Italian asset markets continue to fare better than many expected. The political uncertainty following the March election has been followed by confidence that the Five Star Movement and the (Northern) League will be able to put together a government in the coming days. If so, Italy would have taken half the time Germany did to cobble a government together after inconclusive elections. Politics makes for...

Read More »FX Daily, May 18: EUR/CHF Continues the Collapse

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press...

Read More »FX Daily, May 16: US Yields Soften After Yesterday’s Surge

Swiss Franc The Euro has fallen by 0.40% to 1.1804 CHF. EUR/CHF and USD/CHF, May 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mixed today after the Dollar Index rose to new 2018 highs yesterday. It is being driven by rising US rates, which also punishes short dollar positions. The US 10-year yield rose seven basis points yesterday to nearly 3.10%. It...

Read More »FX Daily, March 06: Resiliency Demonstrated

Swiss Franc The Euro has risen by 0.36% to 1.1634 CHF. EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The resiliency of the status quo is again on display. After much chin wagging and finger pointing after the Italian elections and the modest decline in Italian assets, they have bounced back today. Italian bonds and stocks are participating...

Read More »FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

Swiss Franc The Euro has fallen by 0.08% to 1.1549 CHF. EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers...

Read More »FX Weekly Preview: Recovering from Too Much of a Good Thing?

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it. A broad range of financial instruments constructed to profit from continued low volatility, such as exchange-traded...

Read More »Italian Election–Two Months and Counting

- Click to enlarge Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members. And yet it is Italian politics...

Read More »For The First Time Ever, The “1%” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank’s infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past year, suggests that the lower...

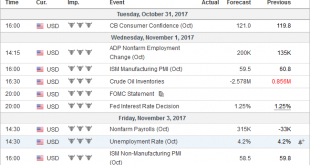

Read More »FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

Summary Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain. The week ahead will be among the busiest in Q4. In this note, we provide a brief sketch of the different events and data points that will shape the investment climate. Given the importance of initial conditions, we will begin with an overview of the...

Read More »Why Small States Are Better

Andreas Marquart and Philipp Bagus (see their mises.org author pages here and here) were recently interviewed about their new book by the Austrian Economics Center. Unfortunately for English-language readers, the book is only available in German. Nevertheless, the interview offers some valuable insights. Mr. Marquart, Mr. Bagus, you have released your new book „Wir schaffen das – alleine!” (“We can do it – alone!”)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org