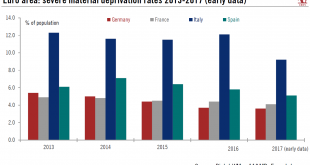

Latest poverty figures provide government with an argument for fiscal stumulus. Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase...

Read More »Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus.Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase instalments or other loan payments; one week’s holiday away from home; a meal...

Read More »FX Daily, September 05: Continuing EM Pain Helps the Dollar, but does Little for Yen

Swiss Franc The Euro has risen by 0.20% at 1.1305. EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia’s bourse saw the largest decline (~3.75%) in the...

Read More »FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past. First, the bar to dissuade the market against a 25 bp rate hike on...

Read More »FX Weekly Preview: Dog Days of August Begin

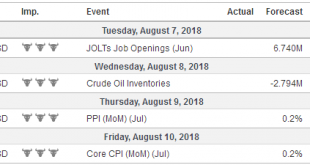

United States With most of the major central bank meetings and important economic data out of the way, the dog days of August are upon us. In terms of drivers, it means that players will have to look elsewhere for inspiration and it means that market liquidy is likely not at its best. That said, there are a few economic reports that will grab investors’ attention, even if briefly. Among them will be the US July CPI....

Read More »FX Daily, June 12: US-Korea Summit Fails to Impress Investors

Swiss Franc The Euro has risen by 0.03% to 1.1609 CHF. EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major...

Read More »FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

Swiss Franc The Euro has fallen by -0.42% to 1.1485 CHF. EUR-CHF and USD-CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today’s activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. ...

Read More »FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

Swiss Franc The Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the...

Read More »What Happened Monday?

Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

Summary: The euro fell every day last week against the Swiss franc. Italian political anxiety is the key development. Speculators in the futures market got caught leaning the wrong way. The Swiss National Bank’s decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org