Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today. The three-day rally in Europe’s Stoxx 600 is being snapped today. US futures are posting small losses. The US 10-year yield is little changed around 3.17%, while European benchmarks are narrowly mixed, with the periphery doing better than the core. The dollar is enjoying a firmer...

Read More »Nasty Number Five, Not Hawk Hiking CBs

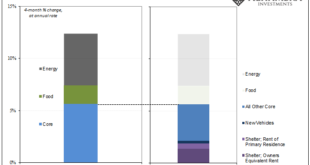

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide. For once, CPIs (or European HICPs) seemed to have confirmed the narrative. Unlike 2018 when inflation indices kept policymakers and their forecasts out in the...

Read More »The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

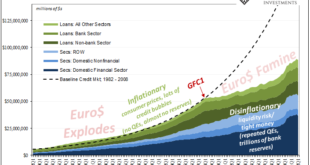

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was. What data? The “everything” data, the most comprehensive financial and monetary compendium yet available: The Financial Accounts of the United States, or Z1. While this doesn’t quite...

Read More »The End Game Approaches

The pendulum of market sentiment swings dramatically. It has swung from nearly everyone and their sister complaining that the Federal Reserve was lagging behind the surge in prices to fear of a recession. On June 15, at the conclusion of the last FOMC meeting, the swaps market priced in a 4.60% terminal Fed funds rate. That seemed like a stretch, given the headwinds the economy faces that include fiscal policy and an energy and food price shock on top of monetary...

Read More »Market Pulse: Mid-Year Update

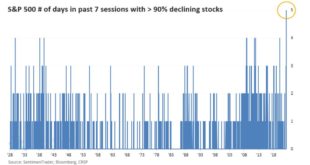

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

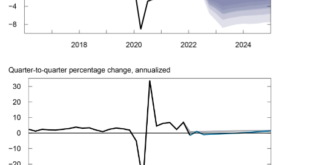

Read More »Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament. From there, to try to get the...

Read More »How Long Will Inflation Last 2022

What if we told you that you could predict the future? For today’s guest, this is certainly the case when it comes to future market events. He hasn’t got a crystal ball, instead, he has nearly 300 years of historical analysis and models that have led him to the conclusion that markets operate in clear, predictable cycles. For Charles Nenner there is little point in trying to explain why something happened because it did happen and it will happen again. Charles Nenner...

Read More »Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay. The short end of the yield curve (USTs and elsewhere) is plotting like FOMC dots, whenever oil and crude...

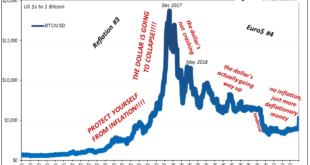

Read More »It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer. It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the...

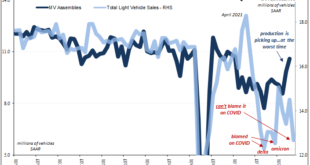

Read More »Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022. At a seasonally-adjusted annual rate of 12.7 million, it was a quarter fewer than sales put down in May 2021 and 13% below the not-great level from the month prior in April 2022. Such puny results have typically been reserved for those...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org