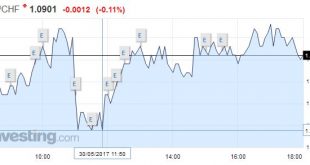

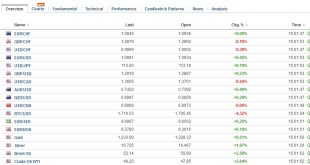

Swiss Franc The euro is lower at 1.0901 (-0.11%). EUR/CHF - Euro Swiss Franc, May 30(see more posts on EUR/CHF, ) - Click to enlarge FX Rates With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the...

Read More »FX Daily, May 15: Softer Dollar and Yen to Start the Week

Swiss Franc . FX Rates The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in...

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

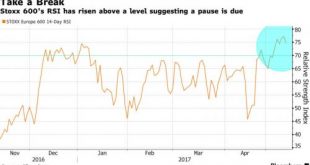

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

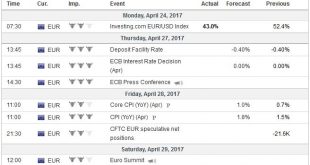

Read More »FX Weekly Preview: Politics and Economics in the Week Ahead

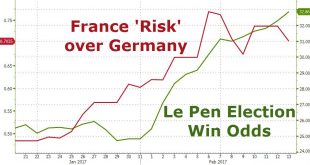

Summary: Provided Le Pen and Macron or Fillion make to the second round, the market response to the French election results may be short lived. BOJ, Riksbank and ECB meetings. Spending authorization and some announcement from the White House on tax policy are in focus as Trump’s 100th day in office approaches. The results of the French presidential election will be known prior to the open of the Asian...

Read More »Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

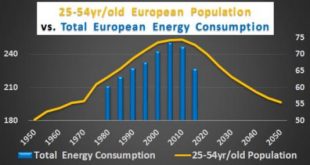

Authored by Chris Hamilton via Econimica, The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives...

Read More »Currency Denomination Risk in the Euro Area

In the FT (Alphaville), Marcello Minnena explains what type of currency denominations of Euro area sovereign debt constitute credit events; and how markets assess the risk of such denominations. After the Greek default in 2012 new ISDA standards entered into force: contracts made since 2014 protect against euro area countries redenominating their debt into new national currencies [unless the debt is redenominated] into a reserve currency: the US dollar, the Canadian dollar, the British...

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More »Re-Denomination Risk in France and Italy

On the FT Alphaville blog, Mark Weidemaier and Mitu Gulati argue that re-denomination risk in the Euro zone is most prominent in France and Italy. Bonds with CACs trade at higher prices. Most French and Italian [but not Greek] debt is governed by local law. … the governments could pass legislation redenominating their bonds from euros to francs or lira. … [But] some French and Italian bonds — bonds issued after January 1, 2013, with maturities over a year — have Collective Action Clauses...

Read More »These Are The 3 Main Issues For Europe In 2017

Submitted by George Friedman and Jacob Shapiro via MauldinEconomics.com, What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake....

Read More »While Davos Elites Address Populism, Just “Eight Men Own Same Wealth As Half The World”

As political and business elite gather at the Swiss ski resort of Davos, a new report is shining light on the shocking reality of the wealth gap between the very rich and poor that is “pull our societies apart.” A report by Oxfam released ahead the World Economic Forum in Davos shows the gap between the ultra-wealthy and the poorest half of the global population is starker than previously thought, with just eight men...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org