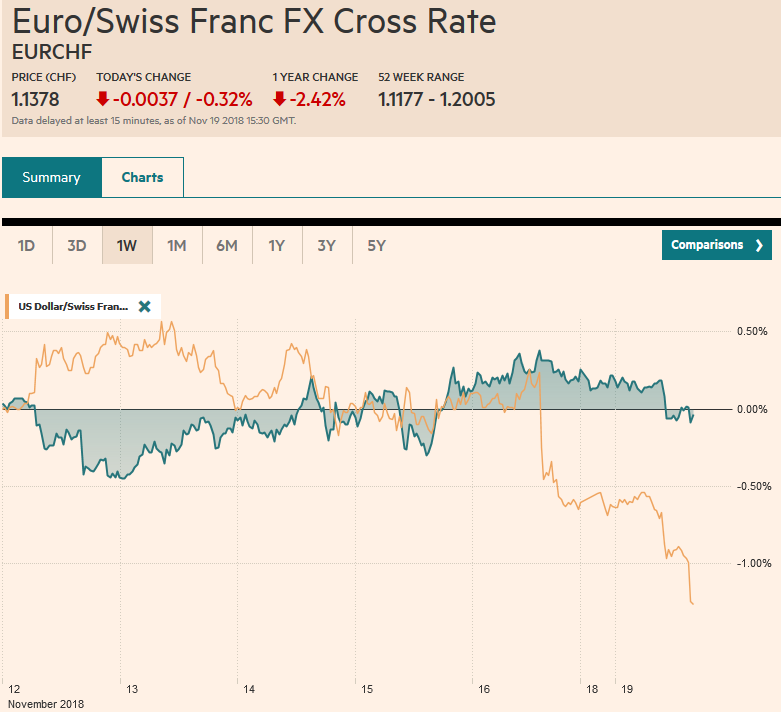

Swiss Franc The Euro has fallen by 0.32% at 1.1378 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is an uneasy calm in the global capital markets. Investors are digesting the weekend news, which includes the failure of APEC to issue a joint statement due to US-China tensions that we highlighted by dueling speeches by China President Xi and US Vice President Pence. There was apparently little progress on breaking the impasses in the UK over Brexit. Although Prime Minister May is widely criticized, there is no agreement on an alternative plan or leader. Equity markets are mostly higher. The MSCI Asia Pacific extended its

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, MXN, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.32% at 1.1378 |

EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: There is an uneasy calm in the global capital markets. Investors are digesting the weekend news, which includes the failure of APEC to issue a joint statement due to US-China tensions that we highlighted by dueling speeches by China President Xi and US Vice President Pence. There was apparently little progress on breaking the impasses in the UK over Brexit. Although Prime Minister May is widely criticized, there is no agreement on an alternative plan or leader. Equity markets are mostly higher. The MSCI Asia Pacific extended its advance for a third session, while in Europe, the Dow Jones Stoxx 600 is trying to snap a three-day fall. The S&P 500 traded higher in the last two sessions, and the early call is flat to slightly higher. US 10-year Treasury yields have not risen since November 8, and that streak may also come to an end today. Core European yields are a couple basis points higher, while peripheral yields are softer. The US dollar is narrowly mixed. Of note, the Australian and New Zealand dollars, which had been outperformers are the heaviest today, with the complex of European currencies trading firmer. |

FX Performance, November 19 |

Asia Pacific

Xi and Pence exchanged barbs at APEC Summit over the weekend. The rhetoric contrasts with hopes that the US and China can find a way forward at the G20 gathering at the end of the month when Trump and Xi meet. A dispute over the wording of the final statement prevented one from being issued. It is the first time APEC failed to generate a joint statement, though previously an ASEAN gathering also could not agree on a final statement as Sino-American rivalry created a fissure. Former Treasury Secretary Paulson has warned of an “economic iron curtain,” and given the US tariffs and threats of more, it seems to already be taking place, and it is most certainly not just about economics as the attempt to revitalize the “Quad” (US, Japan, India, and Australia) to block the projection of Chinese military influence in the area.

Japan reported a larger than expected trade deficit in October. The JPY449 bln deficit was six-times larger than the median forecast in the Bloomberg survey, but the details were favorable. Exports rebounded smartly to 8.2% year-over-year after1.3% decline in September that had been undermined by the natural disasters that hit the country. Of note, exports of semiconductors, electronics, and autos rose. Japan’s exports to China rose 9.0% from a year ago. Exports to the US rose 11.6%, and shipments to the EU rose 7.7%. Imports jumped almost 20% from a year ago after a 7% increase in September. Japan imported more oil from Saudi Arabia and more LNG from Australia. Higher energy prices helped inflate Japan’s imports.

The US dollar has been confined to less than a third of a yen today, through the European morning. The greenback slipped through the pre-weekend low against the yen, but support ahead of JPY112.50, where a roughly $970 mln option is set to expire today, remains intact. There is another option (~$700 mln) that will be cut at JPY113.00. The Australian dollar is consolidating in the upper end of its pre-weekend range. Initial support is seen near $0.7300, and a break of $0.7270 is needed to signal anything of importance. Meanwhile, the four-day advance of the yuan ended today with a small pullback. Support for the US dollar is seen near CNY6.93, and the CNY7.0 is still invested with psychological energy.

Europe

Brexit continues to be a key focus, though the cloud of uncertainty has not been lifted. In some ways, the UK continues to dance around the same problem: TINA-there is no alternative. After protracted negotiations, neither the EC nor Prime Minister May wants to re-open talks as Gove as demanded a -pre-condition to assuming the post from which both Davis and Raab resigned. There is no alternative plan to what has been negotiated. Members of the Tory Party have threatened to bring May down, but have failed to coalesce around a different candidate or even a stalking horse. The Sun reports that there are 42 Tory MPs that have submitted letters of no confidence, while 48 are needed. Press reports today suggest that May will take her case to UK businesses.

Separately, Rightmove warned that UK house prices are softening. It reported that asking prices eased by 0.2% this month, the first decline since 2011. Sterling fell to about $1.2725 on November 15 and is rising for the second consecutive session today to reach almost $1.2885. The intraday technicals warn that resistance in the $1.2940 may be too far. Initial support is seen in the $1.2840-60 area.

News from the eurozone is light. There is a Eurogroup meeting of finance ministers. Macron’s push for an EMU budget has been compromised to be within the larger EU budget and rather than a fiscal tool to be used to counter economic downturns, it appears to be yet another (seem Juncker’s fund and EIB) investment fund. Initial reports suggest the size has not been agreed. The Italian government has indicated some albeit limited flexibility. It is willing to cut “wasteful” government spending and would consider some measures that would limit the deficit to 2.4% of GDP. At the end of the week, the EC will announce its budget assessment of all the members that may be in violation of the debt and deficit rules.

The euro has been confined to less than a third of a cent range today, though managed to marginal extend last week’s gains. Initial resistance is seen near $1.1450. The high for the month was recorded on November 7 at $1.1500. A break of $1.1360-80 would be seen as confirming a near-term top and setting the stage for a move lower.

North America

The holiday-shortened week for the US begins off slowly without much data. A key talking point is an apparent shift in expectations for Fed policy. The implied yield of the December 2019 fed funds futures contract eased 15 bp last week. The Federal Reserve’s forecast had implied a pause next year. After anticipating four hikes this year, the Fed’s dots pointed to a median expectation of three moves in 2019. The market had leaned toward two. We suspect that some observers are misreading the recent comments by Powell and Clarida. Both endorsed continued gradual rate hikes. Powell had cited potential headwinds next year that included slower growth abroad (end of the US fiscal stimulus and the culmination of past Fed hikes). Some observers played up comments by Bostic, Kashkari, and Harker. The former two have opposed nearly every hike in the normalization cycle, and Harker has been on the record questioning the merit of a December hike since at least early October.

Also, note that over the past couple of weeks, both Japan (world’s third largest economy) and Germany (the world’s fourth-largest economy) reported contractions in Q3 GDP, while early Q4 data suggests a recovery is already underway. We had penciled in three hikes between now and the middle of next year.

The US dollar is holding an uptrend line against the Canadian dollar that began early last month and is found near CAD1.3130 today. Initial resistance is pegged in the CAD1.3180-CAD1.3200 area. Last week’s high was near CAD1.3265. The dollar closed softly after the Mexican peso before the weekend. Bids were found near MXN20.08. The MXN20.25-MXN20.30 area offers a preliminary cap.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,Featured,MXN,newsletter