Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the weekend. The US 10-year yield is up a couple of basis points to 1.66%. Last week, it briefly traded above 1.70%. European core yields have edged slightly higher, while the peripheral bonds are outperforming. The Antipodeans and Norwegian krone are leading the way higher among most majors, with the yen,

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Brazil, Brexit, Copper, COVID, Currency Movement, EU, Featured, inflation, Japan, Mexico, newsletter, Philippines, Poland, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

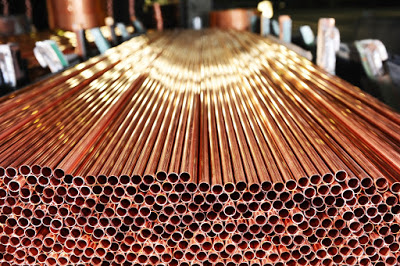

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the weekend. The US 10-year yield is up a couple of basis points to 1.66%. Last week, it briefly traded above 1.70%. European core yields have edged slightly higher, while the peripheral bonds are outperforming. The Antipodeans and Norwegian krone are leading the way higher among most majors, with the yen, Swiss franc, and Swedish krona sporting softer profiles. Most emerging market currencies are edging higher, but the Turkish lira has come under more downside pressure. President Erdogan's decision to kick out 10 ambassadors from the US and Europe adds to the weight of the unexpectedly large rate cut last week. They had coordinated efforts to press authorities to release a jailed businessman over the 2016 coup attempt. Gold is probing higher and trying to establish a foothold above $1800, and December WTI has traded at a new high near $84.75. Copper, which lost around 5% in the past two sessions, has come back bid and is up more than 1% today. The CRB Index fell last week to snap an eight-week rally.

Asia Pacific

Three months ago, Japan's Deputy Prime Minister Aso seemed to announce a shift in the country's policy toward Taiwan. Press reports quoted him pledging Japan's support if attacked by China. The Sunday Times wrote: "The statement by Taro Aso, the deputy prime minister, signals a shift in policy towards Beijing. "If a major problem occurred in Taiwan, it would not be going too far to say that it could be an existential threat [for Japan]," he said." Adam Liff of Brookings says the Sunday Times is wrong and that there has not been a shift in Tokyo's policy: "But the meaning and implications of the deputy prime minister's remarks — which were delivered at a private political fundraiser — for Japan's official policy are easily misconstrued. Japan's government has never made an explicit commitment to defend Taiwan or to necessarily assist a possible US military response if a cross-strait conflict occurs. My ongoing research on Japan-Taiwan relations and the U.S.-Japan alliance suggests that recent developments do not indicate a major change in Japan's official posture toward the Taiwan Strait." In answer to a question at a town hall meeting last week, President Biden broke from the "strategic ambiguity" official position to offer "strategic clarity" that the US would defend Taiwan if attacked. However, by the end of the day, the White House denied that the president was signaling a change in the US stance. Over the weekend, 10 Russian and Chinese warships exercised together and almost encircled Japan.

Covid cases are flaring up in China, Australia, and New Zealand. Beijing warned the infections will likely increase in the coming days as 11 provinces now report cases. Commerce and transportation are being disrupted. This speaks to a potential extension of supply disruptions. Singapore may extend social restrictions for another month. Europe is also reporting new cases. Russia may be considering a new lockdown later this month as fatalities rise to near-record levels. Germany has the highest cases since May; the UK since July. Latvia seems in the throes of a full-fledged crisis, and 50% are unvaccinated (40% in the US). Belgium is also considering tightening curbs.

In a roundup of other developments in the region, we note that the LDP lost one of two seats in yesterday's special election ahead of next Sunday's lower house election. However, the LDP is expected to maintain its majority. Prime Minister Kishida's support has not risen, but the opposition is weak and doing worse. In Australia, support for Prime Minister Morrison's Liberal-National coalition has slipped to its lowest level in nearly three years. Labour has pulled slightly ahead. Elections must be held by next May. In the Philippines, President Duterte's daughter has confirmed she will not seek to succeed her father and instead will support former senator and scion Marcos. South Korea reports Q3 GDP figures first thing tomorrow. The economy is expected to have grown by 0.6% after 0.8% in Q2.

The dollar is trading quietly in about a third of a yen range in the trough seen ahead of the weekend. Last week, it firmed to JPY104.70 before pulling back to JPY113.40 ahead of the weekend. The consolidative tone may continue in North America today. The Australian dollar is firm within its pre-weekend range and is probing near $0.7500. The intraday momentum indicators suggest the space above there will likely be limited today. The PBOC set the dollar's reference rate at CNY6.3924 compared with the median projection (Bloomberg survey) of CNY6.3916. The central bank boosted its liquidity provision (net CNY190 bln), the most since early this year, ostensibly to ease month-end pressures. In the spot market, the yuan is virtually flat on the day.

Europe

Early last year, many observers looked at the lockdown imposed in China to contain the virus with dismay and saw it as authoritarian and something "we" would never do. And yet, when the virus hit, many representative government countries adopted social controls and stay-at-home protocols that were just as stringent. China has been intervening in the commodities market, including selling some industrial metals from its strategic stockpiles (accumulated in previous efforts to support prices). Its National Development and Reform Commission is reportedly studying specific measures to intervene in the coal market, where prices have doubled since the beginning of last month. Again, many observers see it as evidence of the nature of the regime. The US has called upon OPEC+ to boost oil output but has so far been reluctant to tap its own strategic reserves to address the price surge that is denting the economic recovery. It has, though, committed to selling some as part of a past fiscal agreement. Last week, the London Metals Exchange announced several ad hoc measures to address the apparent shortage of copper. These included requiring large holders to lend the copper back to the exchange, allowing short positions to delay delivery, and limiting backwardation (when near-term prices are dearer than longer-term contracts). As Bernanke once quipped, in a crisis, there are no idealogues, or perhaps fairer, in a crisis, ideology is often sacrificed for expediency.

The expectations component of the Germany IFO survey dragged the overall business conditions reading lower. It slipped more than expected to 95.4 from 97.4. It has not risen since June. The assessment of current conditions did better than expected, easing to 100.1 from 100.4. Still, it is the first back-to-back decline since April/May 2020. Business conditions eased to 97.7 from 98.8.

At the end of last week, press reports suggested that the EU was considering how to respond if the UK invokes Article 16 of the Northern Ireland Protocol, which allows it to unilaterally suspend parts of it, as it has threatened to do. A powerful response is threatened to deter the UK. The EU could suspend in whole or in part the trade agreement with the UK, as it argued in last year's negotiations that the Northern Ireland protocol was necessary for any post-Brexit trade agreement. It is not clear that it will come to that. There has been some effort on both sides to find common ground. The EU has made offers to relax the border check. The UK seems to be finding a space for the European Court of Justice, the arbiter of disputes according to the agreement. Another sticking point is the UK's proposal calls other aspects of the agreement that govern state-aid. This and the role of the ECJ are not the kinds of disruptions that appear covered by Article 16. The UK's position lends credence to accusations that Johnson never intended to stick with last year's agreement and has been pushing for fundamental changes from the get-go, which is what ex-adviser Cummings has maintained.

When everything is said and done, the euro remains within the range set last Tuesday ($1.1610-$1.1670). A break of $1.1600 could spur losses to $1.1570. An option for roughly 675 mln euros expires tomorrow at $1.1610. Sterling was turned back from its approach of $1.38 and was pushed back toward its pre-weekend low near $1.3735. More formidable support may be closer to $1.3700. Meanwhile, note that the implied yield of the December 2021 short-sterling interest rate futures has not risen for five sessions. During this time, it has eased about 10 bp or half of what it had risen on the back of BOE Governor Bailey's comments last Sunday about what the central bank "needs to do."

America

Treasury Secretary Yellen and Federal Reserve Chair Powell recognize that the bottlenecks in the supply chain and tight labor market conditions will likely mean that price pressures will last longer. Over the weekend, Yellen saw the higher inflation readings persisting through the middle of next year. Before the weekend, Powell argued that the Fed was positioned to manage a range of "plausible outcomes" (maximum flexibility) and was also concerned about the persistently high inflation. He endorsed tapering (to be announced at next week's FOMC meeting) but is in no hurry to raise rates. The August Fed funds futures contract has nearly fully discounted a rate hike next July. Separately, although Yellen did not explicitly endorse Powell, she defended the strengthening of financial regulation under his watch, which pushes back against the argument of some of his critics. Meanwhile, a new report by the St. Louis Fed found that early retirement may account for 60% of the 5 mln workers that have not returned to the labor market.

This week that features the first look at Q3 US GDP begins off slowly, with the Dallas Fed's manufacturing survey. The market looks for a slight increase, defying the declines in the Empire and Philadelphia surveys. House prices, new home sales, the Richmond Fed survey, and the Conference Board's measure of consumer confidence are on tap for tomorrow. The Bank of Canada meets tomorrow. It will likely do two things: reiterate that the output gap will close around the middle of next year, which is a push against expectations for an earlier hike, and it will likely reduce its bond-buying to C$1 bln a week, half of the current pace. Mexico reports its IGAE economic activity (August) and September employment. The highlight of the week is the Q3 GDP report at the end of the week. The economy appears to have nearly stagnated. Brazil and Colombia's central banks meet this week. Brazil is expected to hike the Selic rate by another 100 bp, while Colombia is seen hiking by 25 bp.

Last week was the fifth consecutive weekly gain for the Canadian dollar. However, the momentum is stalling. It is virtually flat as the North American session is about to begin. The greenback is knocking on CAD1.2400, where a $670 mln option expires tomorrow. The March 2022 BA futures yield has risen in 12 of the past 14 sessions coming into today. A move above CAD1.2400 today could see a squeeze toward CAD1.2430 initially. The Mexican peso is consolidating in quiet turnover to start the week after advancing about 0.75% last week. There is scope for a move toward MXN20.24-MXN20.27 in this consolidation phase. The Brazilian real was the worst-performing emerging market currency last week amid deteriorating political and economic conditions. The Bovespa tumbled nearly 7.3% last week. The BRL5.60 area offers initial support. The pre-weekend spike took it to BRL5.75 before the dollar pulled back to BRL5.65.

Tags: #USD,Bank of Canada,Brazil,Brexit,Copper,COVID,Currency Movement,EU,Featured,inflation,Japan,Mexico,newsletter,Philippines,Poland