Following today’s FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow. The SNB will keep its powder dry to be able to respond to the results of the UK referendum if needed. The Bank of England is also on hold. The outlook for the BOJ is more in dispute. The strength of the yen and deflationary pressures encourage some to look for Governor Kuroda to ease policy. In fact, a little more than...

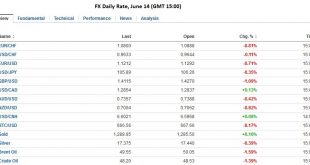

Read More »FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

“The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%”. A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain. Core bond yields are 4-5 bp lower, which...

Read More »FX Daily, June 13: Brexit Dominates

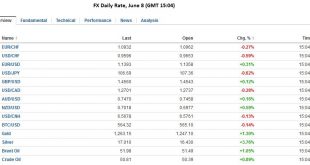

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. See the Dukascopy Video FX Rates The risk that the UK votes to leave the EU next week is the dominant force in the capital markets. It is a continuation of what was seen at...

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

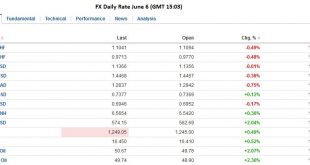

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

Read More »FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

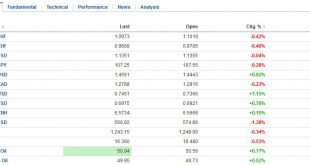

Swiss Franc The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD. The ECB bond buying program has finally started. For us the main reason of the weaker Euro was, however, the bad US jobs report, that will delay also a normalization of rates in the euro zone. via Dukascopy FX Rates The US dollar is posting...

Read More »Greenback is Mostly Firmer, but Yen is Firmer Still

The US dollar is posting modest upticks against most of the European currencies and the Canadian and Australian dollars.However, it has fallen against the yen and taken out the recent low, leaving little between it and the May 3 low near JPY105.50. The New Zealand dollar though is the strongest of the major currencies; gaining 1.5% following the RBNZ’s decision to leave rates on hold, and signal of little urgency to...

Read More »FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

Read More »FX Daily, June7: Another Breakdown of EUR/CHF

Swiss Franc Once again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again.Moreover, CHF appreciated with the Asian block, with AUD and NZD and with the oil price. Swiss sales are pretty high to Asian countries. We also know that rising oil prices usually lead to a stronger CHF. Japan The Japanese yen is the major currency not to be gaining against...

Read More »FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery...

Read More »FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the shifting view of Fed policy than the expectations in some quarter that the RBA and RBNZ could cut interest rates as early as this week. Indeed, anticipation of Fed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org