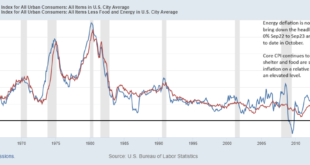

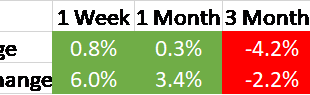

The most anticipated release of the week came in … “Unchanged” or sticky stuck from the August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month. Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed...

Read More »Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS...

Read More »Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone There’ll be no more from now on! Happy days are here again! The skies above are clear again Let us sing a song of cheer again Happy days are here again! Lyrics: Jack Yellen, Music: Milton Ager That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P 500. Bonds have been...

Read More »Weekly Market Pulse: A Fatal Conceit

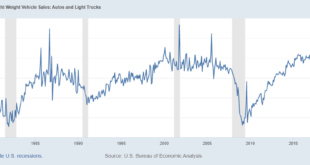

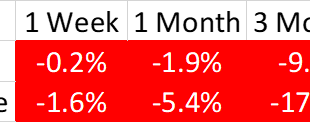

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023. Is the FED’s institutional history about to repeat...

Read More »How To Design Corporate Budget For A Growing Company

Introduction The success of a business organization depends, to quite an extent, on the planning of resources. This planning keeps the business way above others. Budgeting, therefore, becomes a critical aspect of accounting. However, please keep in mind that financial planning in business is steeped in challenges because of the economic turmoil. Do you run your own small business? If yes, then you count yourself among the 99% of small and medium businesses run in...

Read More »Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business. So, no, I don’t know what’s going to happen this year. I do know what the consensus view is, what the majority expects to happen, and that may be more useful. Because...

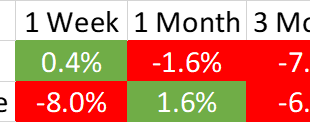

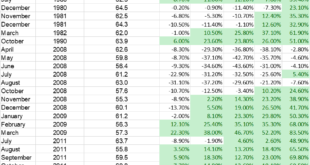

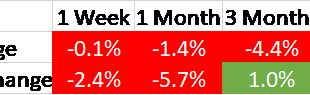

Read More »Great News! Consumer Sentiment Is Awful!

I don’t know how many times I’ve seen blog posts or articles or Tweets about negative consumer sentiment over the last year. These articles rightly point out that the University of Michigan consumer sentiment survey is sitting near (or at a few months ago) 50 year lows. This fact is taken as a negative for the economy and therefore stocks. The only problem is that sentiment today tells you only how people view things today – and investing is about the future. If...

Read More »Weekly Market Pulse: Happy Holidays

We received a host of economics reports this past week; some good, others not so much. The week started with the Consumer Price Index report coming in better than expected at an increase of just 0.1% from the previous month (7.1% from a year ago), compared with respective estimates of 0.3% and 7.3%. This is great news (and the market responded in kind), as inflation continues to moderate not only here but also in Europe. US import and export prices were also both...

Read More »Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed. It’s driven by envy.” I think this perfectly encapsulates our current investing era. In a day and age where social media has replaced not only traditional news media but human interaction, where influencers and gamers are top career aspirations for the nation’s youth, where artists (content creators) are paid by the number of followers, likes, and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org