Via FinancialSense.com, One of the world's most powerful supercomputers, retrofitted for trading the stock market, appears to be betting on a crash in the months ahead. The Financial Crisis Observatory (FCO) at ETH Zurich released its latest Global Bubble Status Report on July 1st. As we discussed with FCO’s director, Didier Sornette, on our podcast in May, they use one of the world’s leading supercomputers to monitor global markets each day for two distinct bubble-like...

Read More »“Monetary Economic Issues Today,” Panel, 2017

Panel discussion with Ernst Baltensperger, Otmar Issing, Fritz Zurbrügg and Mark Dittli (moderator) on the occasion of the publication of the Festschrift in honour of Ernst Baltensperger, Bern, June 16, 2017. SNB press release. Video (SNB Forschungs-TV).

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

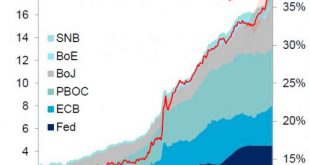

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »The Market Has Its Head Buried Deep In The Sand

The Market Has its Head Buried Deep In The Sand Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets. The most immediate problem is the Treasury...

Read More »Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

Read More »“Secular” Stagnation, A Return to Trend

On Bank Underground, Gene Kindberg-Hanlon criticizes the secular stagnation hypothesis: Real interest rates have fallen by around 5 percentage points since the 1980s. Many economists attribute this to “secular” trends such as a structural slowdown in global growth, changing demographics and a fall in the relative price of capital goods which will hold equilibrium rates low for a decade or more (Eggertsson et al., Summers, Rachel and Smith, and IMF). In this blog post, I argue this...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

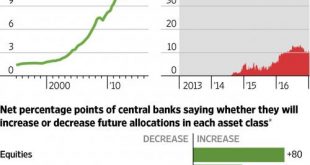

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered “fake news” within the “serious” financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary“, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org